Gold prices fell $3.5 an ounce yesterday, erasing previous day's gains, as data from the labor department showed that the job market is on the right track. The XAU/USD pair traded as low as $1201.51 but managed to climb back above the 1205 level after manufacturing data fell short of market expectations. Markit reported that its preliminary manufacturing purchasing managers' index dropped to 53.8 in May from the final April reading of 54.1 and the Federal Reserve Bank of Philadelphia said its business activity index fell to 6.7 from 7.5.

The U.S. economy is in focus today with inflation figures coming up, Fed Chair Janet Yellen is scheduled to speak at the Greater Providence Chamber of Commerce Economic Outlook. Markets will be listening for any hints on when the central bank will tighten monetary policy, though she may harp on the usual comments that the timing of the first rate rise is data dependent. It appears that the XAU/USD pair is likely to continue its range bound movement.

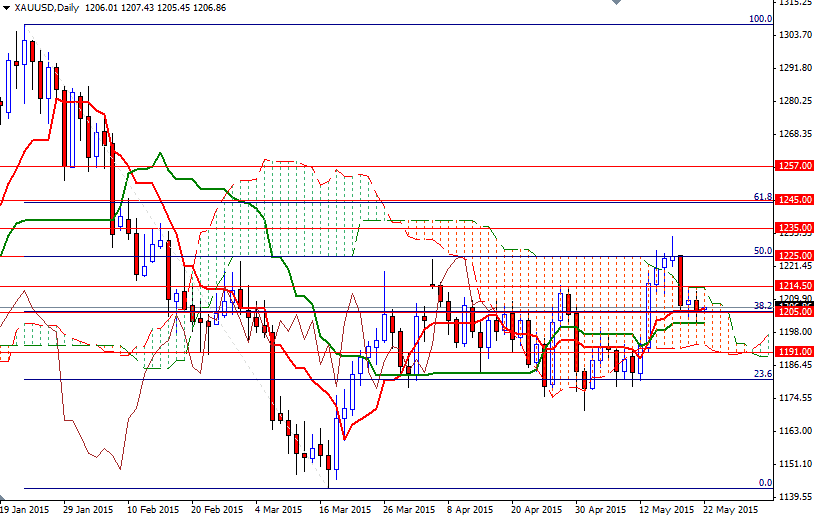

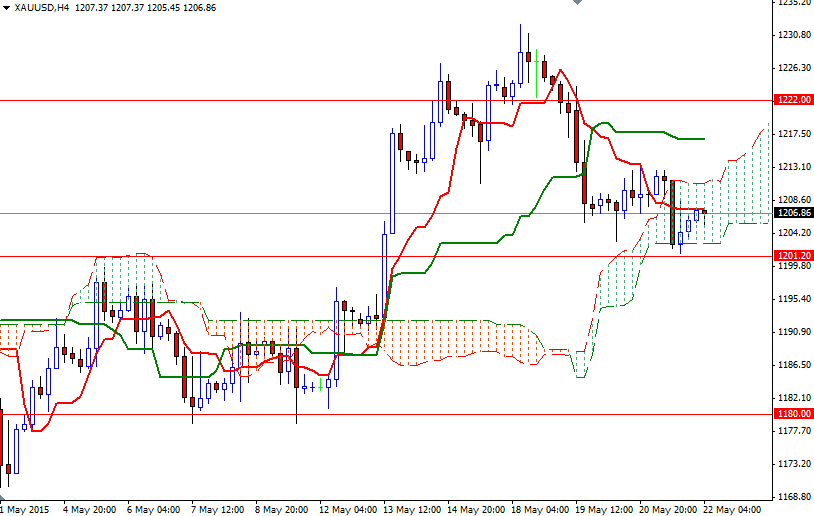

As you can see on the daily and 4-hour charts, the market is trading within the borders of the Ichimoku clouds and both the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) are completely flat. If prices stay firm in the near term with support near 1201.20 - 1199, there will be a possibility of revisiting the 1214.50 - 1211 region. Breaking through the resistance at 1214.50 could ease the pressure on the market and open the doors to the 1225/2 levels. However, if the bears take over and capture the 1199 level, then it would be technically possible to see the XAU/USD pair testing 1191 afterwards.