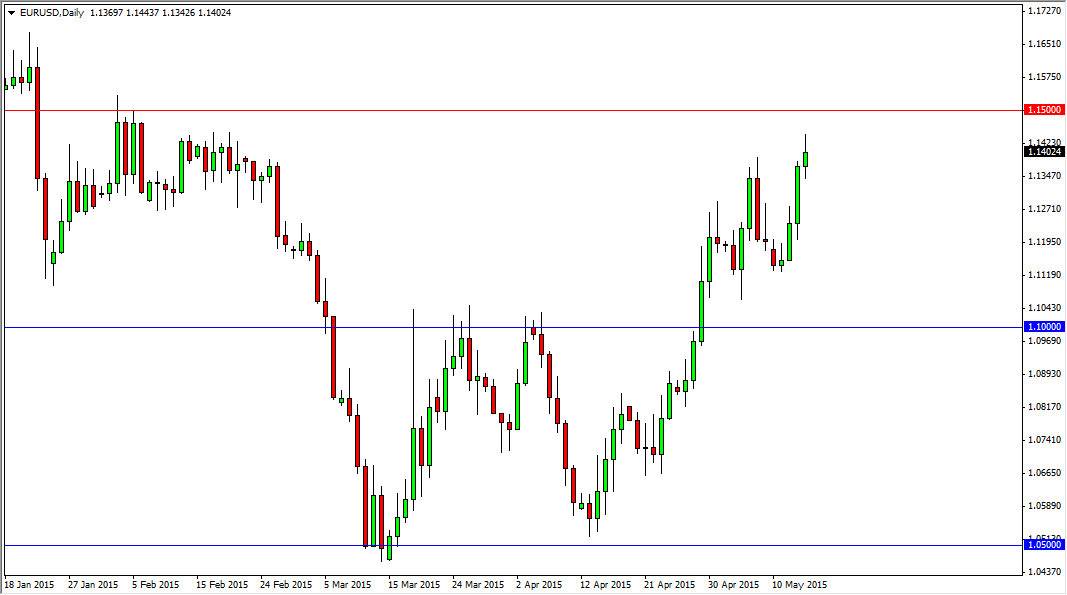

The EUR/USD pair tried to rally during the day on Thursday, but gave up quite a bit of the gains. However, we continue to see the 1.15 level above as resistance. This market certainly has been bullish in general, and I now think that the pair is going to be “buy only” as far as I am concerned. However, I do see that this pair could pull back, but this would only offer value in the Euro in my opinion. The pair will be officially “broken out” and the trend changed in my opinion once we get above the 1.15 level. The markets have been very cruel to the Euro for some time, and we are perhaps seeing that change for the long-term now.

Buy dips going forward

The best way to trade this pair in my opinion will be to buy dips as we get them going forward. The market should be well-supported all the way down to the 1.10 level below, and because of this I see this as a “one-way” market, and I think that we are simply trying to build up enough momentum to break out and above the “ceiling” at 1.15 nearby.

The market is waking up to the fact that the European Union is doing better than once thought, and the Greeks are more than likely going to cooperate with the creditors, allowing the EU to dodge another bullet going forward. This is the way we have been going for years, so you have to ask why things would be different now? Clearly the Europeans aren’t going to let the Union fold, and the Greeks aren’t looking to leave anytime soon. In other words, we have started to price in Armageddon, and it hasn’t come.

I don’t necessarily “like” the Euro, but to be honest – trading currencies isn’t about liking anything. It’s about following the herd – not trying to “outsmart” it. The herd is marching north, given enough time.