Gold edged lower on Monday as strength in the dollar pushed prices down but uncertainty about the timing of a U.S. interest rate increase limited losses. Last week's U.S. jobs report fueled optimism the second quarter will be better than the first quarter though downward revisions to previous figures raised the possibility that the Federal Reserve may take its time in raising interest rates. Expectations that the central bank will not make its first move in June could be supportive for gold but slowing growth in China and weakening demand for physical gold might continue to weigh on the market and keep prices going significantly higher.

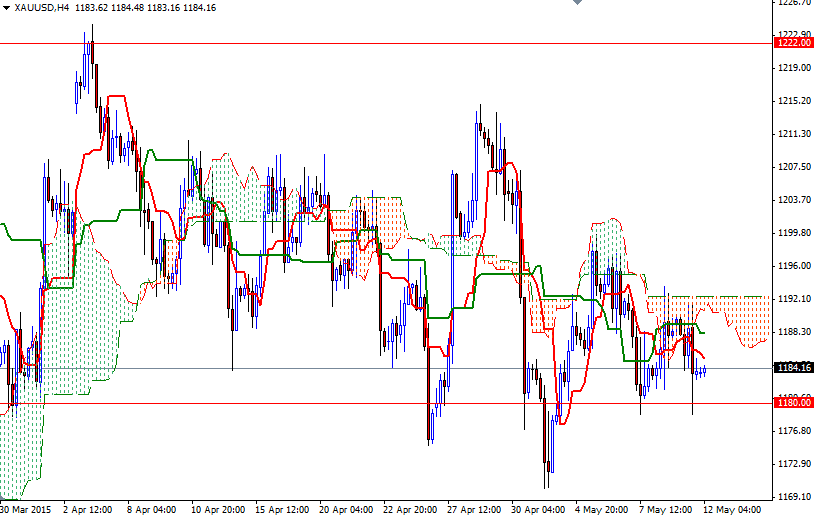

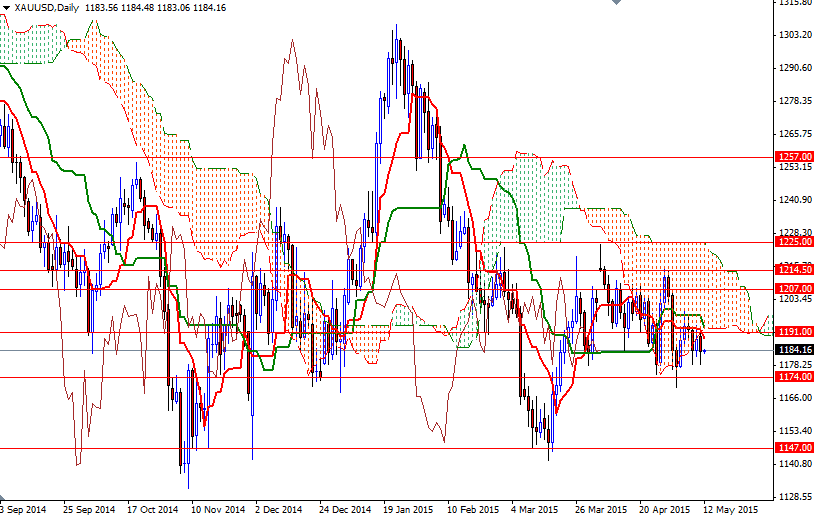

We have seen pretty much sideways action in gold recently but we are going to break out of this tight range eventually. Speaking strictly based on the charts, I think momentum is likely to remain to the downside as long as the market trades below the Ichimoku clouds on both the daily and 4-hour charts.

The initial support level stands at 1180/78.50 but it is quite possible that the XAU/USD pair will test 1174 again if the bulls fails to capture the strategic resistance at 1193/1 where the bottom of the daily cloud and Kijun-Sen (twenty six-day moving average, green line) reside. A daily close below 1174 would suggest that the bears will be aiming for the next support level at 1166. As you can see, the area between the 1193 and 1191 levels has been resistive lately so only breaching this barrier can give the bulls another chance to charge towards 1199. If prices get through, we could see the pair extending its gains and approaching the 1207 level.