USD/JPY Signal Update

Yesterday’s signals expired without being triggered as there was no bearish price action at 123.64.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H4 time frame immediately upon the next touch of the 123.30.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following a bullish price action reversal on the H4 time frame immediately upon the next touch of the bullish trend line currently sitting at around 122.86.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

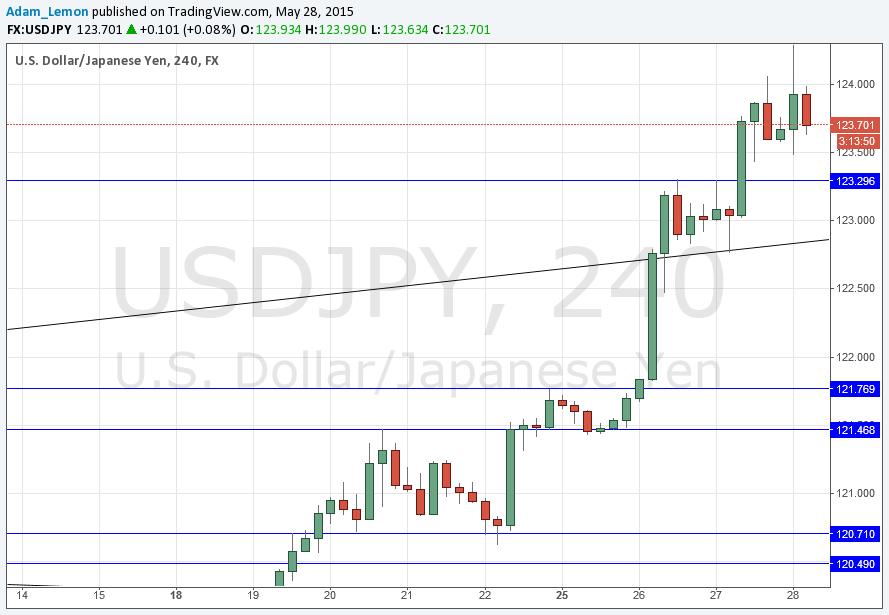

So the bullishness continued and broke up past the anticipated resistance at 123.64 and the round number at 124.00, breaching another multi-year high.

However there is a sign that we may have had the climax of this leg earlier this morning, with a blow-off top and a relatively sharp fall off from the peak.

There was a double top at 123.30 and the next big test of the price action will be to see if this can hold as support. If it holds today, that would suggest that the upwards trend remains intact.

It is really hard to guess if we have seen a high and if not, where that high would be. We could probably expect a lot of selling at 125.00 if we get there.

There will be G7 Meetings all day. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time.