Gold prices closed slightly lower on Wednesday, giving back a small portion of the previous day’s gains, as the 1199/7 area continued to offer resistance. U.S. economic data mostly came in worse than anticipated, but the market had a muted reaction. The Automatic Data Processing Research Institute (ADP) said companies added only 169K employees in April and the Labor Department reported non-farm productivity declined at a 1.9% annual rate in the Q1.

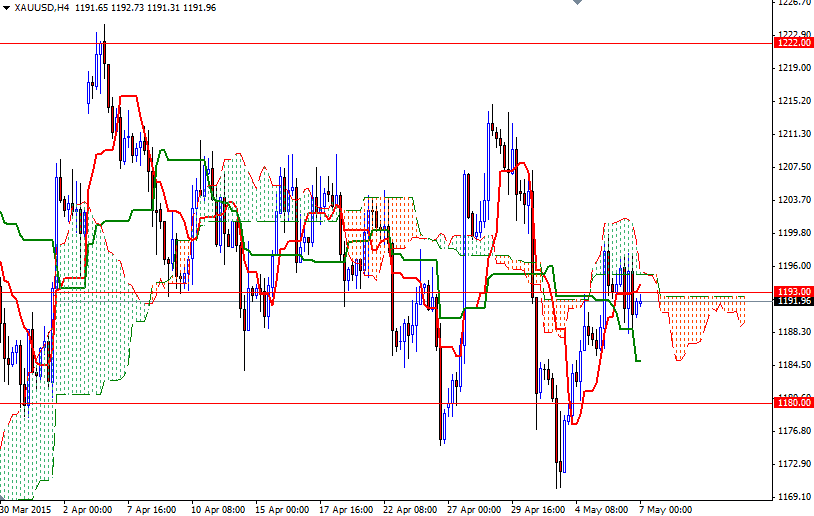

The sluggish figures reinforced the view that the Federal Reserve will not raise interest rates in June but rising U.S. yields put pressure on gold. XAU/USD is hovering in the 1193/1 area at the moment but the market's inability to climb above the Ichimoku cloud on the 4-hour time frame weakens the short-term outlook. If the bulls fail to push prices beyond the cloud, it is likely that the XAU/USD pair will retreat to 1184.90 - 1184 area. The next support, which holds the key to 1174, is located at 1180.

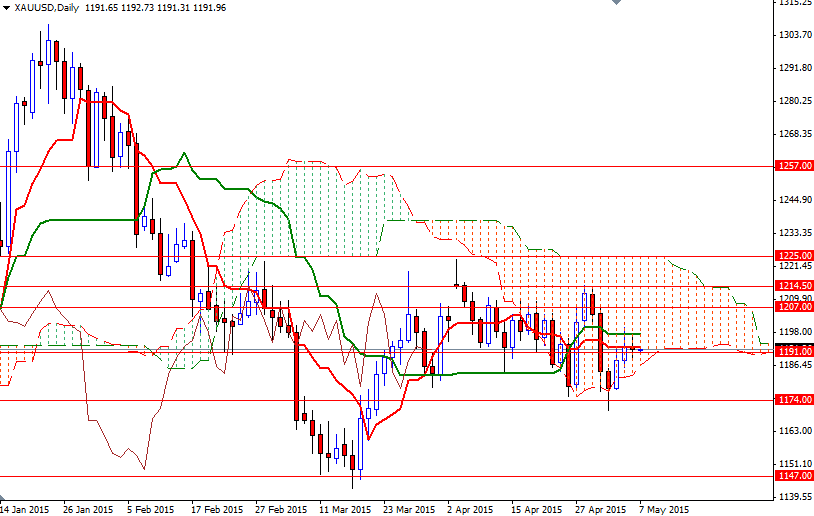

Although there are bearish Tenkan-sen line (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) crosses on the weekly and daily charts, these lines became flat recently as prices are trapped in the 1225 - 1174 zone. If XAU/USD passes through the cloud (4-hour chart), then we might see the market making another attempt to retest the 1199/7 area. I think the bulls have to penetrate this resistance so that they can gain some strength and challenge the 1207 level.