EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line which is currently sitting at around 1.1070.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short if the price is below 1.1220 at 9am London time.

Put the stop loss at 1.1282.

Adjust the stop loss to break even once the price reaches 1.1175.

Take off 50% of the position as profit at 1.1125 and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal with a high above 1.1262 but below 1.1300.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

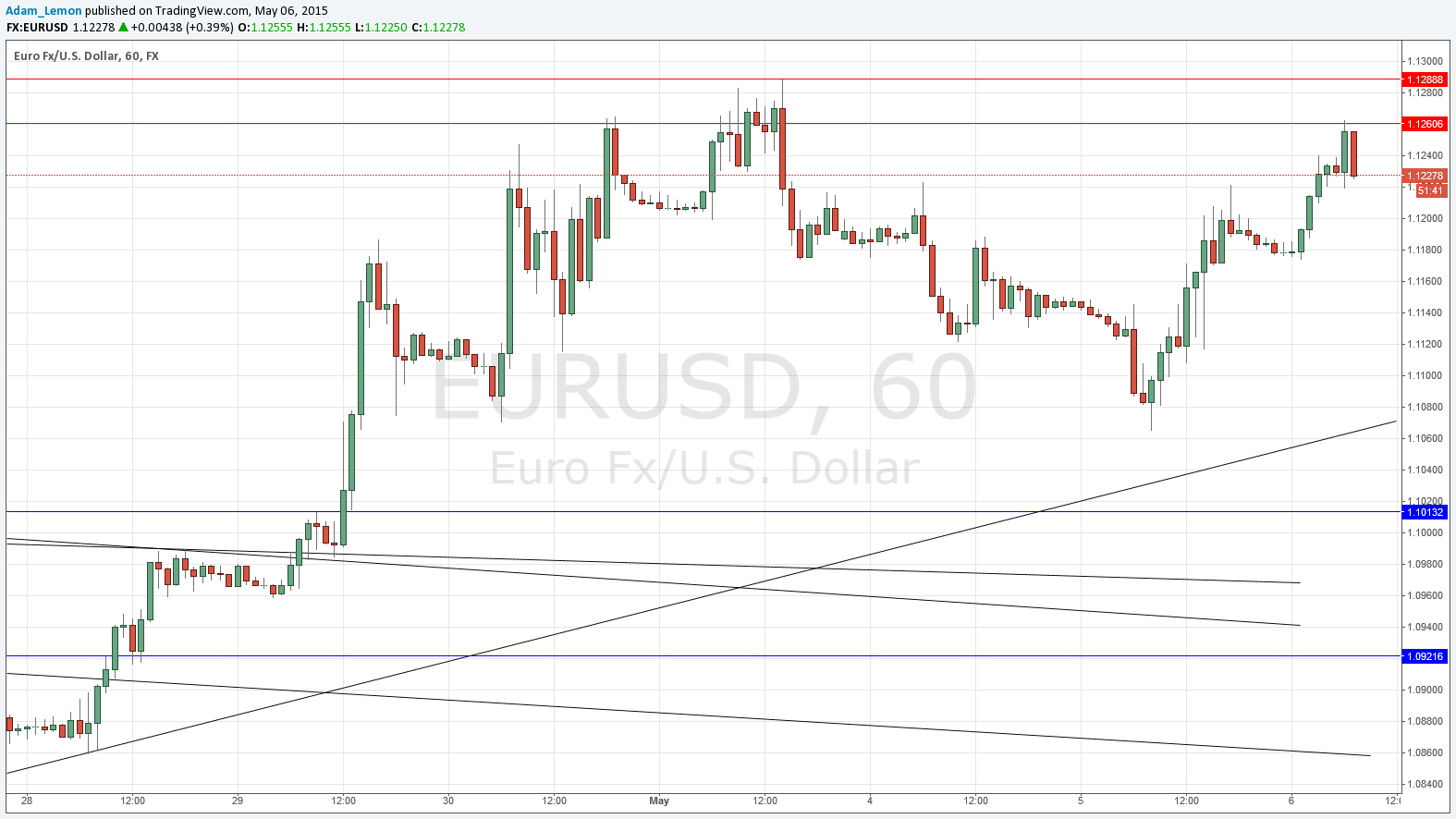

EUR/USD Analysis

Yesterday saw renewed bullishness that has pushed us up again to the strong resistance zone just above the psychologically key 1.1250 level. We may already have made the high of the day and although the pair has been bullish it would be logical to see a possible break down here, although the way down is liable to be choppy.

Below there may be plenty of places where a bullish bounce could happen, but I see no great entry levels until the bullish trend line is reached.

There are high-impact events scheduled today concerning the USD. There will be a release of ADP Non-Farm Employment Change data at 1:15pm London time. Later the Chair of the Federal Reserve will be speaking at a Panel Discussion commencing at 2:15pm.