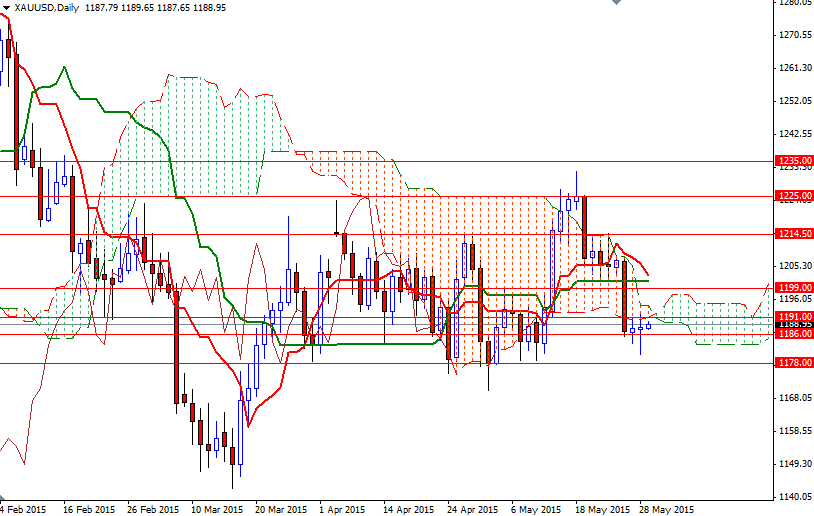

The market had an interesting session on Thursday as the battle between the bulls and bears for supremacy intensified. The XAU/USD pair initially tried to pass through the daily Ichimoku cloud then headed towards the 1178 level but run all the way back up and closed above the 1186 level. While a rebound in the dollar puts pressure on the metal, the prospect of Greece exiting the euro area weighs on European equities and sends players towards safety.

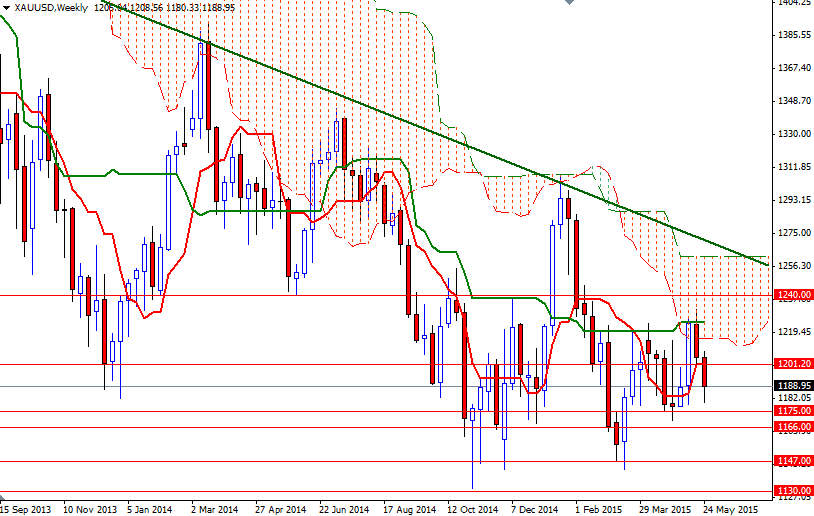

Long lower shadow of yesterday's candle indicates that buying interest continues to emerge on dips, especially when prices approach the 1178/5 region. As you can see on the daily chart, the XAU/USD pair haven't closed below this area since late March. Today's revision to first quarter U.S. Gross Domestic Product data will have some influence on gold prices and it seems the market is expecting a weak report.

To the upside, initial resistance is at 1194/1, followed by 1201-1199. If we see a surprisingly large downward revision, it is likely that the market will tackle this barrier. A break above the 1201 resistance would suggest that the XAU/USD will try to march towards the 1208 level. However, a surprise lift to Q1 growth could boost the dollar and send XAU/USD lower. On its way down, support can be seen around 1186/3 and 1178/5. If the market dives below the 1178/5 support which has been holding the market up for two months, I think the bears will be aiming for the 1166 level next. Once below that, there is little to slow down the bears' progression until 1147.