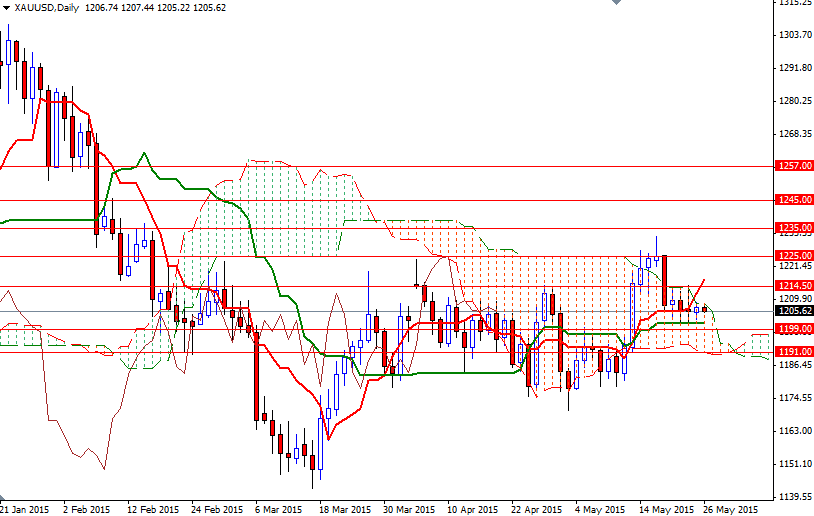

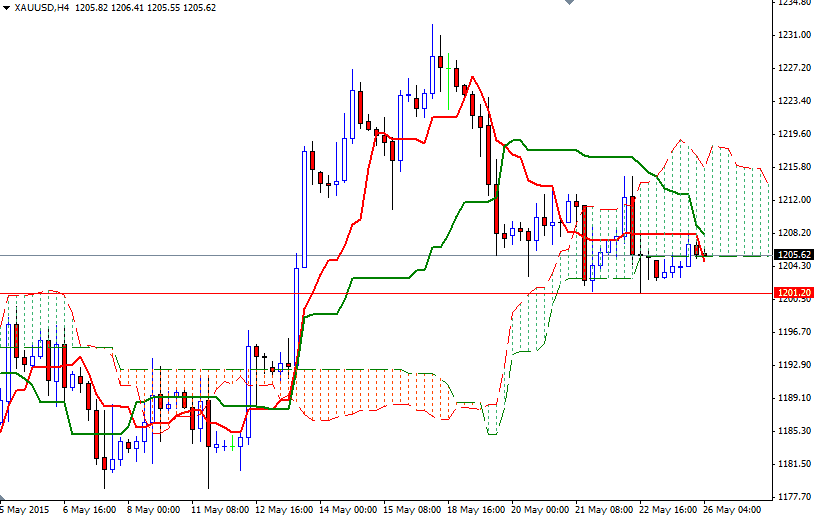

Gold started the week slightly higher but remained within a narrow trading range as liquidity was thin due to due to public holidays in the United States and the United Kingdom. After a relatively low volume trading day, the XAU/USD pair continues to consolidate above the $1205 level. The market has been stuck between the $1214.50 and $1201.20 since last Tuesday and this extremely tight trading range is making it hard to trade.

Investors have been avoiding the market as the prospect of rising U.S. interest rates set a generally negative backdrop for gold. Divergence between the Federal Reserve's path toward rate hikes and stimulative policies in Europe and Japan are likely to continue supporting the dollar so it is difficult to get too bullish on gold in the long term. However, despite all these negatives, the XAU/USD pair has repeatedly found strong support around the 1200 level recently.

That said, I think it makes sense to wait until we break out of this tight market. If we can successfully pass through the 1214.50 level, then the next targets will be 1219.30, 1225. Beyond 1225, I see a strong resistance between 1235 and 1245 area and I guess this is where the real fight is going to happen. On the other hand, if we break down below the 1201.20 - 1199 area, where the weekly Tenkan-Sen (nine-period moving average, red line) and daily Kijun-Sen line (twenty six-day moving average, green line) lines reside, the bears will be aiming for 1191. A daily close below 1191 may give sellers the extra power they need to test 1179/5.