USD/JPY Signal Update

Yesterday’s signals were not triggered as there has been no bearish price action yet.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Use the H4 chart.

Long Trade 1

Go long following a bullish price action reversal on the H4 time frame immediately upon the next touch of the 120.49.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H4 time frame immediately upon the next touch of the broken bearish trend line currently sitting at around 120.22.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short if the price is between 120.87 and 120.75 at 1pm London time today.

Put the stop loss 1 pip above today’s swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H4 time frame immediately upon the next touch of 121.84.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

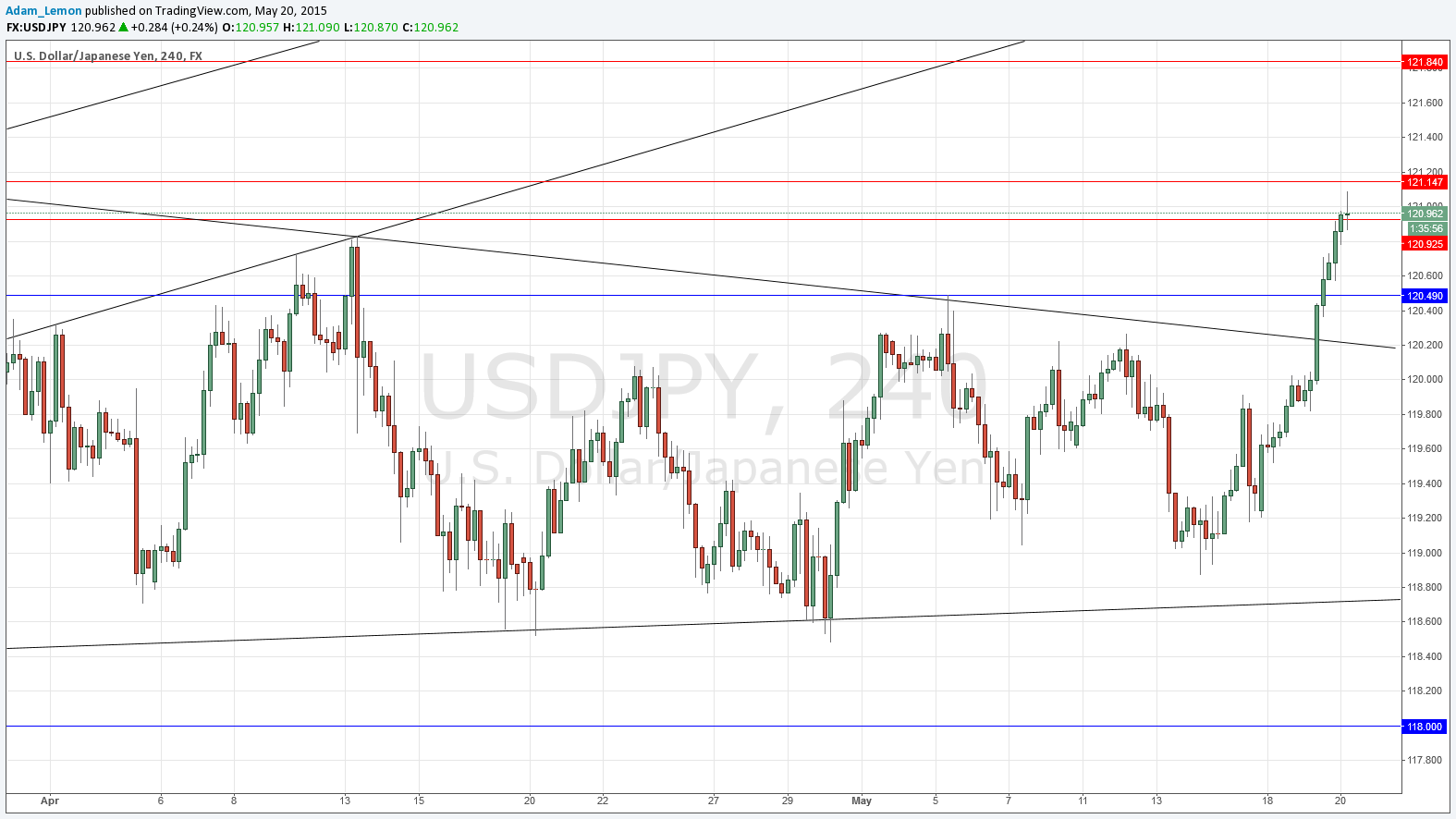

Surprisingly there was a very exciting development in this pair yesterday: there was a bullish breakout above the triangle which has contained the price for almost two months. There was a rise in the USD across the board but it has been especially strong against the JPY which remains one of the most comparatively weak currencies.

We have now reached an anticipated resistance zone from 120.92 to 121.15 and the upwards move is showing signs of stalling here, although there is nothing bearish just yet as at the time of writing. The best way to judge whether a short here could be a good idea is to wait for the New York open and see if the price is below 120.87.If there is such a pull back, be nimble because there can then be support at 120.49 and also below that at a classic retest and rejection of the broken upper triangle trend line.

Right at the top of the chart is the multi-year high of 121.84 which might also give another opportunity to go short. Alternatively if it breaks we could be seeing 124.00 the next stop.

The Bank of Japan may not be happy with a strong move up from 120.00 so they might make public comments to chill any strong rise. This may not be effective, but it is something to bear in mind if we get a big move up.

There is the FOMC release later today, and so overall the next 24 hours could be a wild ride. There is good potential today in this pair, but be careful and be attentive.

There will be a release of U.S. FOMC Meeting Minutes at 7pm London time.