Summary

Forecasts as far ahead as several weeks should always be taken with a pinch of salt as the underlying circumstances of the market may change dramatically over the course of the month. However, it is possible to have some predictability when the possibility of shock events is discounted.

I believe the most reliable pairs to watch for direction during May 2015 are going to be USD/CAD short and GBP/USD long.

Quantitative Analysis

It is best to begin with the USD as it is the hub of the Forex market.

The USD has fallen meaningfully in value over the past 1 month and 3 month periods. This is a significant quantitative change in the market and is suggestive of continuing USD weakness over the coming month.

Next, it should be noted that both the GBP and the JPY have been enjoying steady movement overall for many months, with the GBP rising and the JPY falling.

Over the past 3 months, we are also seeing strong turnarounds from bearish to bullish in CAD and NZD, and in AUD to a lesser extent.

This suggests that the current month will see rises in GBP, CAD, NZD and AUD, and falls in USD and JPY – in these orders of preference.

Technical Analysis

USDCAD

The chart below shows that there is still room for this pair to fall. Monthly lows may be made at or close to the support levels of 1.1800 or 1.1670. There is plenty of resistance above and it is very hard to see the monthly high being made above 1.2300 or possibly 1.2400. If 1.2110 holds it will be a bearish sign.

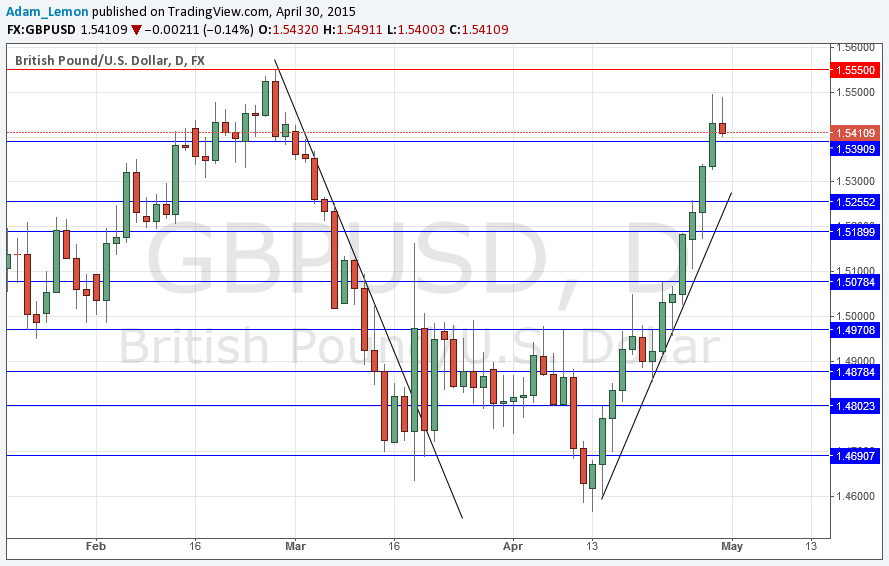

GBPUSD

The chart below shows very starkly what a spectacular rise this pair has enjoyed over the previous couple of weeks. However it also shows clearly the danger at the 1.5550 lately which is very suggestive of a double top forming after such an unbroken upwards move.

Due to these factors, unless there is a very quick break up past 1.5550, a better move would probably be to wait for a pull back at or close to one of the numerous support levels below, especially very early in the London session, before buying the pair. There is likely to be especially strong support at the 1.5000 area but if we fall back that far then an up month has become very questionable. I see the monthly low as being likely to fall closer to 1.5250 or possibly 1.5100. It would probably make sense to take at least profits at 1.5500 / 1.5550.

Fundamental Analysis

Many traders believe fundamental factors should either be ignored completely, or taken as the primary factor to consider in entering or exiting a trade.

My own belief is that fundamental analysis is best used as a final filter in deciding whether to take a trade that already looks good from a technical perspective.

Therefore let’s consider the aforementioned currencies from a fundamental perspective.

Both the GBP and the CAD have higher base rates than the USD.

Of the three currencies, the market probably sees the next rate rise as most likely to come in the GBP, closely followed by the USD.

The USD is seen as having the strongest economy, but that perception is arguably under threat now.

The CAD may be impacted by the price of oil with a positive correlation, and the price of oil is bouncing back and rising strongly.

Overall it seems that the fundamental factors are mixed and questionable enough to probably not be a block in the direction of the trades discussed.