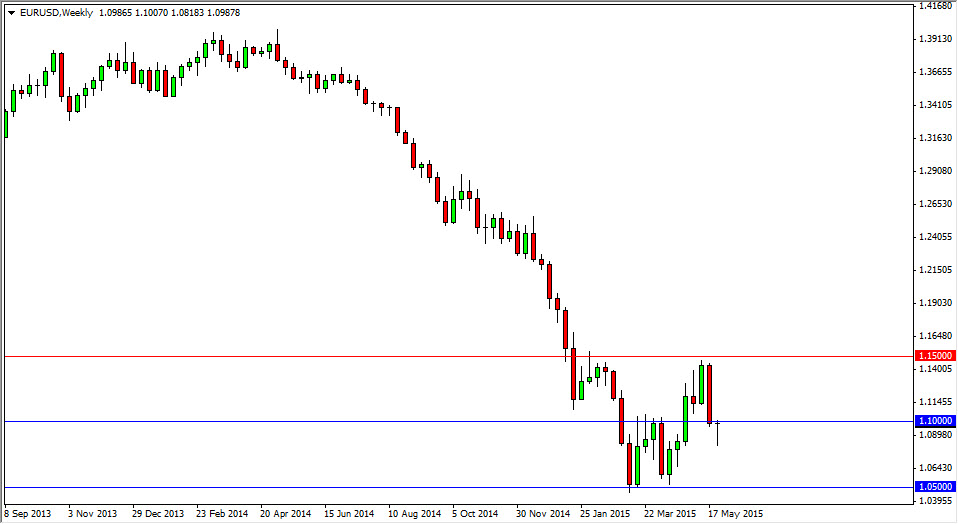

EUR/USD

The EUR/USD pair initially fell during the course of the week, but ended up finding enough support below to turn things back around and form a nice-looking hammer. The hammer sits just below the 1.10 level, and if we can break above there the market should break out to the 1.14 handle. I think that this market is about to break out to the upside, and quite frankly I am very cautious about shorting this market over the course of the next couple of weeks. Ultimately, it’s a matter of closing on a daily chart above the 1.10 level, and I’m a buyer.

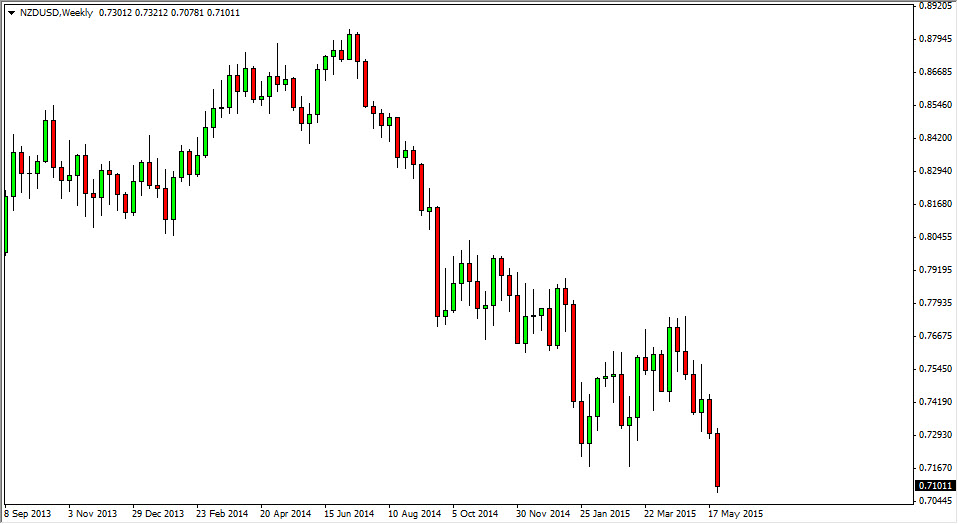

NZD/USD

The NZD/USD pair fell hard during the course of the week, breaking below the 0.72 level. In fact, this is a fresh, new low, and as a result the market looks like it should continue to go even lower. We believe that the market will head to the 0.70 level, which could be supportive. Ultimately, once we break below there this market really could fall apart. I think short-term selling opportunities will abound in this marketplace on not only a break down below the range for the week, but short-term rallies as well.

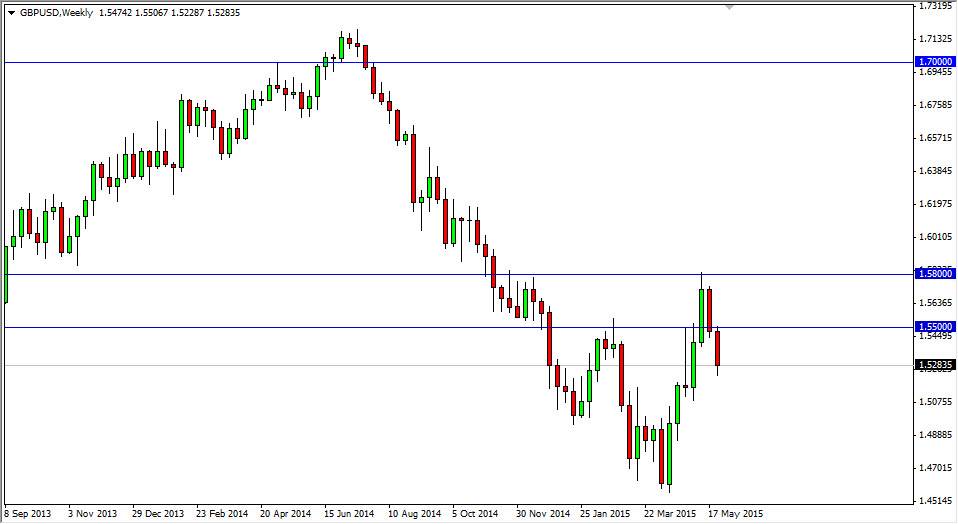

GBP/USD

The GBP/USD pair broke down during the course of the week, and now looks as if it’s heading to the 1.50 level. With this, the market is one that you can only sell, and I think that short-term rallies will be selling opportunities. On the other hand, if we got above the 1.55 level, we would be more than likely trying to head towards the 1.58 handle. With this, the market looks soft, but certainly will be volatile in my opinion going forward.

USD/JPY

The USD/JPY pair broke out above the top of the ascending triangle during the past week, and as a result looks as if it’s ready to continue going much higher. With that, I believe that we will not only head towards the 125 handle, but above there as the market will more than likely target the 130 level given enough time. The interest-rate expectations out of both central banks dictate that this pair should continue to go higher, and as a result pullback should be a buying opportunity.

.jpg)