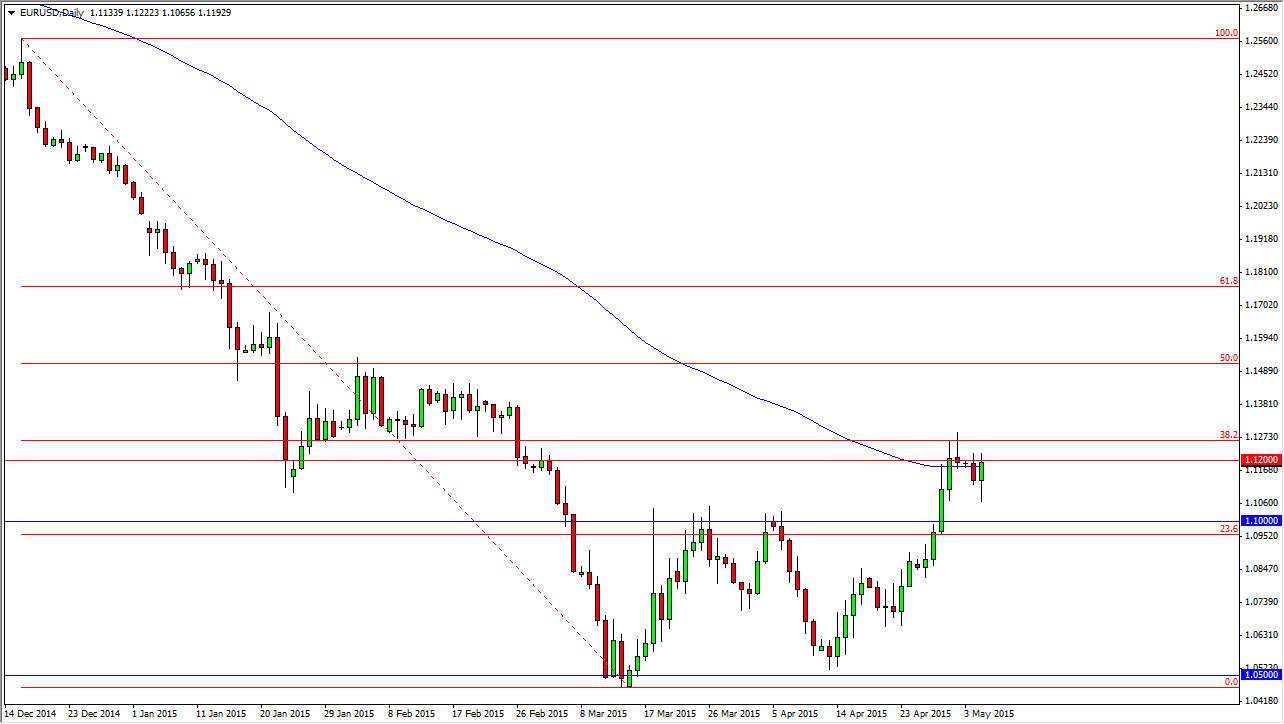

The EUR/USD pair initially fell during the day on Tuesday, but found enough support near the 1.1050 level to turn things back around and form a hammer. This hammer coincides nicely with the 100 day exponential moving average, so we have to start to wonder whether or not this market can make up its mind? At this point time I don’t know that we’re going to get an explicit move right away. I do think that above the 1.12 level there is a significant amount of resistance, so we are going to continue to struggle for clarity. I think this is going to be a very difficult pair to trade for anything more than a short-term scalp in the next few sessions.

Significant resistance above

I think that there is a significant amount of resistance and noise all the way to the 1.15 handle. That area is essentially what I am using to determine the trend overall. If we find ourselves trading above the 1.15 level, I think the trend has changed and we are starting to go higher. Quite frankly, the rally in the Euro has been much stronger than I would have guessed it was going to be. That being said, I recognize that we’re going to struggle with the Euro going higher at this point, as the next 3 handles look fairly resistive.

I think if we pullback from here there should be plenty of buying orders below, probably bouncing the market off of the 1.12 handle. Ultimately, it is going to be difficult to trade this pair for any real length of time but I think we can use it as an indicator. In fact, I am using this pair to decide what to do with the Euro against several other currencies around the world such as the Japanese yen, Canadian dollar, and Swedish krone. Ultimately, I think this pair will be very volatile and we are most certainly at a very significant tipping point right now.