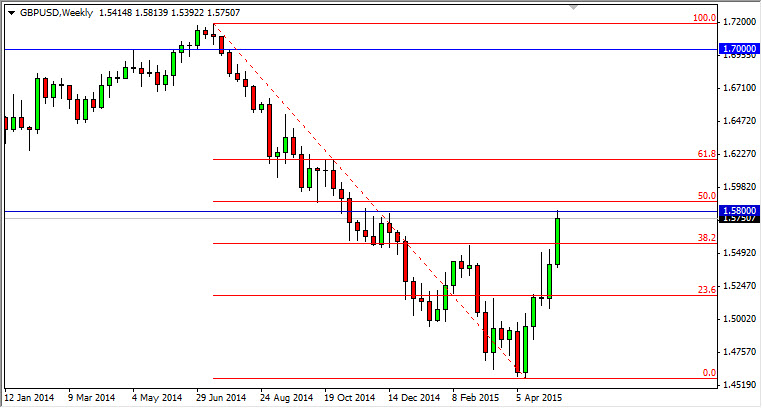

GBP/USD

The GBP/USD pair broke much higher during the course of the week, testing the 1.58 level which was my longer-term target for a while. However, the question then becomes whether or not we can get above there? I think we do eventually but it is very likely we get a little bit of a pullback in order to build up momentum. I would look at 1.55 as potential supportive area to continue to buy the British pound. On the other hand, if we can break above the 1.58 level, if effective the 1.60 level will be tested next.

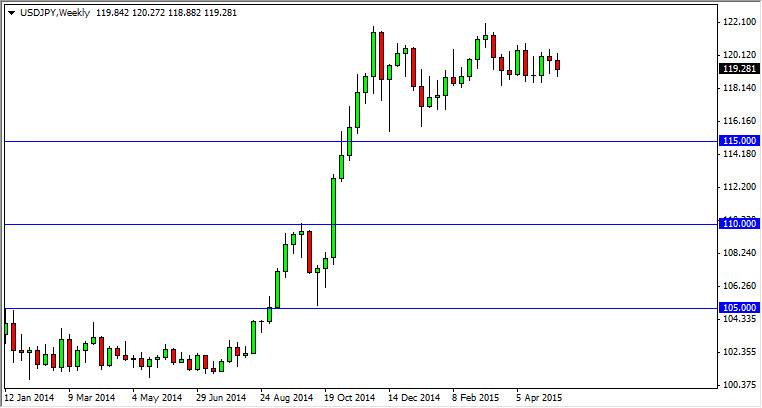

USD/JPY

USD/JPY pair had a fairly quiet week, as we continue to consolidate just below the 120 level. I think this market going to continue to grind sideways, but I look at it as one that is in a longer-term uptrend, meaning that I am willing to buy short-term pullbacks. However, as far as longer-term trades are concerned we need to get above the 122 level in order to see any real significant returns. I still believe that the “floor” in this market is at 115, and as long as we stay above there we are still solidly an uptrend.

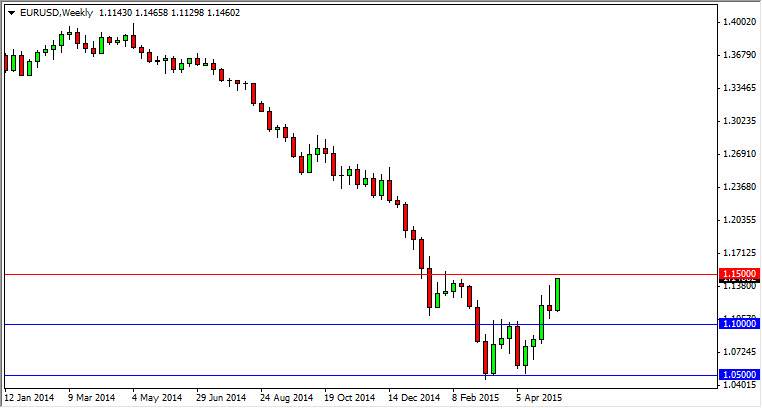

EUR/USD

The Euro finished the week strong, closing at the very top of the range. Since we are just below the 1.15 level, I believe that we are trying to build up momentum to break out to the upside. Once we do, I believe that the downtrend is over. In other words, I don’t have any argument to sell this pair right now, at least as long as we are above the 1.10 level.

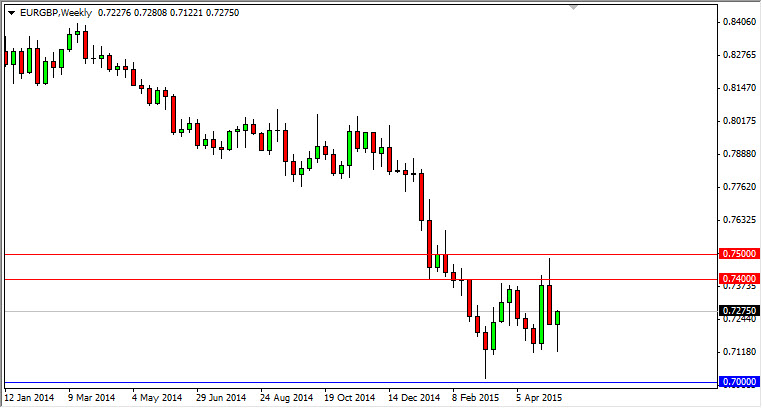

EUR/GBP

The EUR/GBP pair initially fell during the course of the week but found enough strength to turn things back around and form a nice-looking hammer. Ultimately though, I think there is far too much resistance at the 0.74 region, extending all the way to the 0.75 handle to start buying this market. In fact, I would prefer to sell this market once we get into that area. It’s not that the Euro should be avoided, quite the contrary, it’s just that the British pound is that strong.