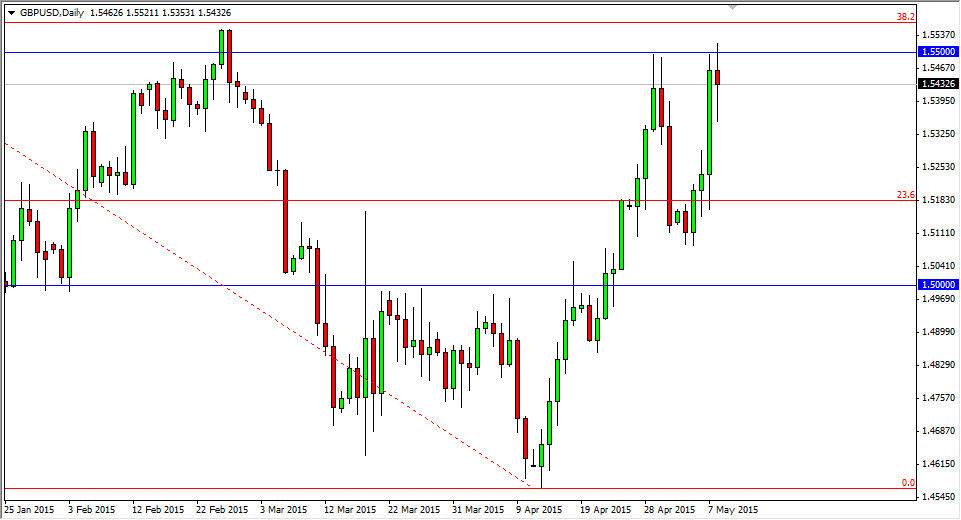

The GBP/USD pair broke higher as well as lower during the session on Friday in reaction to the Nonfarm Payroll numbers out of America. The British pound has recently rallied due to the election results in the United Kingdom, and as a result I believe that we are trying to build up enough momentum to break out to the upside. We don’t have it yet obviously, but I do see the 1.55 level as massive resistance. If we can clear that area decisively, I would be a buyer of this pair as I think at that point in time the trend will have changed, and we should go to at least the 1.5750 level almost immediately.

Pullbacks at this point in time look like they are more than likely going to be momentum building exercises, meaning that we will continue to see bullish pressure overall, but a couple of these attempts may need to be made in order to continue and break above the resistance in order to free the British pound go higher over the longer term.

Bullish overall, taking my time

I believe that I have no interest in selling this pair right now, and really I can’t think of any reason to. With that being said, I believe that the market will continue to offer buying opportunities from time to time, as the overall attitude of the market seems to be bullish, and I’m not going to fight it. I think that there is massive amounts of support near the 1.52 level, but also recognize that this is going to be a significant fight. It is not until we break down below the 1.50 level that I would even consider selling, which is something that I don’t anticipate seeing anytime soon. Because of this, I essentially am only trading this in one direction. If we can get above the 1.57 level though, I think we break out to much higher levels over the longer term. The area between the 1.55 and 1.57 will more than likely be choppy, but I think once we get to that general vicinity it will all be over for the sellers.