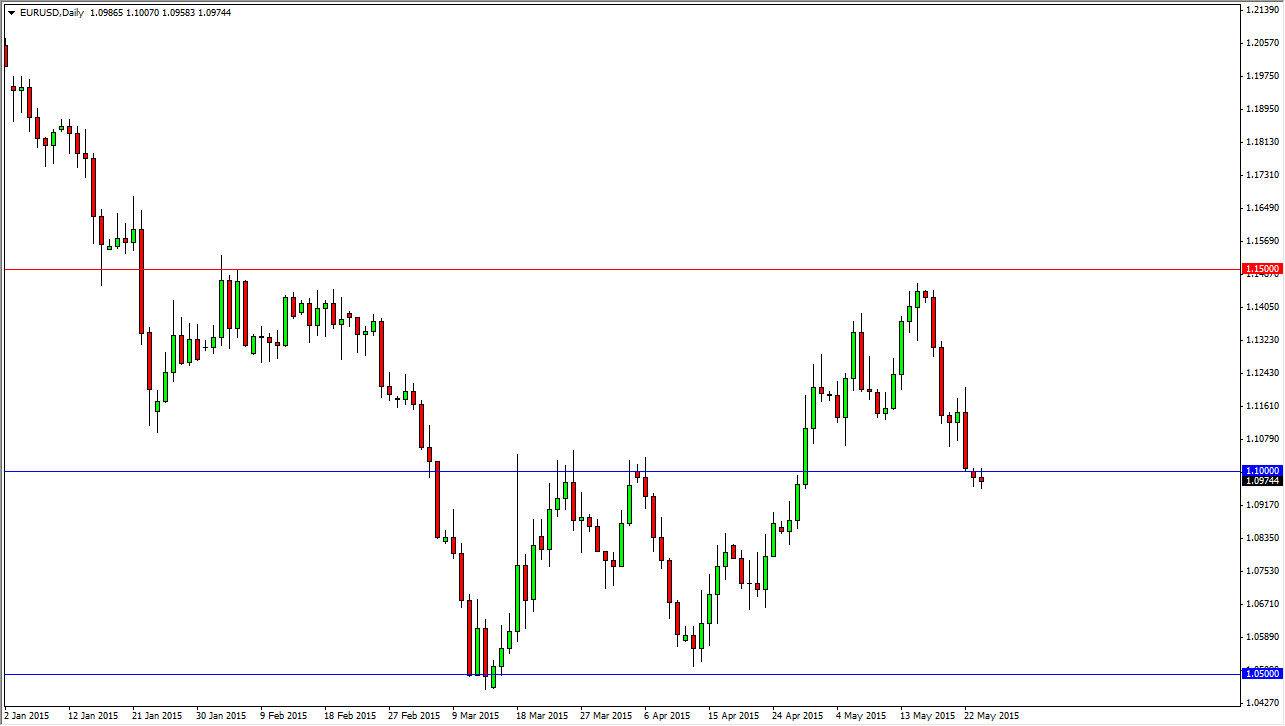

The EUR/USD pair did very little during the session on Monday as one would anticipate, simply because the Americans were away before Memorial Day. That being the case, the market really didn’t do too much in the way of making a decision, which should change today. The 1.10 level is a magnet for price lately, as we have seen quite a bit of resistance at that area previously, and now see quite a bit of support. That being the case, the market will have to make a decision somewhere in this general vicinity.

The market should make an impulsive move in one direction or the other, and once it does I will simply follow this pair. If we can break above the 1.11 level, I am a buyer as this market should then head to the 1.14 handle or so. On the other hand, if we break down below the 1.09 level, we would be sellers and aiming for 1.06 or so.

Noise out of Athens

Quite frankly, I’m getting very bored with the entire Greek situation. While it is painfully obvious to me that there will never be a serious solution, it appears that we are simply putting one Band-Aid on the Greek problem after another. As an American, I find this ironic as I could say the same thing about our debt problem. Nonetheless, the markets will do what they do, and right now it appears that they will react every time Athens says something inflammatory, only to turn things back around once the Greeks capitulating, as they will do. With that, I have to wonder whether or not the Euro will continue to go lower.

It’s easier to simply layout a “binary trade” in order to make the decision. The area that we are at right now was once significantly resistive, and now it appears that the supportive action should be expected in this area that we are seen. As I said above, I am simply going to let the market move one way or the other and follow.