GBP/USD Signals Update

Yesterday’s signals expired without being triggered as although the price did reach 1.5187 there was no bearish price action there.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trade 1

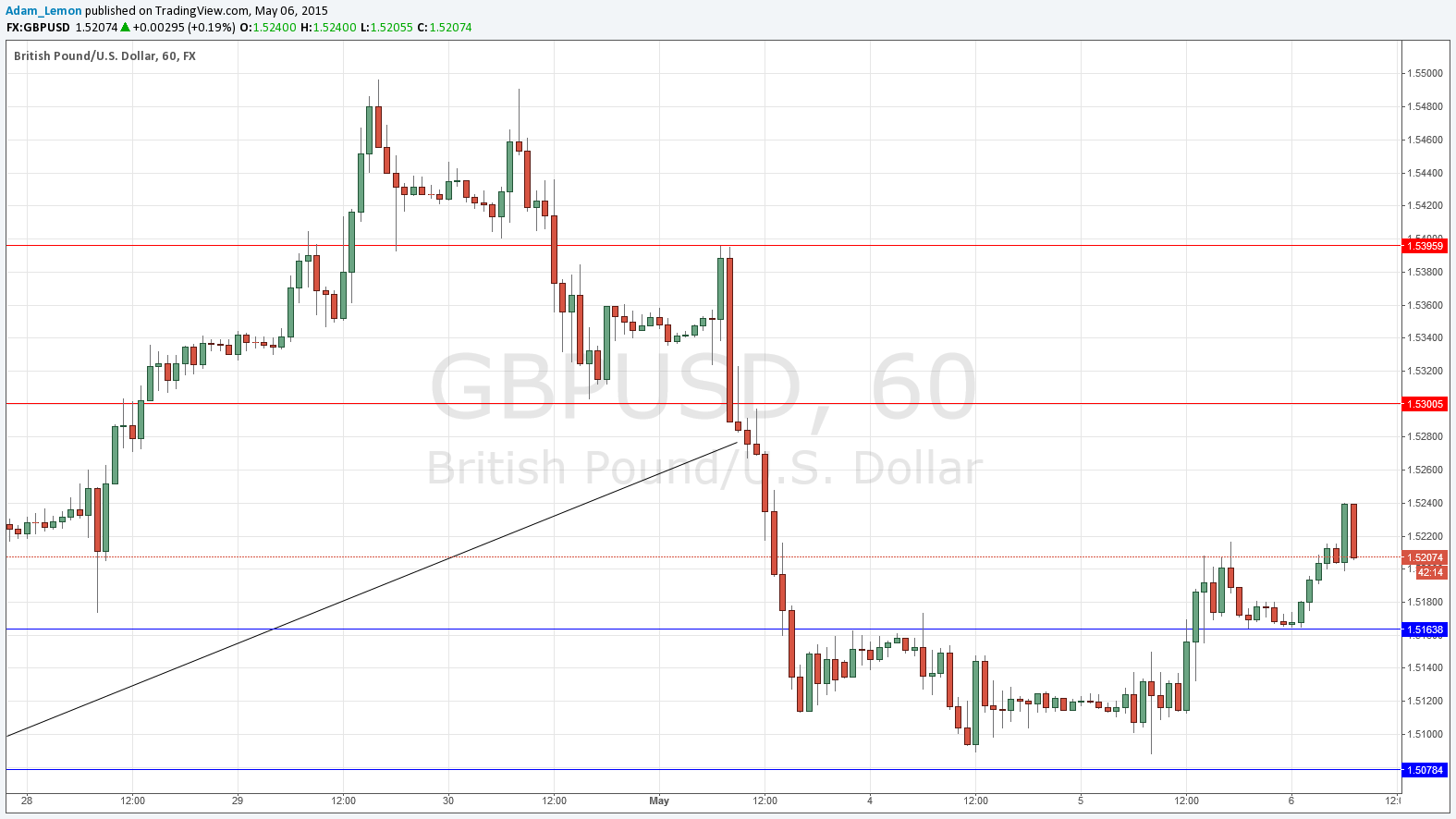

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5164.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5225 and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5078.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5140 and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5300.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5100 and leave the remainder of the position to ride.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5395.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5325 and leave the remainder of the position to ride

GBP/USD Analysis

I was a little wrong in expecting support and resistance levels to hold yesterday, in fact this pair flipped a resistant area to become probable future support at around 1.5164. This is a bullish sign.

There remains plenty of event risk with the British voting tomorrow in a General Election that still looks very likely to produce an unstable outcome.

There are high-impact events scheduled today concerning both the GBP and the USD. At 9:30am London time there will be a release of U.K. Services PMI data. Regarding the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm followed by the Chair of the Federal Reserve speaking at a Panel Discussion commencing at 2:15pm.