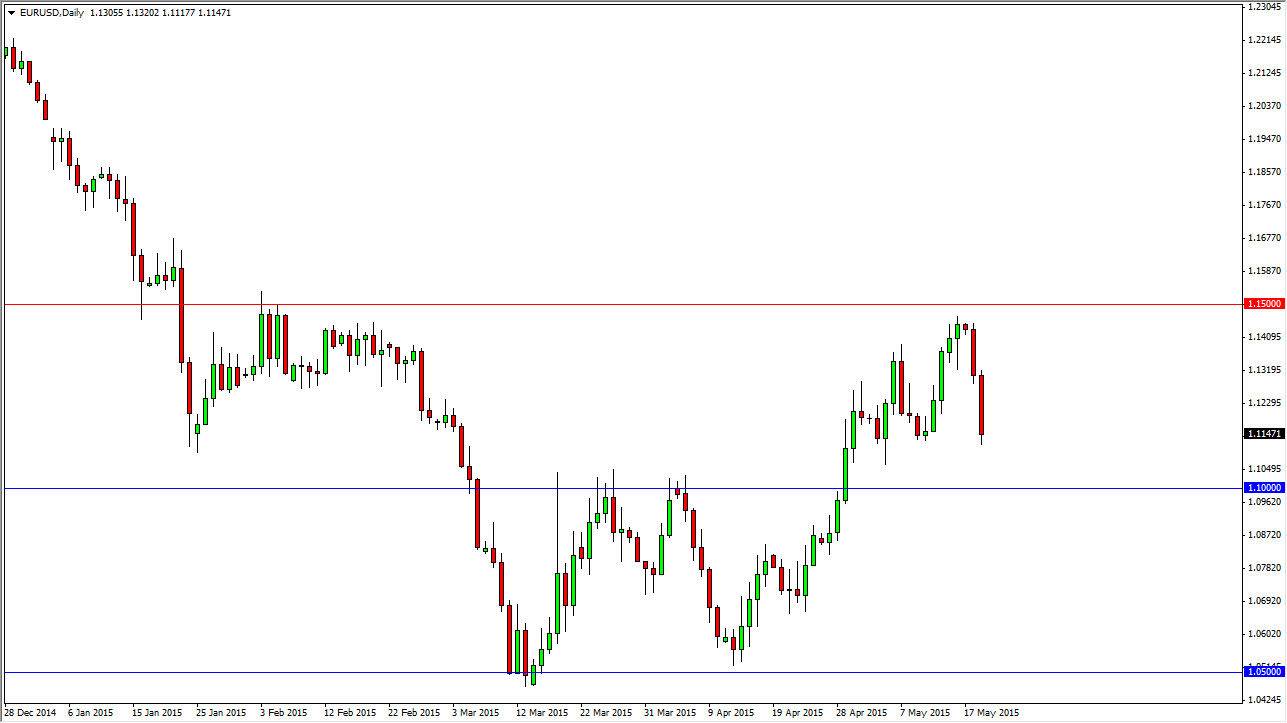

The EUR/USD pair fell rather hard during the session on Tuesday, testing the 1.1150 level. With that, it appears that the market is going to try to find buyers between here and the 1.10 level, and as a result I am actually waiting for a supportive candle in order to go long. I think we are trying to form a massive “W pattern”, which of course is one of the most positive and bullish reversal signals that you can find.

I believe that the 1.10 level is essentially a bit of a “floor” in this market, and that a lot of buyers should be interested in the market once we get to that area. Also, you have to recognize that the 1.1150 level has been supportive recently, and that should continue to be the case going forward. I think that once we get above the 1.15 level, the trend has changed completely in the Euro, and we will find plenty of buying pressure above there. After all, a lot of people will be caught on the wrong side of the market at that point.

Patience

I think that patience will be needed as we try to find out whether or not there is plenty of support in this area. I think that this market will continue to find plenty of interest, after all we are looking at a couple of different moving parts of the same time. The Greek situation of course continues to capture all of the headlines, and any time there’s a bit of concern of a breakup out of Europe, the Euro will fall. On the other side of the Atlantic Ocean, you have the Federal Reserve which of course now looks very unlikely to raise interest rates anytime soon. Because of this, you have quite a bit of volatility in this marketplace. If we can finally get above the 1.15 level, I would be much more comfortable trading this pair. Usually this point in time I am looking to buy this pair, but I would not be looking to hang onto the trade for any real length of time.