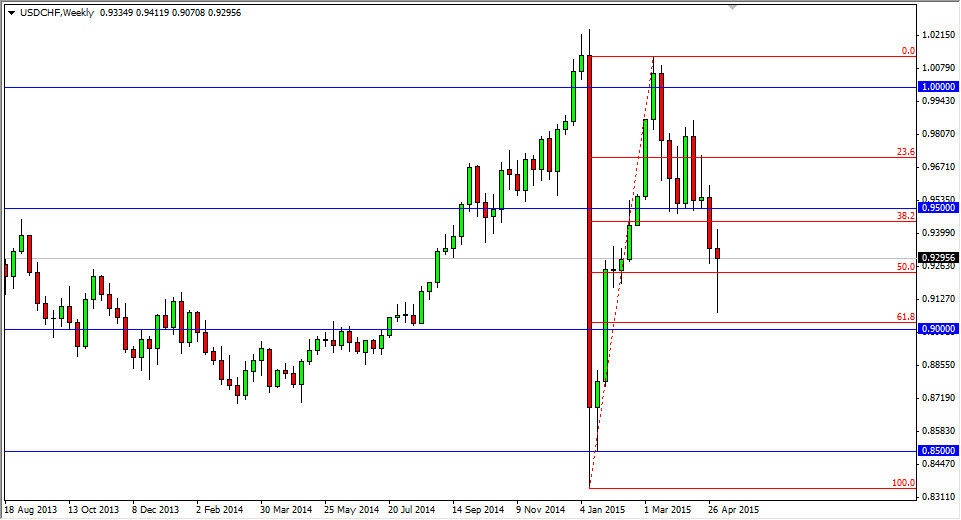

USD/CHF

The USD/CHF pair originally fell hard during the week, testing the 0.90 level. The area just above it is offering enough buyers to push the market towards the 0.93 handle. The pair looks like most of the CHF-related pairs, as the Franc is losing some of its luster. The US Dollar looks strong against many currencies at the moment, and it looks like this market won’t be any different. The 0.95 level above is resistive in my opinion, as it was once massive support.

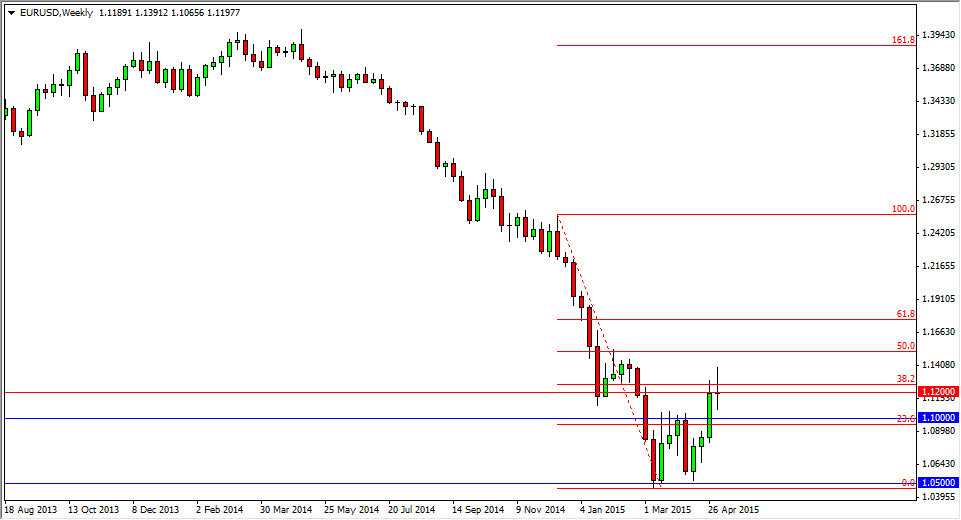

EUR/USD

The EUR/USD pair initially rose during the week, but found enough pressure to the downside at the 1.14 level to turn things around. The resulting candle is a shooting star, and with that I think that the pair will fall. However, be aware that the 1.10 level is supportive, so we need to get down below there in order to continue to the downside. The market will be volatile regardless of the outcome.

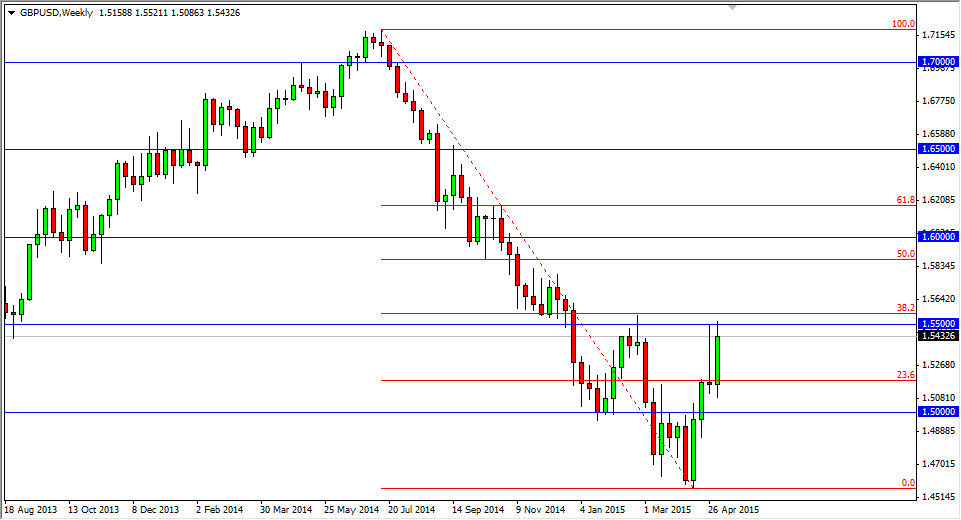

GBP/USD

The GBP/USD pair rose strongly during the week, as we test the 1.55 level above. That are also features the 38.2% Fibonacci retracement level of the entire move, so a bit of selling pressure is expected. However, I think that the fact that we closed so high in the range signals that we are going to break out eventually. The area above is resistive until the 1.57 level, but in the end we should get over it.

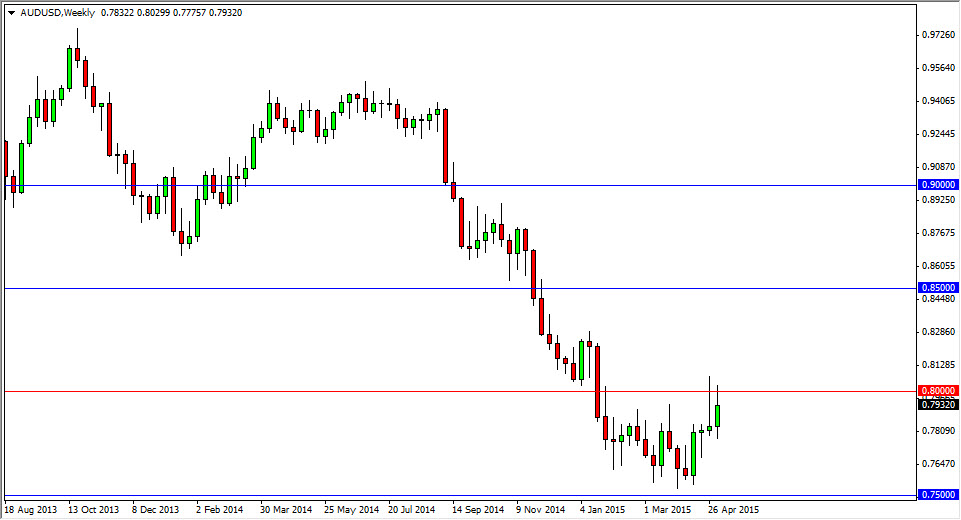

AUD/USD

The AUD/USD tested 0.80 yet again this past week, as there has been selling there time and time again. The pullback has me thinking that the market is probably going to fall from here in the short-term. The daily chart certainly looks a bit soft as well, so I am still bearish of the Aussie dollar going forward, but the biggest probability is that the US Dollar is so strong in general. Watch commodity markets for direction as well, as the Aussie tends to follow the overall attitude of the risk appetite around the world.