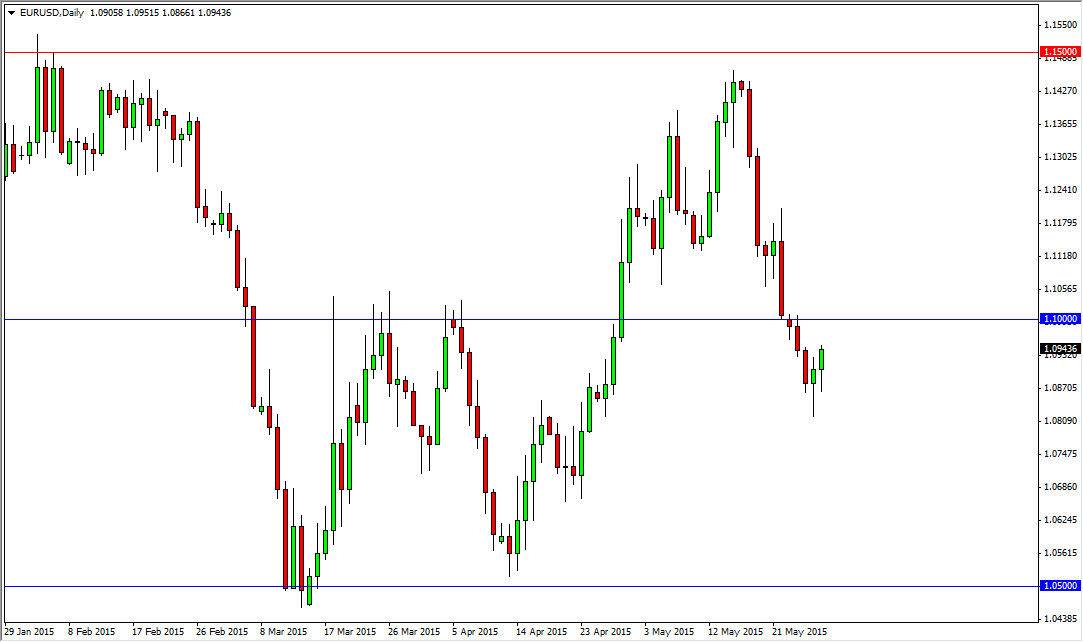

The EUR/USD pair initially fell during the course of the day on Thursday, but as we did on Wednesday, we ended up bouncing enough to form a hammer. This hammer tells me that there is significant buying pressure below, but I have to worry about the 1.10 level above. In fact, it’s not until we get well above there that I can consider buying this pair because I quite frankly don’t trust the Euro in general. With that, I think that we will more than likely see sellers near the 1.10 level, so if we get a resistive daily candle, I will not hesitate to start selling. I would also be a seller if we can break down below the bottom of the hammer from the Wednesday session, which is essentially the same thing is breaking down below the 1.09 level.

Headline noise

At this moment in time, I think this is one of the more dangerous pairs to trade. This is because a lot of rumors are pushing the Euro around at the moment, and then of course all the nonsense that we are still dealing with in the Greek drama unfolding. Quite frankly, comes down to what the market to pain attention to at the moment, which is either going to be what’s going on in Athens, or the interest-rate expectations coming out of the Federal Reserve. At this point in time, I have to have a bit of a negative bias, but I do recognize that a bounce is very likely.

Ultimately, we can break down I think we will go to the 1.06 level, and then the 1.05 level. If we do manage break above the 1.10 level significantly though, I don’t see any reason why we will then try to get to the 1.12 handle, and then the 1.14 handle after that. If we managed to somehow track higher and break above 1.15, at that point in time the entire trend is changed as far as I can see. Because its summer, I suspect that we probably will be more or less range bound though.