USD/CAD Signal Update

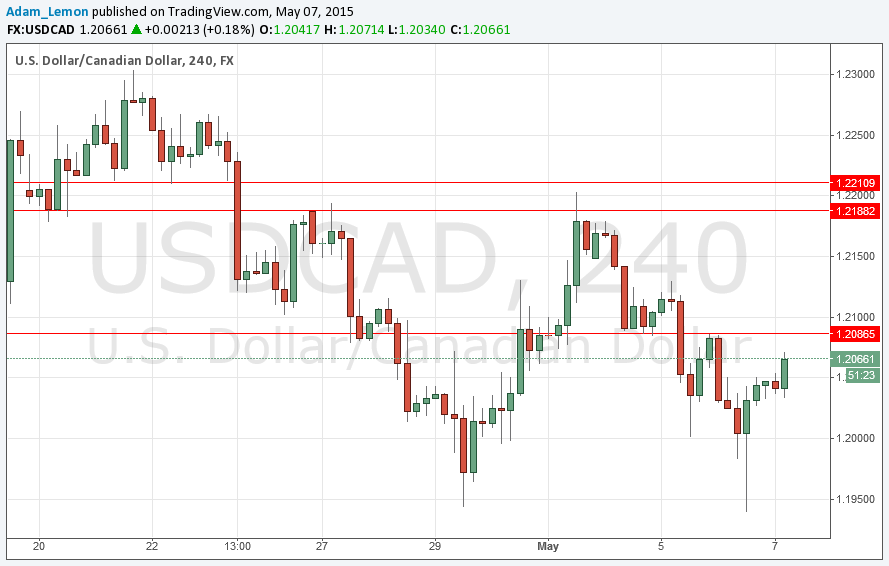

Yesterday’s signals were not triggered as the price never reached either 1.2086 or 1.2188.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be made between 8am London time and 5pm New York time today.

Short Trade 1

Go short after extremely bearish price action on the H1 time frame immediately following the next touch of 1.2086.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after extremely bearish price action on the H1 time frame immediately following the next touch of 1.2188.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

This pair has been falling very bearishly over recent weeks, with the Canadian Dollar becoming the strongest of all the major currencies over the medium-term. However yesterday there was a very sharp move up from a new low, so a major pull back feels likely now. Despite that we have still not broken up past resistance at 1.2086 which will be the first test for any new bullishness. It would be wise to be extremely cautious in taking any short trade off this level.

There are high-impact events scheduled today concerning both the CAD and the USD. Regarding the USD, there will be a release of U.S. Unemployment Claims data at 1:30pm London time. Simultaneously there will also be a release of Canadian Building Permits data.