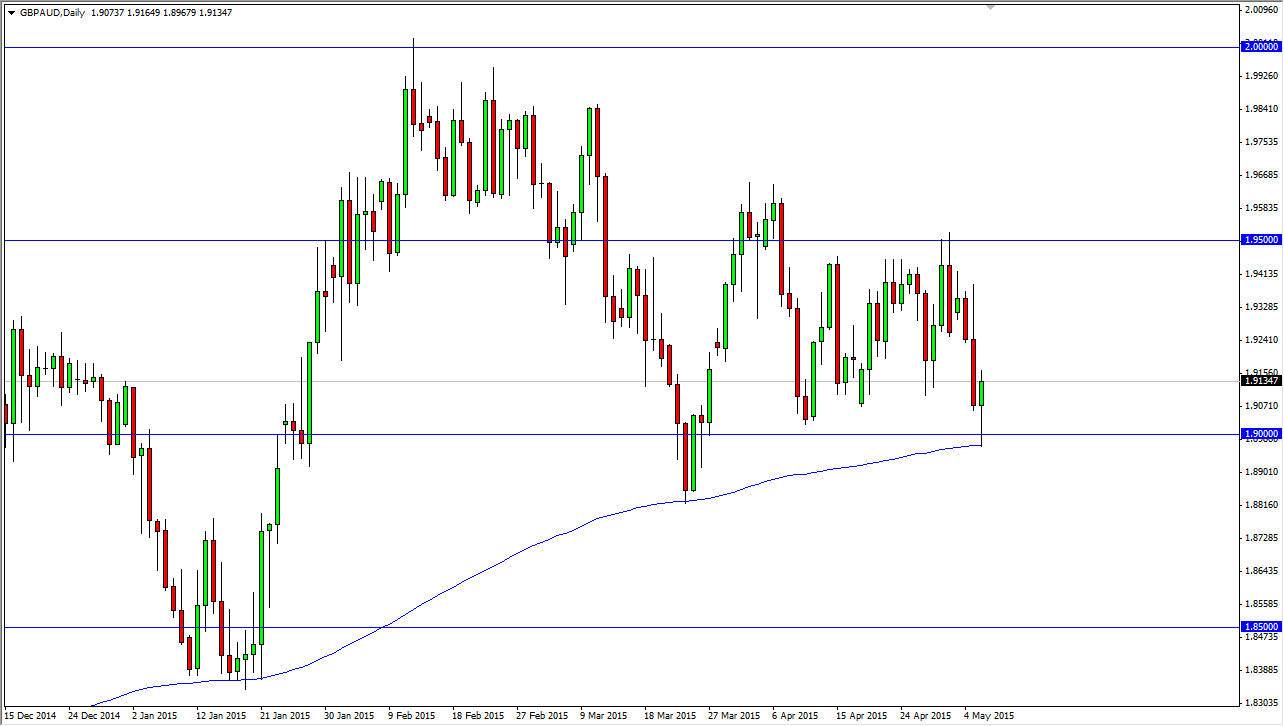

The GBP/AUD pair initially fell during the session on Wednesday, but as you can see turned things back around to form a hammer at the 1.90 level. This coincides nicely with a shooting star on the AUD/USD pair, suggesting that Australian dollar weakness is coming. With that, we also formed the hammer right on a large, round, psychologically significant support level, plus we also had the 200 day exponential moving average act as dynamic support. Because of this, I feel that if we can break the top of the hammer, we should then head to the 1.95 level which is the top of the recent consolidation area.

The British pound is doing okay, but the Australian dollar looks more right to fall than anything else. Because of this, I feel that this market will go higher based upon the Australian situation, and not necessarily the British one. I think that breaking above the 1.95 level might take a bit of work, but it can be done. I just don’t think it will be done today.

Short-term consolidation, short-term charts

I believe that the short-term consolidation that we have been in lends itself to traders stepping in on short-term charts such as the 15 minute variety in order to take advantage of a well-defined rectangle. You don’t necessarily have to use that timeframe, just keep in mind that longer-term trades are going to be very difficult to come by. With this, I believe that the consolidation continues for the time being, especially considering that the Nonfarm Payroll numbers come out on Friday, which don’t necessarily affect this pair directly, but certainly gets the markets attention in general.

On the other hand, if we do break down below the bottom of the hammer, I think this brings in the long-term traders on the short side, and the market will more than likely head to the 1.87 level next, and then the 1.85 region as it was once supportive at the beginning of the year.