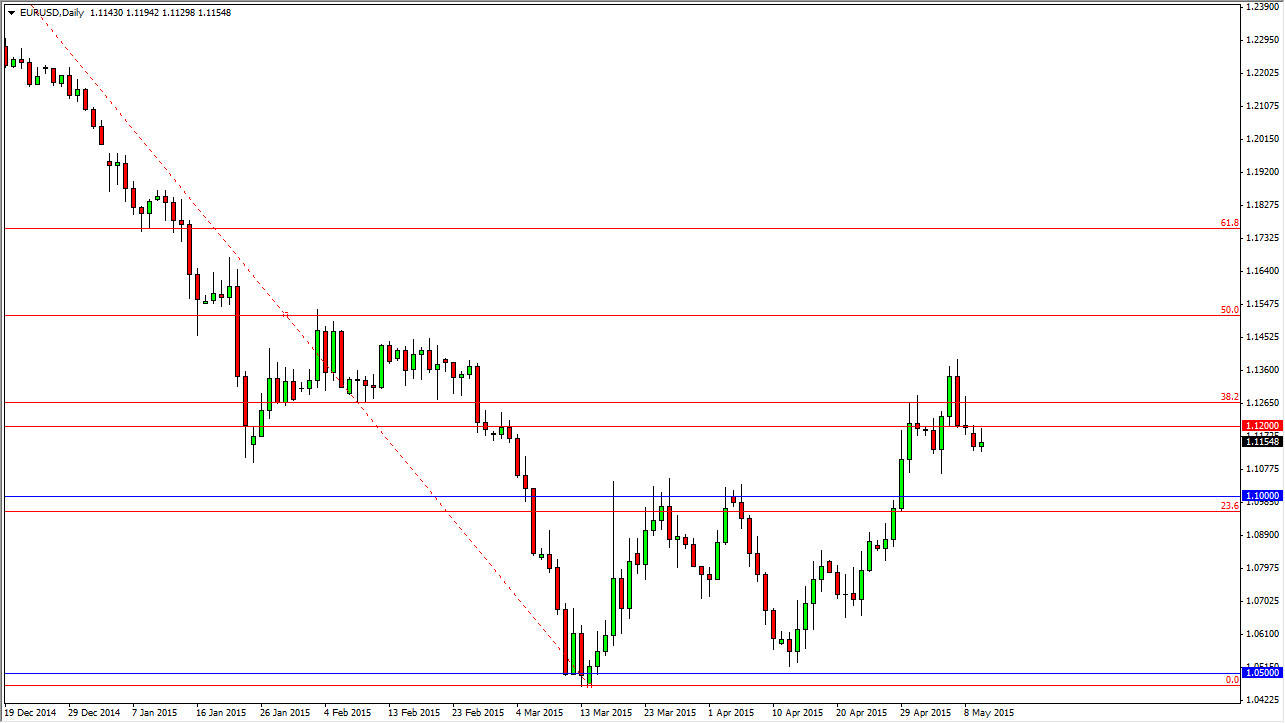

The EUR/USD pair initially broke higher during the day on Monday, but found the 1.12 level to be a bit too resistive for the buyers, and as a result pulled back to form a shooting star. The shooting star of course is negative, but at the end of the day I think there’s far too much in the way of support below. I think that we will more than likely only pullback to somewhere in the neighborhood of 1.10 over the course of the next couple of sessions, and then find buyers below. On the other hand, we could just simply break the top of the shooting star, which is also a very positive sign.

Trend changes are always nasty

The time a trend changes in a Forex pair, it tends to be a very messy and nasty affair. Sure, you can look back at charts from many years ago and think that you would’ve done the right thing, but the truth of the matter is that while they are happening, the markets are very volatile. It’s a very difficult market place to trade, but I do believe that we are starting to see a bit of a trend change at this point. I have that completely confirmed to me if we can get above the 1.15 level for any significant amount of time. In the meantime, expect a lot of drama to push the market back and forth. In other words, wipeout as many people as humanly possible.

If we did break down below the 1.10 level, at that point in time I would have to consider this market still very bearish. I think that would be a backbreaker as far as confidence is concerned for the traders out there that want to push this market higher, as it would be a return to a previous cluster that was rather significant. However, this just seems like a longer-term rally waiting to happen, so I think we will continue to fight back and forth until we break either above 1.15, or below the 1.10 level, giving us our longer-term bias.