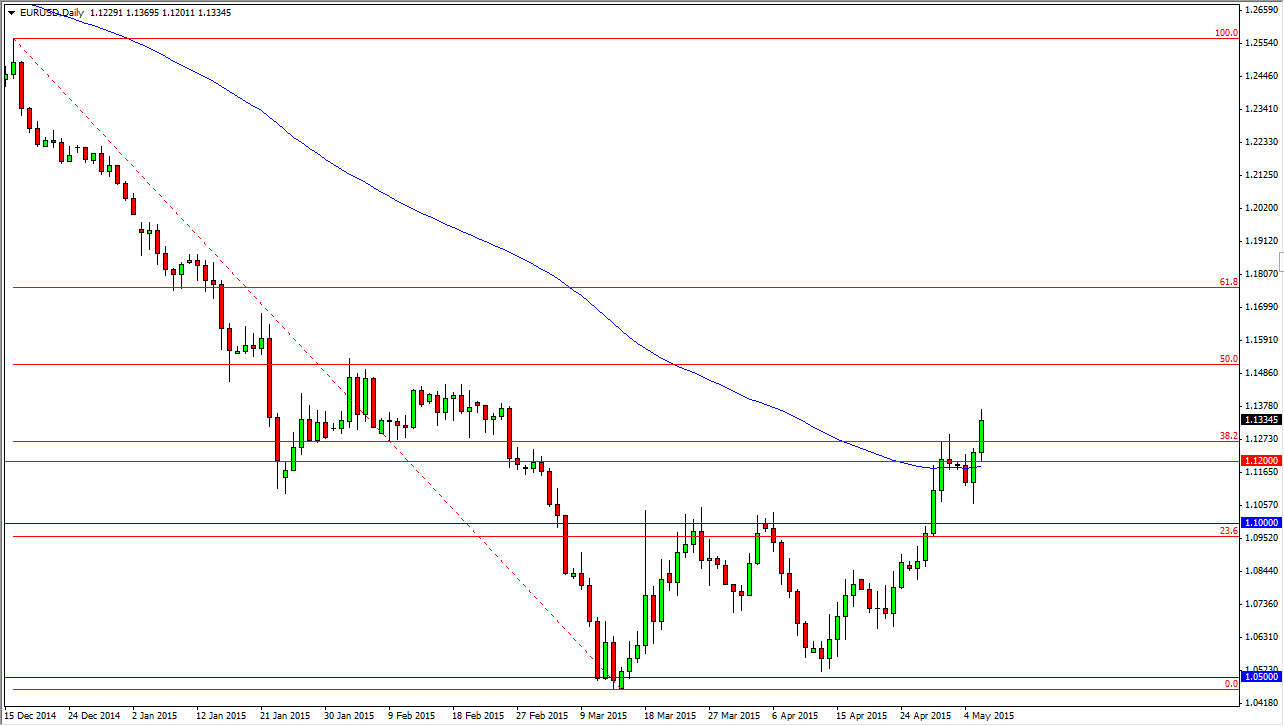

The EUR/USD pair had a very strong showing on Wednesday, as it now appears that it’s only a matter time before we break out and above the 1.15 handle. With that being the case, I think that short-term traders will continue to buy this pair based upon pullbacks that offers supportive candles. The 1.12 level which was once resistance should now be supportive, it appears that a collision with the 1.15 level is imminent. Not only is that a large, round, psychologically significant number, but it is also the 50% Fibonacci retracement level from the selloff that began in late 2014. Adding more credence to this area is the fact that there is a cluster of trading between here and there. In other words, I believe that the trend in this pair will definitely be bullish if we can get above that level. It’s that important.

Buying pullbacks

I now am starting to believe in the Euro, even though I believe that the market may be jumping the gun a bit. However, most people believe that the markets are trying to predict what’s coming in 6 months, and what this chart tells me is that 6 months from now the situation in Europe should be okay. I would say “okay”, and not good because I think that’s a stretch. However, the economic numbers are getting better from the continent, so the exchange rate of 1.05 was always going to be too low. I was very bearish of this pair until recently, but I cannot argue with the fact that we now see quite a bit of strength.

Now that we are starting to get a complete confirmation of a trend change, it becomes a “buy only” type of marketplace on that break out. We aren’t quite there yet, but I think short-term buying opportunities will abound. I believe that once we get above the 1.15 level, the market will probably start rapidly climb as there really isn’t much in the way of resistance above that area until you get much, much higher, somewhere near the 1.20 region.