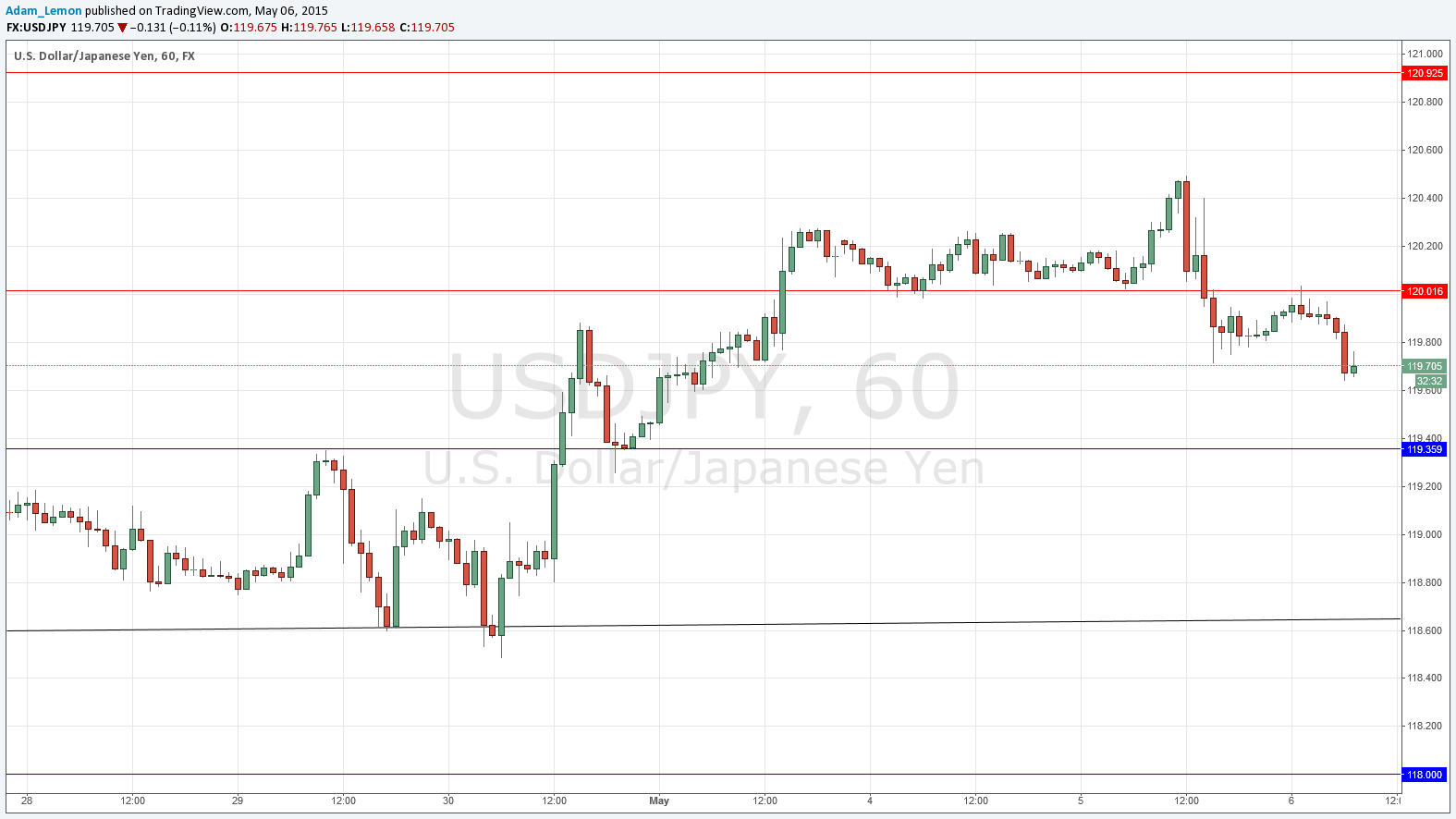

USD/JPY Signal Update

Yesterday’s signals produced a long entry at 120.26 that fortunately would have been moved to break even when 20 pips in profit, therefore avoiding any loss on the subsequent fall in price.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 119.36.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 118.65.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 3

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 118.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 120.01.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 120.92 and 121.14.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

Things initially looked bullish yesterday as the price based off 120.00 and then began to move up with some momentum during the early part of the London session. However the price then fell, breaking below the support at 120.00, and this level was subsequently flipped to resistance, with a candle wick basing off it during the Asian session and pushing the price down.

We are now caught between 120.00 and 119.36 and we will probably remain there until the New York session when the USD news might push the price around.

There are high-impact events scheduled today concerning the USD. There will be a release of ADP Non-Farm Employment Change data at 1:15pm London time. Later the Chair of the Federal Reserve will be speaking at a Panel Discussion commencing at 2:15pm.