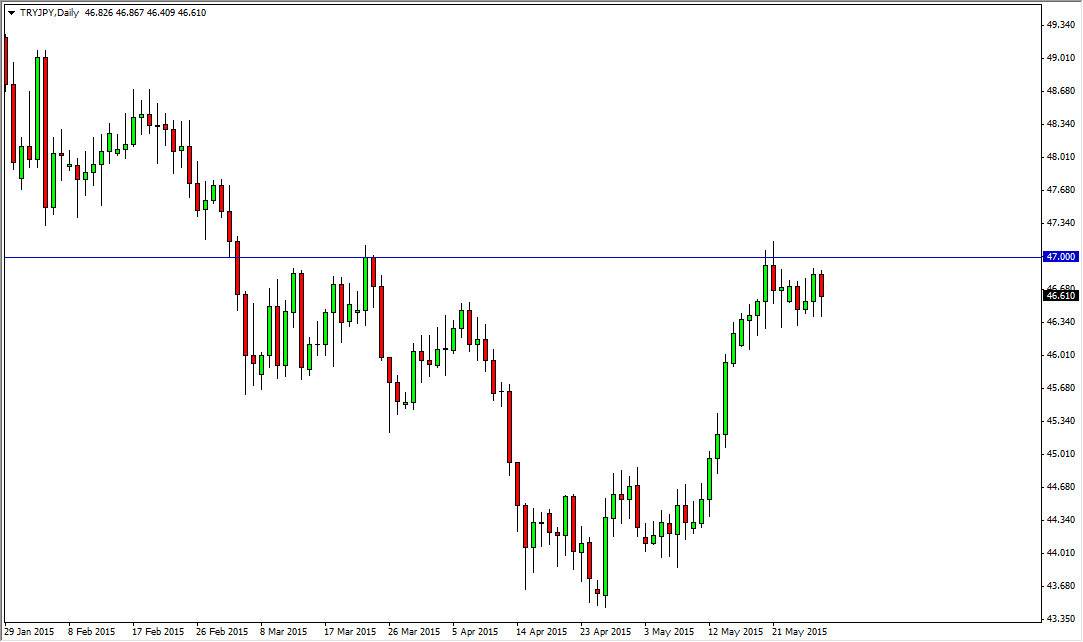

The TRY/JPY pair fell initially during the course of the session on Thursday, testing the 46.50 level for support yet again. That being the case, the market forming a hammer of course suggests that we are going to have buying pressure soon. If we can get above the 47 level, we feel that the market should then go to the upside, perhaps heading to the 48.50 level. I think that we go even higher than that given enough time, and I do like this pair like quite simply because the Turkish lira gives quite a decent swap over the Japanese yen.

I see the 46.50 level as been extraordinarily strong, as well as the 46 handle. Ultimately, this market should continue to go much higher over the longer term as the swap will help as interest-rate differentials between Turkey and Japan of course will be very wide.

No interest in selling

This is a great market to “buy-and-hold” just simply for the carry trade, but as a result the market should continue to attract traders unless of course there’s some type of incident in Turkey, or if the Middle East suddenly blows up. However, as long as things can remain somewhat stable I believe that there should be plenty of upward and sustained pressure in this pair. I think the fact that we continue to find buyers at the 46.50 level tells me that we are trying to break above the 47 handle, and as you can see on the chart it has been rather resistive and supportive both in the past.

Because of this, I think that if we can break above there, it will certainly bring in a flood of buyers orders. Because of this, we believe that it’s only a matter time before we hit the 50 level but recognize that it is a longer-term type of trade as far as that’s concerned. But having said that, that’s what makes his trades are great: you get paid to wait. A break above 47, I am a buyer. I am also a buyer down at the 46.50 level on supportive action