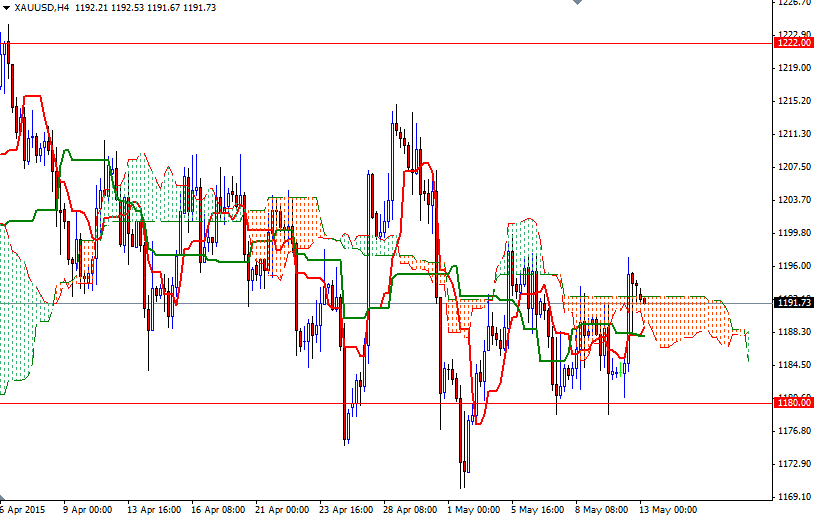

Gold settled up $10.25 at $1193.81 on Tuesday, helped by weakness in the dollar and equities, but rising yields on U.S. Treasuries and German Bunds capped gains. The market initially moved lower but found enough support around the 1180 level again to turn things around and challenge the 1199/7 resistance. Uncertainties in the major stock markets could provide a lift to gold in the short-term but the candlesticks show a real lack of momentum at the moment.

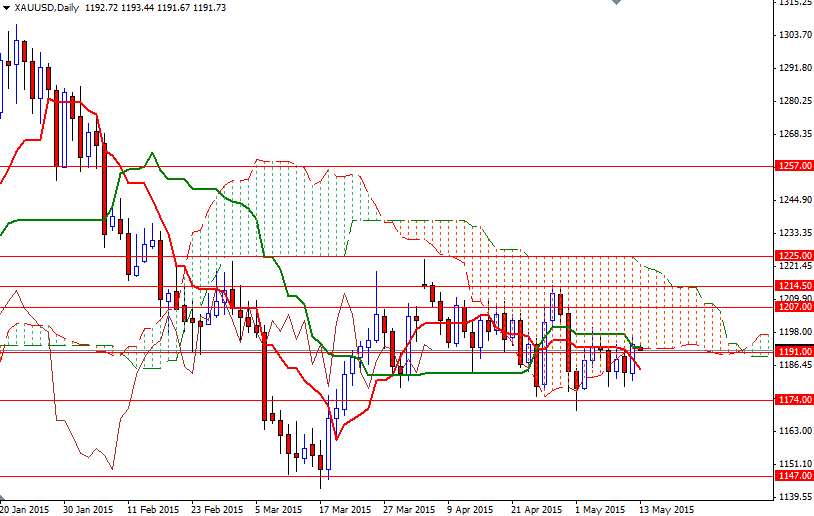

XAU/USD has been bouncing between 1180 and 1199 level since the begging of last week as the battle between the bulls and bears intensified. From a short term perspective, I think trading above the 1191 level is positive for gold but the market has to push its way through the 1199/7 resistance zone in order to gain some traction. Once this resistance is cleared, XAU/USD might can set sail towards 1207. If the bulls penetrate this barrier, the 1214.50 level could be the next port of call.

However, the daily Ichimoku cloud stays on top of us and that suggests there are tons of resistance ahead. To the downside, initial support is at 1175.50 (the bottom of the cloud on the 4-hour time frame) followed by 1180. The bears will have to push prices below 1180 if they intend to put extra pressure on the market and test the support at 1174. Since closing below this level would place the short term technicals in the same direction with the overall trend, it wouldn't be so surprising to see the market visiting 1147.