Gold prices rose 0.85% yesterday, posting the first gain in four sessions, and settled at $1188 an ounce. Gold’s rebound on Monday came as weak Chinese data spurred speculation that officials will take additional measures in a bid to bolster slowing growth. According to data released by the HSBC, the index of manufacturing activity slipped to 48.9 from 49.2. The precious metal which hit a six-week low of $1170.25 last week tested the 1193/1 resistance before pulling back to the current levels.

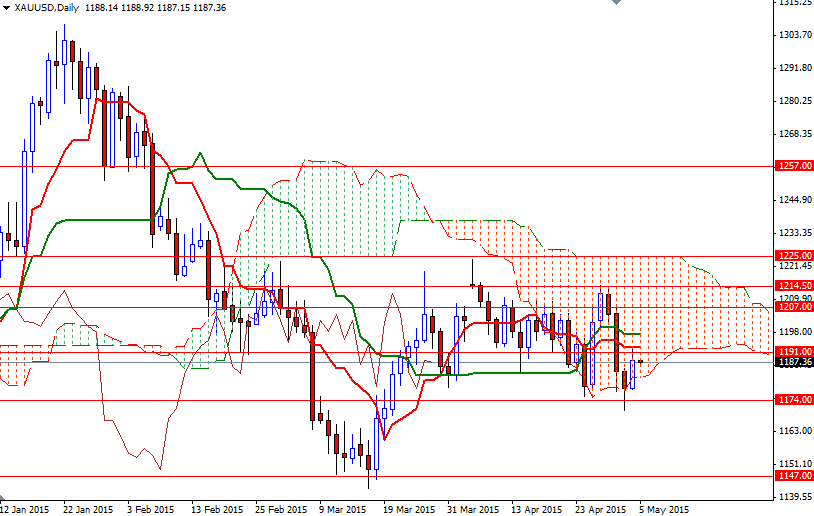

A flurry of economic data will be released throughout the week but April’s non-farm payrolls report will be the most influential one in determining the future of the Fed's normalization plans. If we have a set of strong reports this week, the market would drift lower and test the critical support between the 1147 and 1130 levels. Since this area has been holding the market up since November, closing below it could bring extra pressure and force the XAU/USD pair to test 1114 and 1088/6 afterwards.

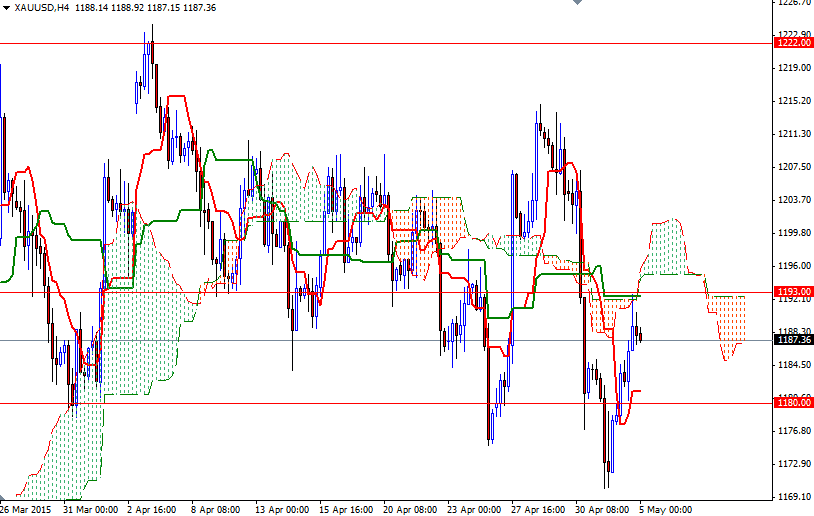

In the meantime, I will keep an on the 1181/0 and 1174 supports because the market will have a tendency to visit these levels unless the bulls manage to push prices above the 1193 resistance. Beyond that, the bears will be waiting in the 1199/7 area. If the bulls clear this barrier, at least on a daily basis, then it is likely that that the XAU/USD pair will head towards the 1207 level. The technical picture remains weak while the Tenkan-sen (nine-period moving average, red line) is moving below the Kijun-sen (twenty six-day moving average, green line) on both the daily and 4-hour charts.