USD/CAD Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at 1.2071.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be made between 8am London time and 5pm New York time today.

Short Trade 1

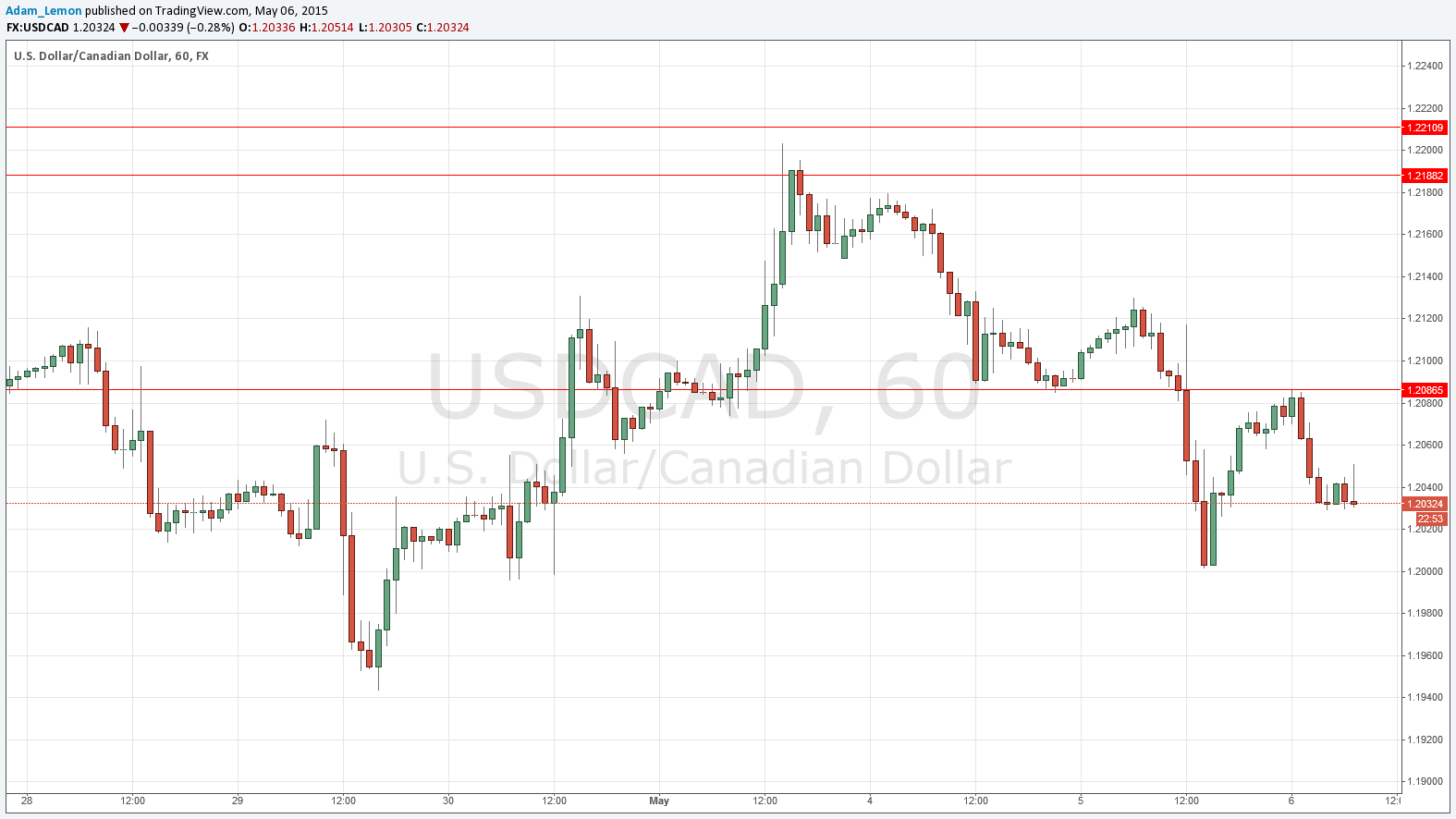

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2086.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after immediately upon the next touch of 1.2188.

Place the stop loss at 1.2215.

Move the stop loss to break at 1.2155 and take half of the position as profit.

Leave the remainder of the position to run.

USD/CAD Analysis

The bearish momentum has continued with this pair. Although we did briefly break down below 1.2050, which I had seen to be a very bearish sign, the price came back right away and moved up to bounce back down off 1.2086 which has become good flipped resistance from previous support.

The pair still looks bearish and in fact is one of the major drivers in the market right now with the CAD being positively correlated with the price of oil which has been putting in a strong recovery from its recent falls. However there is key data due later from both sides of this pair and this may have a strong impact in any direction.

There are high-impact events scheduled today concerning both the CAD and the USD. Regarding the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm London time followed by the Chair of the Federal Reserve speaking at a Panel Discussion commencing at 2:15pm. At 3pm, there will be a release of Canadian Ivey PMI data.