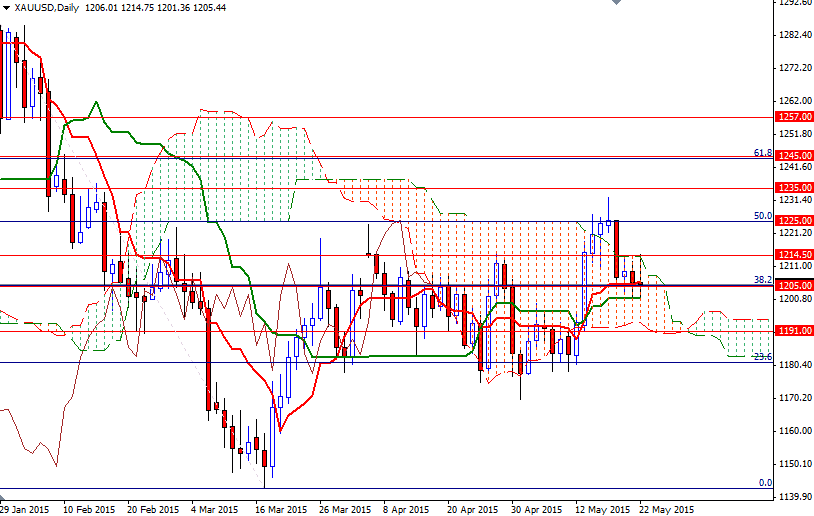

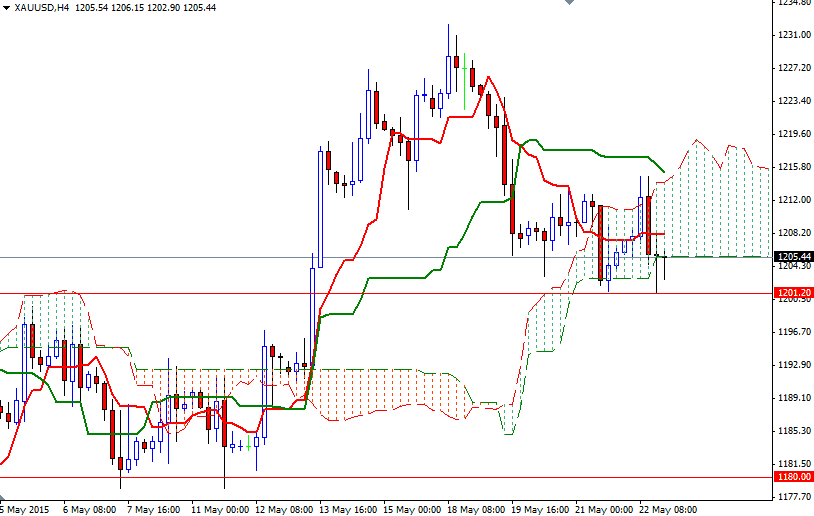

Gold prices settled at $1205.44 per ounce, falling nearly 1.5% over the course of the week, as gains in the dollar sapped demand for the metal. The market tried to pass through the resistance at the 1214.50 level again on Friday but sellers stepped in and dragged prices back to the 1201.20 level where the daily Kijun-sen (twenty six-day moving average, green line) resided after the Labor Department reported that the core consumer-price index rose 0.3% in April. In their recent speeches, Fed policy makers have reiterated that they were watching inflation and the labor market to determine when to lift the key short-term interest rate from near zero.

However, although the greenback extended its rally after Fed Reserve Chair Janet Yellen said

"Delaying action to tighten monetary policy until employment and inflation are already back to our objectives would risk overheating the economy", the gold market had a muted reaction. While Yellen said she thought weak growth during the first part of the year was largely the result of a variety of transitory factors, she also made it clear that "the actual course of policy will be determined by incoming data and what that reveals about the economy".

Prices have been trapped in a relatively narrow range of around $50 an ounce since mid-March and because of that investors demonstrate limited interest in gold. Since we are not in a trending market so buying on the dips and selling on the rallies approach will still be the way to go. To the downside, the initial support level stands around 1201.20 - 1199. If this support is broken, it is likely that the XAU/USD will test the 1192.91 - 1191 zone next. On the other hand, if the bulls hold the market above the daily Kijun-Sen, we could see a push up towards the 1214.50 level. Breaking through this barrier which held prices in check over the last three sessions would indicate that XAU/USD might make a fresh assault on 1225.