The USD/INR pair is one that a lot of you probably don’t trade. After all, the Indian rupee is a fairly exotic currency, but it is also a reflection of the Asian growth as well as emerging markets in general. Because of this, you can take a look at this market as a reflection of risk appetite around the world. As the US dollar continues to grind higher against the Indian rupee, it suggests that perhaps the market is a little bit more cautious in general. Obviously, there is also the possibility that it is solely reflecting upon Indian politics or Indian interest rates.

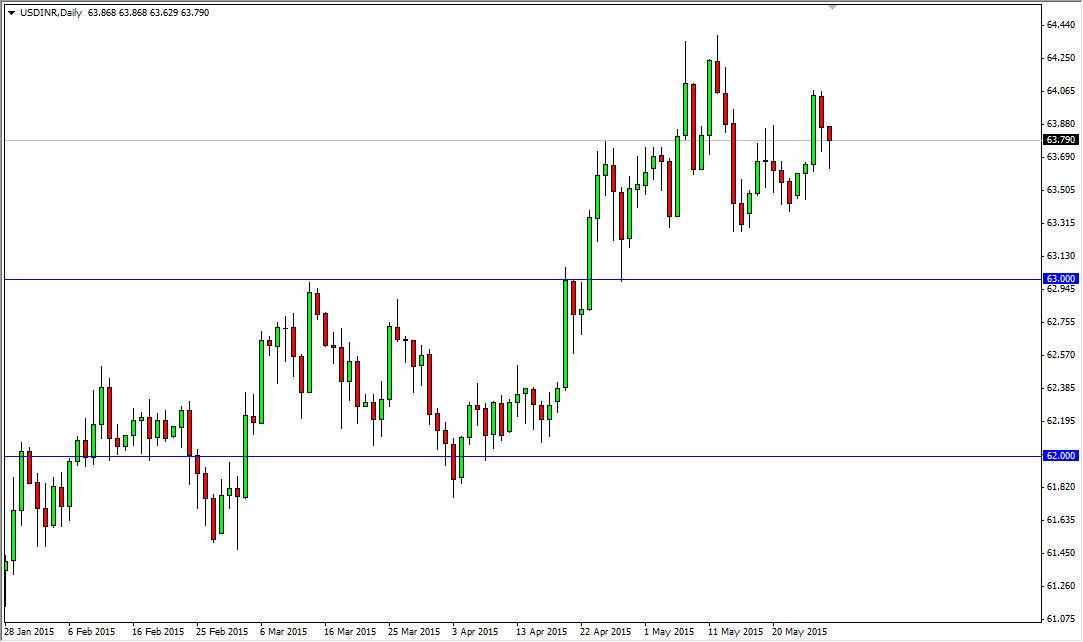

From a technical analysis point of view, it appears that pulling back during the session and bouncing off of support below tells me that the market is more than likely going to continue to grind higher. We should head towards the 64.25 level, and possibly break out above there. I believe that the market would be a decent buying at this point in time, as the US dollar in general seem to be pretty strong.

63 is vital

I believe that the 63 level is vital, as it is essentially going to be the “floor” in this marketplace, as there is a massive amount of noise between the 63 and the 62 level. Because of this, I feel that the market will more than likely bounce if it does fall, and as a result I am fairly confident that the upward trend continues. With this, I have a very strong bias to the upside in this pair, especially considering how well the US dollar has done recently. After all, in an environment where the US dollar is doing fairly well, why on earth would trader suddenly want to buy the Indian rupee?

Ultimately, this could be a “by on the dips” type of situation, the spread is tight enough that you can do that. However, you have to realize of this pair does tend to move rather slowly, so patience is always needed when trading the rupee.