Gold edged higher on Wednesday as the dollar pared its recent gains after minutes from the Fed’s last meeting showed policy makers believed June is probably too soon to start raising interest rates. "Many participants, however, thought it unlikely that the data available in June would provide sufficient confirmation that the conditions for raising the target range for the federal funds rate had been satisfied..." the minutes said. Although the records also suggests that the Fed's outlook on the economy remains optimistic, since the April meeting, economic indicators have appeared weak.

At the beginning of this year, the U.S. Federal Reserve was expected to increase rates in June but the slowdown in the first quarter and subdued inflation backdrop shifted thinking on this. Indeed, the possibility that the Fed will wait beyond June would be seen as positive for gold but the market couldn't rally because the correlation with stocks, crude oil and euro has strengthened. The XAU/USD pair has spent the Asian session within the 1214.50 and 1205 levels so I will keep monitoring this tight range.

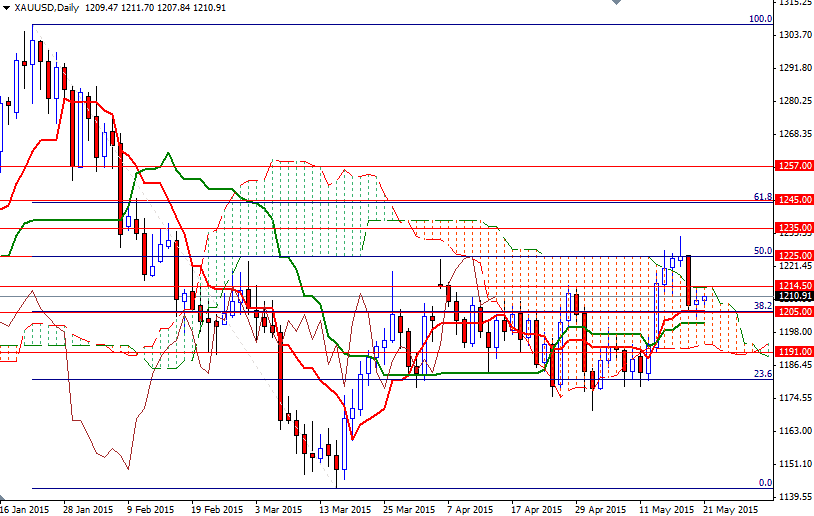

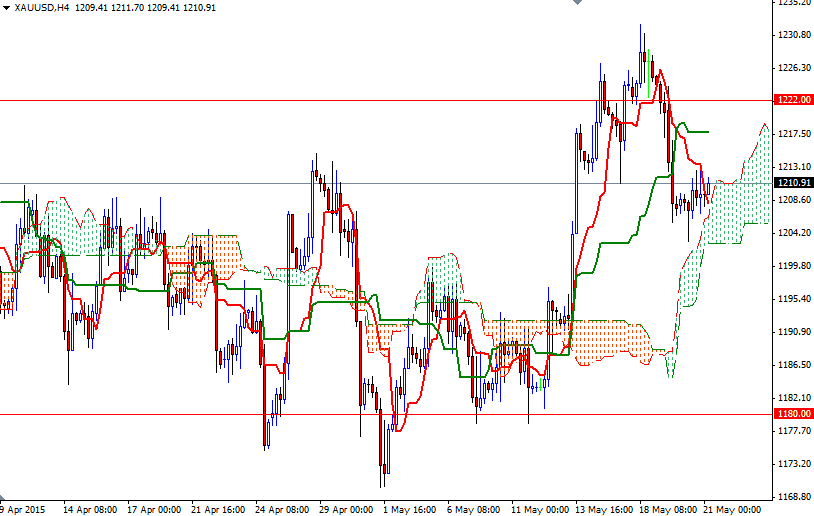

The market is holding above the 1205 level as the Ichimoku clouds on the 4-hour time frame continue to provide support but the technical outlook remains mixed. XAU/USD is currently stuck inside the daily cloud and the weekly cloud on top of us still puts some extra pressure. If prices climb back above the top of the daily cloud, then we are likely to proceed to 1217.70. Resistance is strong in the 1225/2 area so shattering this barrier is essential for a bullish continuation. If the bears take the reins and drag the market below 1205, the next stop will probably be the 1201.20 - 1199 region. Falling through this support would indicate that the bears are getting ready to challenge the bulls at the 1192.91 - 1191 battle field.