Gold prices settled lower yesterday, extending losses from the previous session, as the greenback continued to recover on the back of better than expected jobless claims data. The XAU/USD pair traded as low as $1178.76 an ounce after figures from the Labor Department showed applications for jobless benefits held near a 15-year low, pointing to sustained strength in the labor market despite moderate economic growth. Fed officials had stressed earlier this month that the labor market needs to be stronger before getting into the hiking cycle.

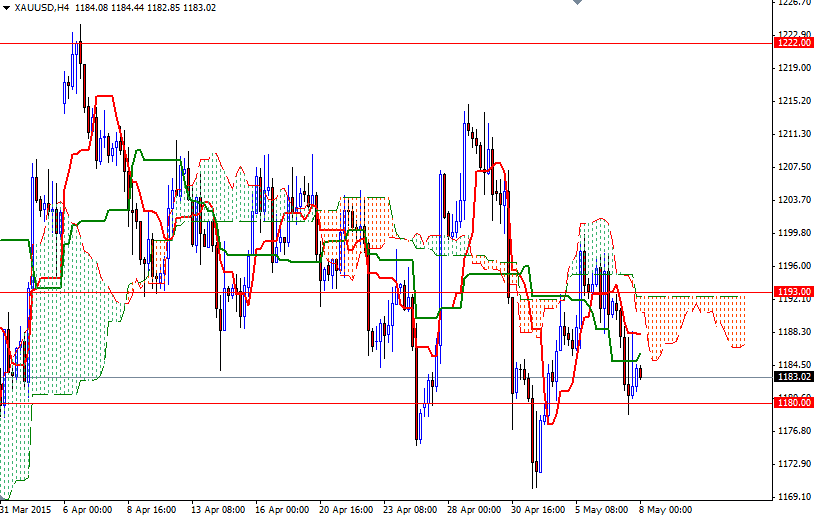

The U.S. economy is in focus today with the non-farm payrolls data coming up. The trend in weekly claims suggests that weak hiring in March may have been a blip and because of that the dollar is being supported. However, another gloomy payroll report, coupled with a weak wage growth, may revive diminishing views that the Federal Reserve would not act until later this year. The pattern on the daily chart indicates that the market is feeling the bearish pressure from the Ichimoku clouds. That means the XAU/USD pair has to pass through the 1193/1 area, where the Tenkan-Sen (nine-period moving average, red line) and bottom of the cloud coincide on the daily time frame, in order to alter the short term technical picture and head towards the next barrier around 1199.

If the bulls succeed in clearing this resistance, then the 1207 and 1214.50/1212 levels will probably be their new targets. We have an intra-day support zone at 1180 which seems to he holding, but there is a chance we will see the XAU/USD pair falling further to the 1174 level, once the market drops below yesterday's low. If the 1174 support level is broken, it would be technically possible to see the market testing 1166 afterwards.