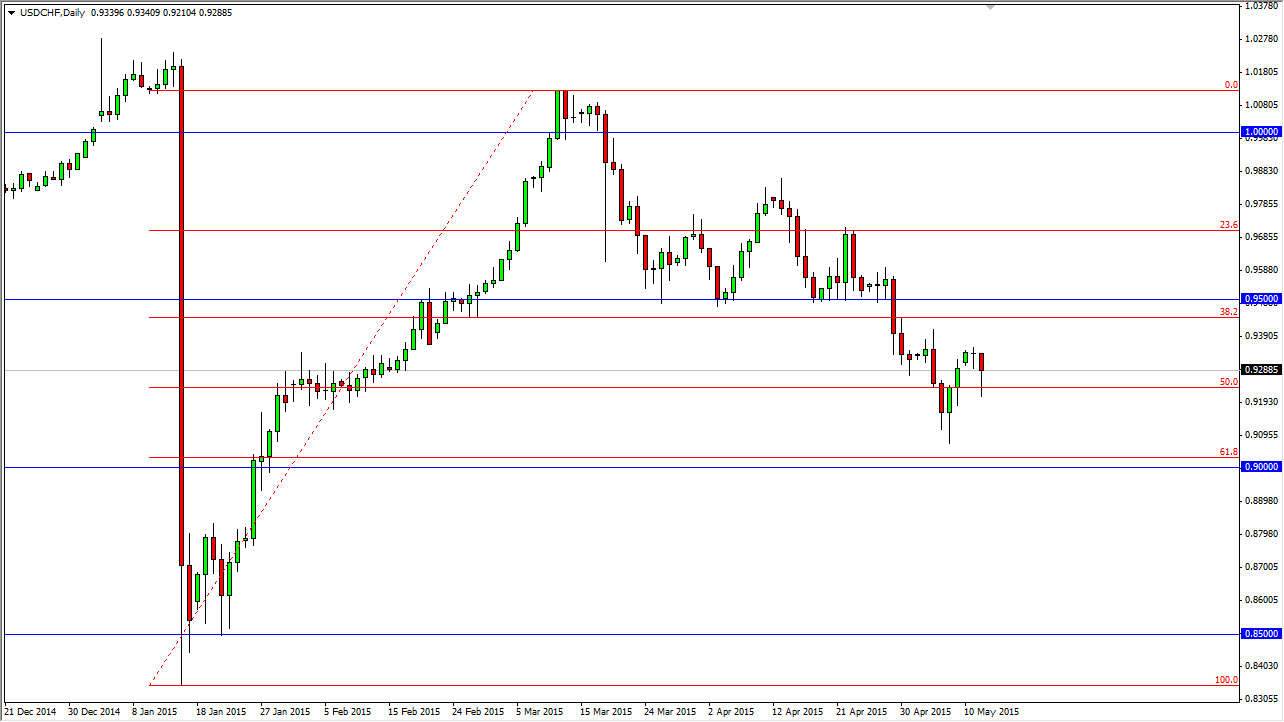

The USD/CHF pair fell during the course of the day on Tuesday initially, but found enough support at what is the 50% Fibonacci retracement from the bottom. This coincided nicely with the 0.9250 handle, an area that had seen quite a bit of clustering previously. The fact that we formed a hammer during the session does in fact catch my attention, and therefore I feel that this market is probably going to rally. The EUR/USD pair which normally runs the exact opposite of this one is showing signs of struggling a bit at the moment, so I think everything is lining up for a move to the next resistance level which I see as the 0.95 handle.

The Swiss franc itself is selling off of it around the currency markets right now, so this isn’t a real stretch. I believe that this pair will struggle quite a bit at the 0.95 handle though, because it does look massively resistive. If we break above there, the pair could go much, much higher.

Short-term trade

Because of the aforementioned 0.95 handle, I feel that this is more or less going to be a short-term trade. Don’t really have the inclination to risk a bunch of money at this moment, and as a result I feel like the market is probably only going to offer about 200 pips worth of motion. That’s okay though, because quite frankly in this type of environment that’s not a bad trade.

If we managed to break down below the 0.90 level, we would ostensibly break the 61.8% Fibonacci retracement level, which of course is a very negative sign and more often than not leads to a complete “round-trip” of the larger move. With that in mind, I feel that we would head to the 0.85 level. I don’t see that happening anytime soon, but it is something to pay attention to just in case we get that type of movement. In the meantime, expect a lot of choppiness, the EUR/USD certainly shows the same thing so I believe that short-term trading the only thing we can do.