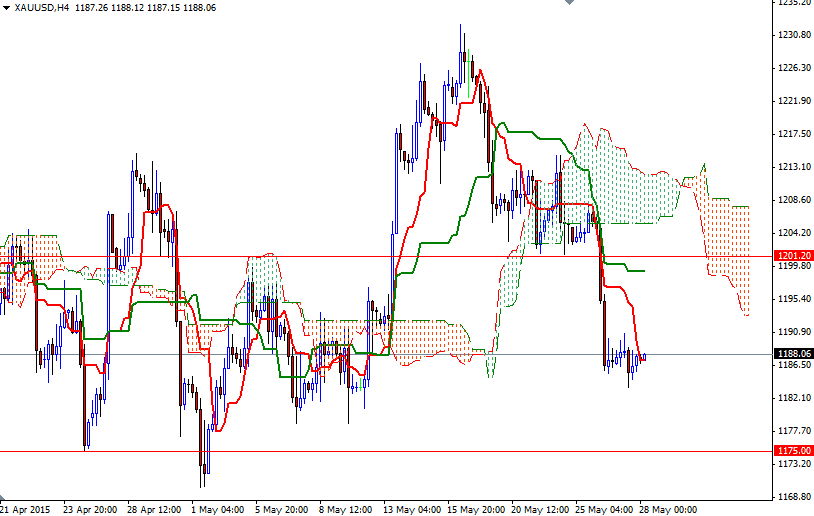

Gold prices ended Wednesday nearly unchanged as the bulls and bears struggled for near-term control, with neither gaining an edge. The market steadied after initially hitting $1183.56 an ounce, the lowest since May 12. While we see some safe-haven demand from renewed worries over Greece's debt problems, the market continues to feel the repercussions of Tuesday's move that pushed prices back below the 1201.20 - 1199 support.

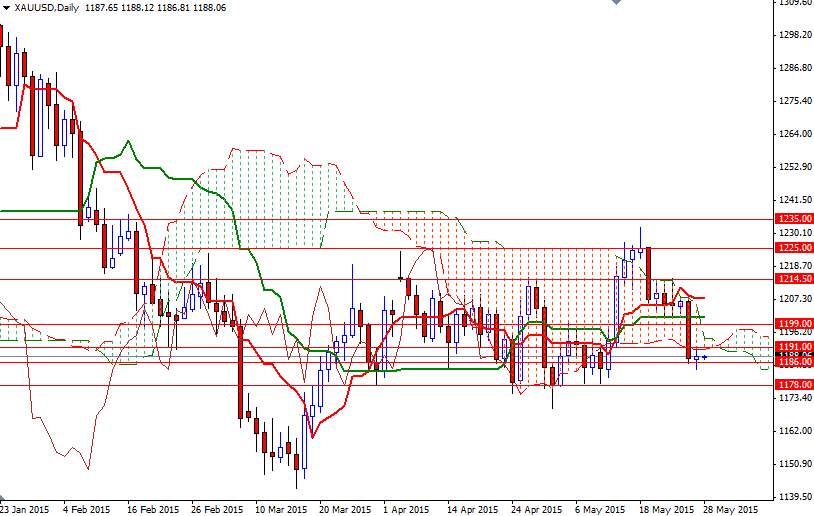

Currently the XAU/USD pair is trading below the Ichimoku clouds on the weekly, daily and 4-hour time frames and that gives the bears an advantage. Keep in mind that the Ichimoku clouds which defines an area of support or resistance depending on their location and in our case they indicate that the path of least resistance is to the south - i.e. the market will have a tendency to grind lower unless the technical picture changes. However, I am aware that the area below, between the 1178 and 1166 levels, has put a temporary floor under the market. Therefore the potential downside is likely to be limited until this support is broken.

To the upside, the initial resistance is located in the 1194.19 - 1191 area which is occupied the daily cloud. If prices can push back up and close above this level, it would be technically possible to see XAU/USD testing the next barrier around 1201.20 - 1199. Breaking through this barrier on a daily basis could encourage buyers and increase the possibility of an attempt to visit the 1207.90 level where the daily Tenkan-Sen (nine-period moving average, red line) line resides.