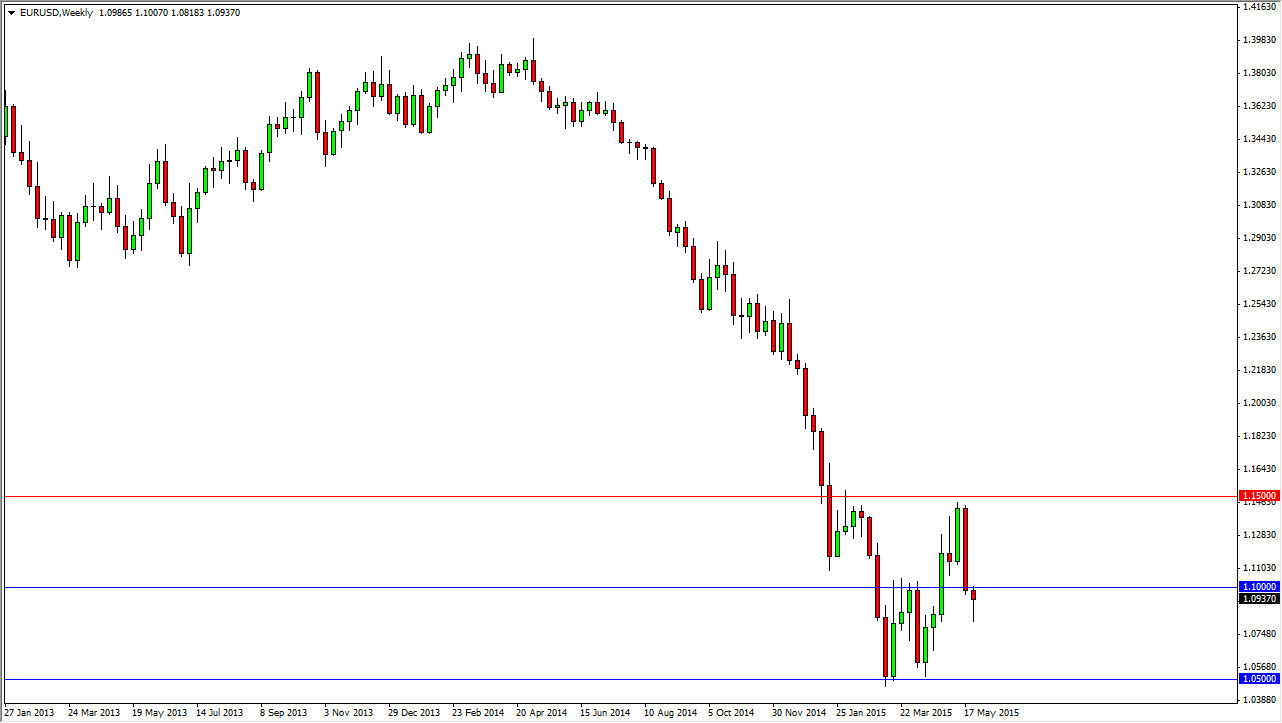

The EUR/USD pair has been an absolute mess for some time. Over the course of the last couple of months we have bounced from lows at 1.05, all the way to the 1.15 area. With this, the 1.10 level is essentially “fair value” at the moment, and that means that it’s very likely that the market will react every time we get near that region. In fact, we have already seen that a bit, and as I write this we have basically formed a hammer just below that handle. This tells me how important the 1.10 level is, and if we can get above there the market should continue to go back towards the 1.15 level.

In the meantime, it is the summertime and I expect volatility

Traditionally, summertime is rather range bound for currency markets, and because of this it would not surprise me at all to see this market bounce around in this region. It is an extraordinarily wide region, but I think that we are more apt to see the Euro pick up a little bit if we can get above the 1.10 level. After all, the Euro has been beaten down so hard that somebody will find value in this currency sooner or later

Keep in mind that headlines out of Athens will of course move the Euro, just as interest-rate differential and interest-rate expectations out of the United States will. I believe that it’s only a matter of time before this market turns around though, because we have seen such a massive selloff. Don’t get me wrong, I don’t think anything in Europe has been fixed, but quite frankly the United States has such a massive debt issue that you can’t feel very good about the US dollar either.

In the meantime, I believe that we will pick one of these 500 PIP ranges to trade in. It’s either between 1.10 and 1.15, or 1.10 and 1.05 shortly.