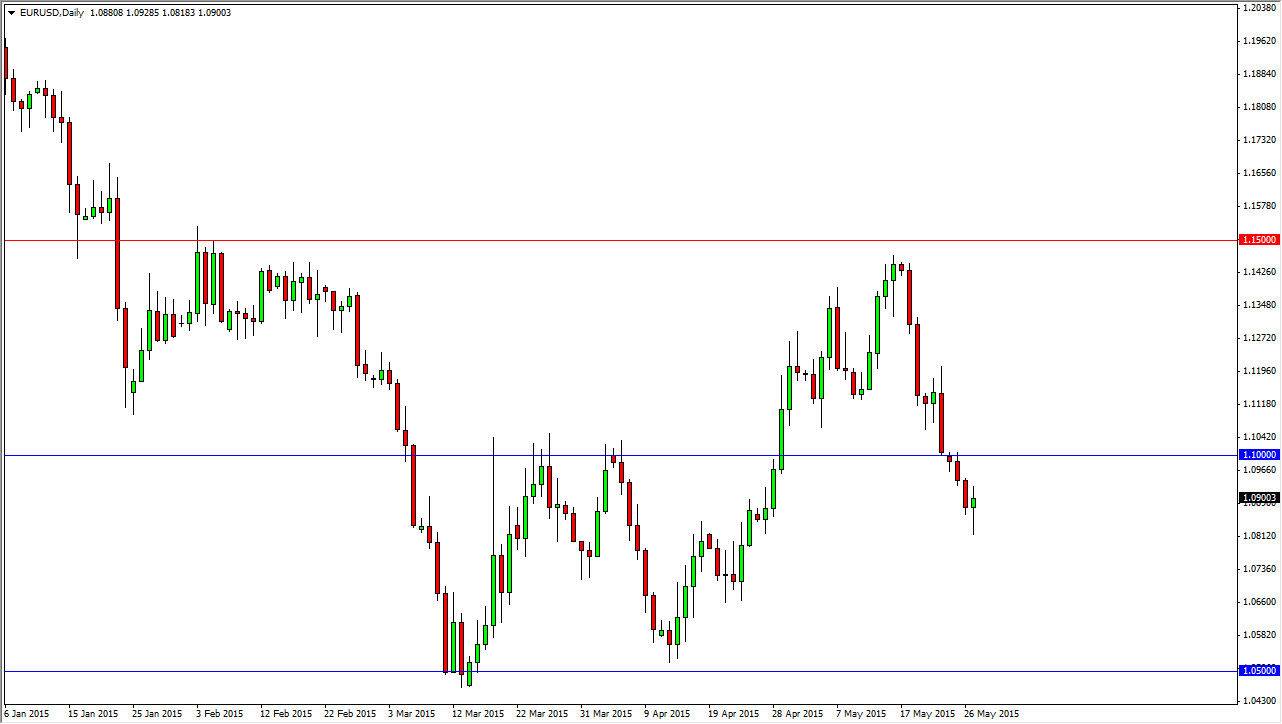

The EUR/USD pair fell initially during the day Wednesday, and even reached towards the 1.08 handle. However, we did find enough support to turn things back around and form a hammer. This of course is a very positive sign, but at the end of the day I am a bit concerned about going long of this market. I think that the 1.10 level could very well be resistance above, and let’s be honest here: a lot of what the bounce was about had to do with rumors coming out of Athens that some type of deal may be had here soon as far as that is concerned. This is a move that we have seen time and time again, and to think that the situation is certainly going to be solved is naïveté at best.

With this being said, the Greek situation is getting rather ridiculous. However, we have to react to the market that we are in, and not logic or mathematics. At this point in time, I believe that the easiest way to trade this pair is going to be paying attention to what I think is essentially “fair value” at the moment.

What I mean by fair value

What I mean by “fair value” is the fact that the 1.10 level is the middle of what could be a large consolidation area. I think of this pair as being a binary question at the moment, are we above 1.10, or below? Now that we are below that area, I think there is still a significant amount of bearish pressure. I would love to see a resistive candle near the 1.10 level that I could start to sell. I would also be a seller on a break below the hammer from the Wednesday session.

If we can get above the 1.10 level significantly, at that point in time I would consider buying. However, I think that the one thing you can count on his volatility. Sometimes, you just have to simplify the trade as much as possible.