Gold prices ended Tuesday's session down 1.63%, or $19.70, to settle at $1187.04 an ounce as a strong rally in the dollar drew investors away from the market.

Yesterday's data from the world's biggest economy were mixed. Durable goods orders numbers were weak but were more or less in line with market expectations. Other reports showed that consumer confidence improved and sales of new homes increased. The possibility of higher interest rates this year also weighed on equities but the recent sharp drops failed to offset pressure on gold from the rising dollar.

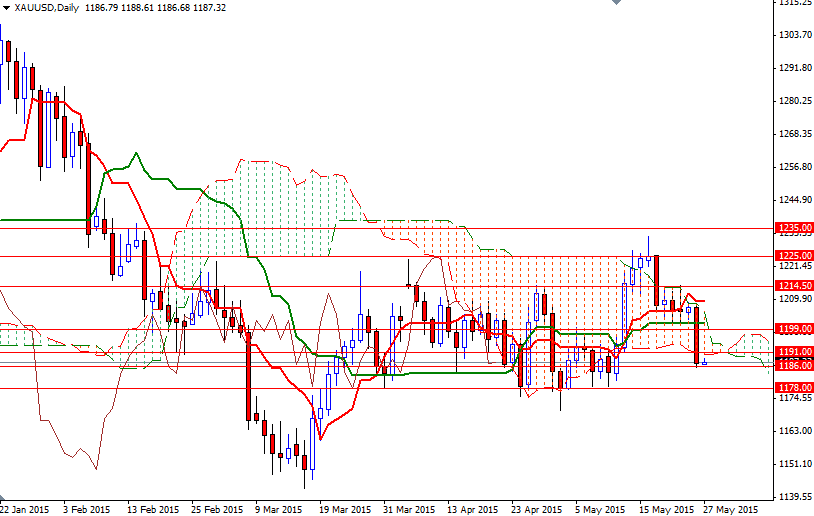

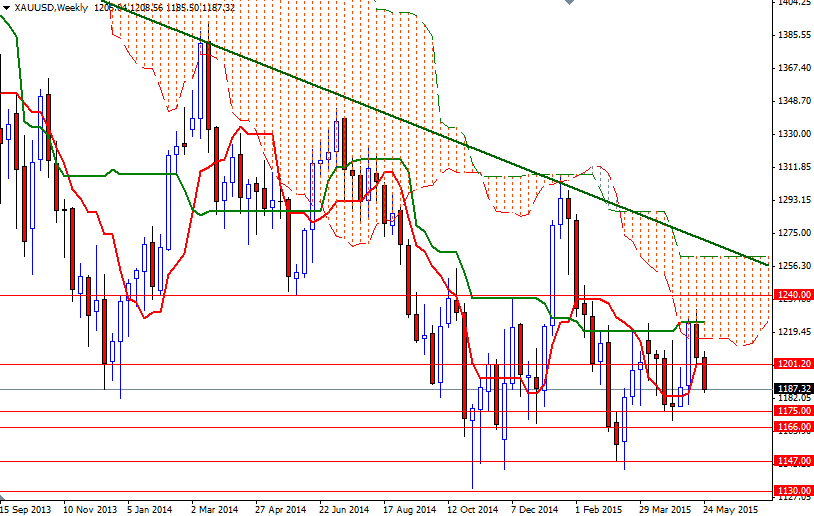

The XAU/USD pair accelerated its slide and hit the lowest level since May 12 after the support around the 1201.20 - 1199 region -which I pointed out in my previous analysis as a strategic point for a bearish continuation- was broken. Although the market found some support at 1186 and recovered slightly to 1187.32, dropping back below the daily Ichimoku cloud is negative for gold. From a purely technical point of view, the odds favor further downside unless the market closes above the 1214.50.

But of course, the bears have to capture 1186 and drag prices below yesterday's low so that they gather enough strength to challenge the bulls waiting in the 1178/5 zone. Once below that, the next stop will probably be the 1166 level. However, if the support at 1186 remains intact, expect a bounce towards the 1191 level. XAU/USD will need to climb above this level to revisit 1197 and 1201.20. Closing above the 1201.20 resistance would indicate that the bulls won't give up before testing 1209/7.