The USD/CAD pair initially tried to rally during the session on Thursday again, but just as we had on Wednesday, the sellers came back into the marketplace and pushed price back down. The shooting star that formed during the session on Thursday suggests that we are in fact starting to struggle. That struggle could translate into lower prices, and quite frankly we are approaching a bit of resistance in the US Dollar Index as well, so this may coincide quite nicely.

You have to pay attention to the oil markets, and they most certainly appear as if they are starting to break out to the upside again, so if we get stronger oil prices, it’s very likely that this pair will drift lower. I am not looking for some type of meltdown, I think that we are just going to see a general slide lower in the US dollar against the Canadian dollar. I believe that the 1.19 level will be targeted, but of course there will be a reaction somewhere near the 1.20 level as well due to the fact that is a large, round, psychologically significant number.

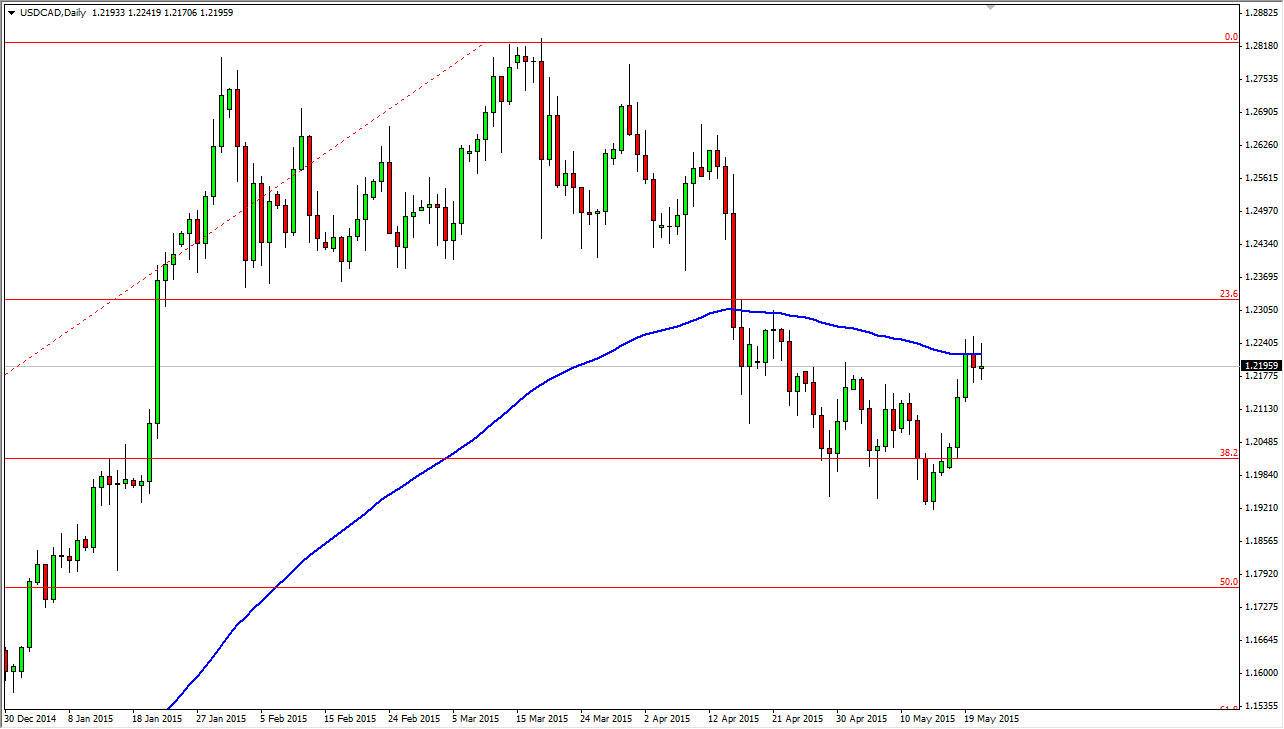

100 day exponential moving average

The 100 day exponential moving average is plodded on this chart, and as you can see has offered dynamic resistance a couple of times during the last couple of months. With that, I feel that the market will more than likely continue to see that as resistance, and with that I think that the area above there will more than likely continue to see resistance all the way to the 1.24 level as well. In other words, I think it’s simply easier to sell this pair which is quite a different scenario than what we have seen until very recent action. Ultimately, the market could very well pullback from here without too many problems, and as a result I think it’s just simply the “path of least resistance” to sell this pair.