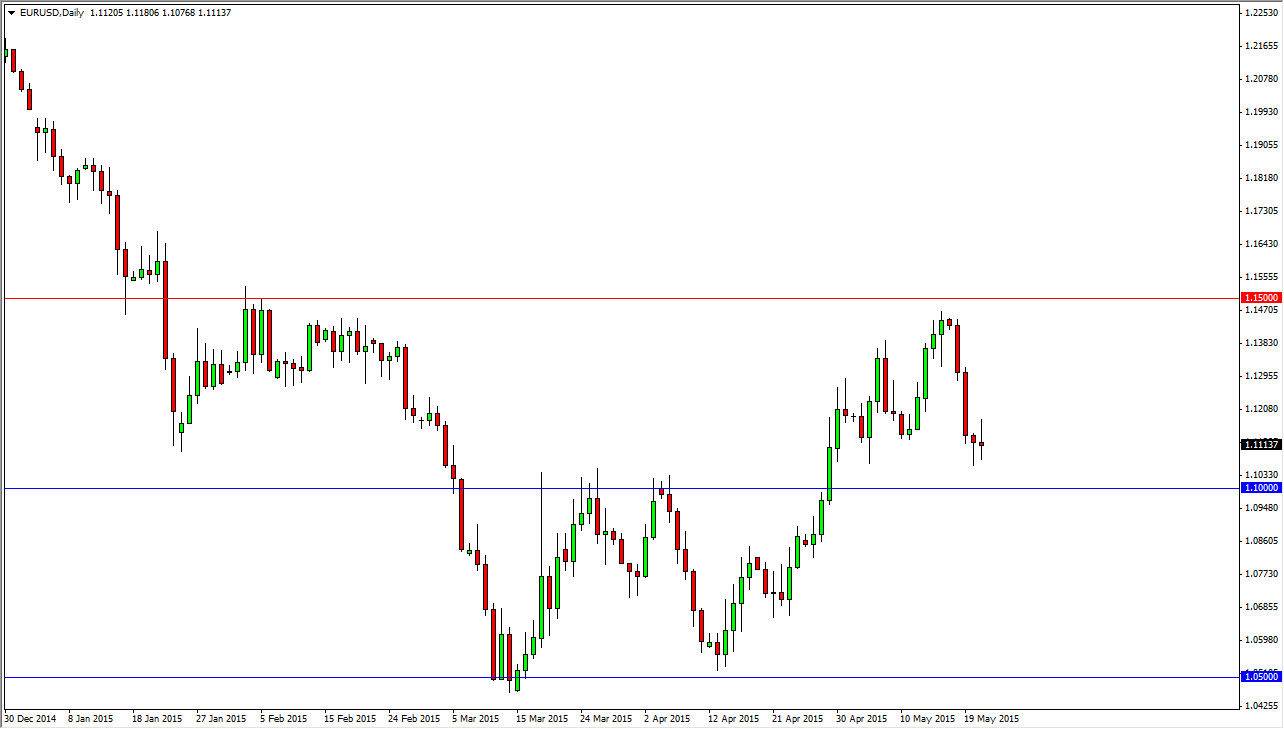

The EUR/USD pair broke down during the session on Friday, as the US dollar showed real strength over all. The market is now testing a seriously important area, and the Euro will have to make its intentions known soon. The 1.10 level is important as we broke above it previously to move towards the 1.14 level. The markets have now pulled back, and if we are going to keep the uptrend going, we have to hold the line at the 1.10 level.

The markets were reacting to the possibility raised by Janet Yellen of a possible rate hike in 2015. However, I think that this was already known, and this reaction was a bit much. With that, I will have to wait to see where we close on Monday, as the Memorial Day holiday will certainly have an effect on the liquidity as well. Because of this, the daily close is going to be very important.

Two possibilities

I believe that there are two possibilities in this market. If we can bounce from this area, we should go back towards the 1.14 level, and possibly head to the 1.15 level. If we can break above there, we are going to change the trend overall. The market falling from here is a sign that we will head back to the 1.06 level in my estimation.

One thing that I can see is that we closed at the bottom of the range for the Friday session, and this is normally a very negative sign – meaning that we should see continuation. However, one has to wonder how much of this could have been Americans closing out positions before the start of a three day weekend? With this, I am not entirely convinced to start selling yet. In this environment, I think waiting an extra day is the prudent thing to do. After all, we are looking at possible longer-term moves in the end. Because of this, I am going to monitor – but I am not too interested in taking the risk until I get more information.