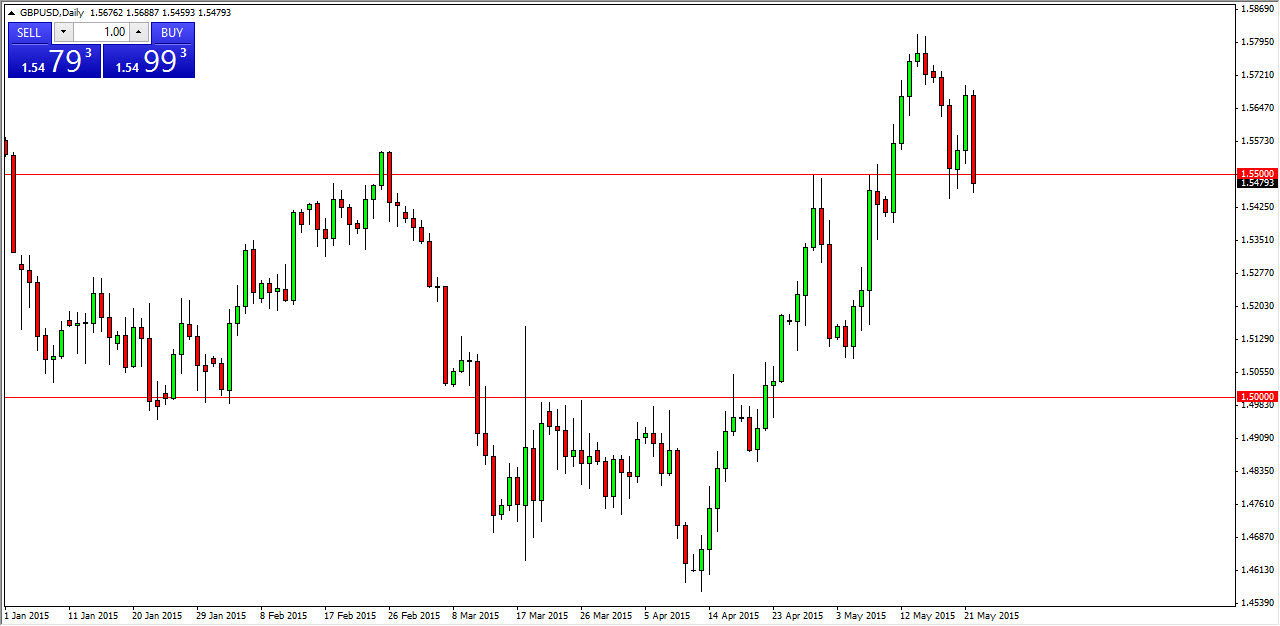

The GBP/USD pair fell hard on Friday, testing a serious support level in the form of the 1.55 – 1.54 range. This is the area that we broke out above recently to free the Pound to reach for the 1.58 level. The markets turned decidedly in favor of the US dollar, and as a result the currency markets suddenly look very murky at the moment. Adding to the possible murkiness is the fact that the Memorial Day holiday is today in the United States. Because of this, I think that it is probably best to leave this market alone for today, but there are certainly some major questions that will be answered over the next day or two. The 1.55 – 1.54 region will determine if we can possibly break out to the upside for the longer-term. The 1.58 level above is where the trend changes in my opinion, and if we can break above that it becomes a “buy only” market for me.

Will wait for the daily close

I will wait for the daily close in this market today to decide what to do next. After all, if we break below the 1.54 level, the market will have to be sold as it would show a turnaround in the momentum of the British pound in my eyes. The market finding support and bouncing from the area would be a positive move in my estimation, and I would be aiming for the 1.58 level again.

There is the possibility that we simply bounce between the 1.54 and the 1.58 levels in the meantime as well, I would be remiss if I didn’t point that out to you. I think that the market will make its intentions known clearly enough, but trying to anticipate this move is a great way to lose money. Sometimes, as Jesse Livermore used to tell us, we are “paid to wait on the markets.” This is one of those times in my estimation, as the markets are balanced on a thin rail.