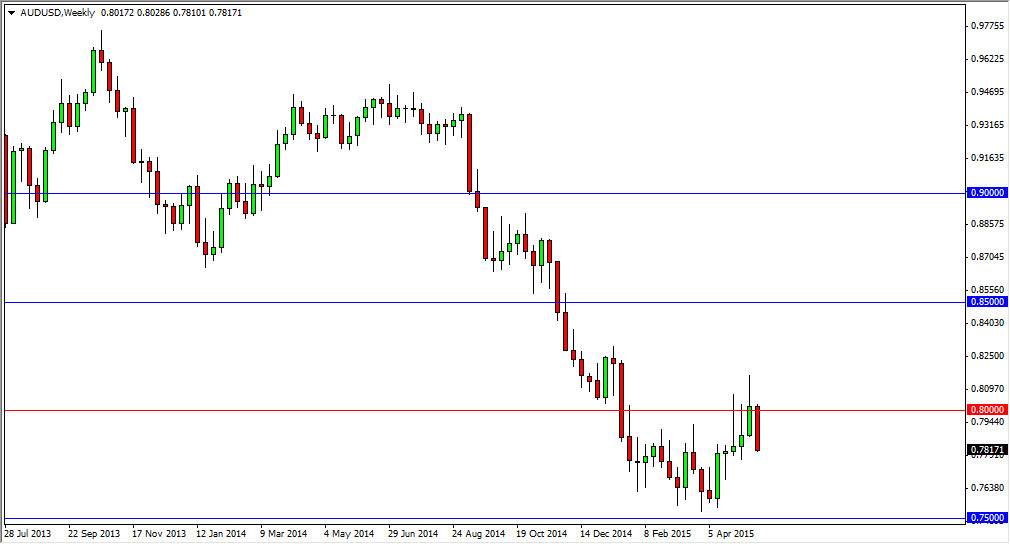

AUD/USD

The AUD/USD pair broke down during the course of the last week, as the 0.80 level offered significant resistance. Because of this, I believe that the market is going to break down given enough time, and the fact that we closed at the very bottom of the range suggests that more selling pressure will bring itself to bear against the market. With this, I am bearish and I believe that we reach down towards the 0.76 level over the course of the next couple of weeks.

GBP/USD

The GBP/USD pair fell during the course of the past week, falling from what looked to be a massive breakout to test the 1.55 level. This is an area that was once resistance so it should now be support, but at this point in time I have to be very cautious about this pair. If we break down below the 1.54 level, I would be a seller. On the other hand, we find a bit of support in this general vicinity, I think we simply consolidate between the 1.54 level and the 1.58 level.

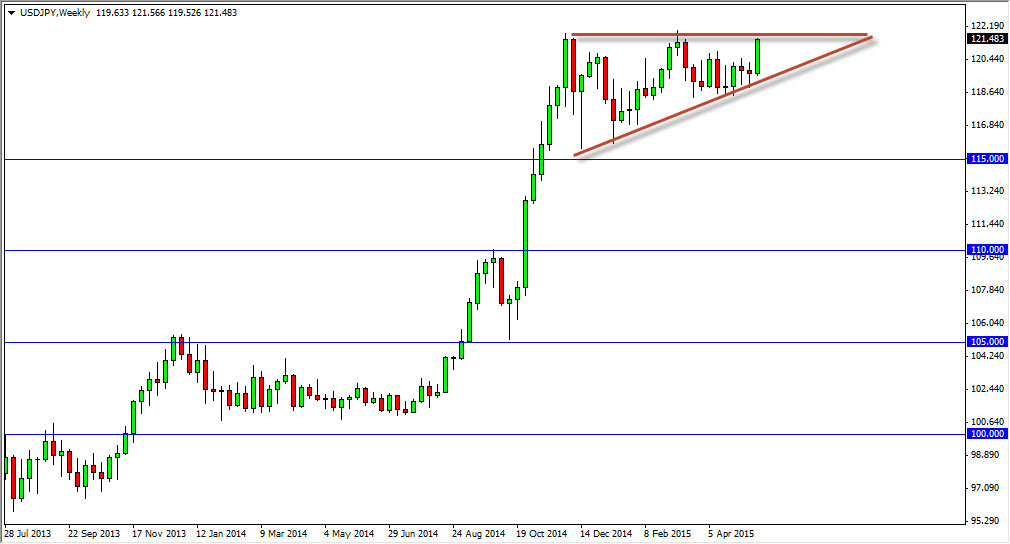

USD/JPY

The USD/JPY pair broke higher during the course of the week, and it now looks like we’re ready to go above the top of the ascending triangle. If we can get above the 121.50 level on a daily close, I believe that we will then grind our way to the 125 handle next, and then possibly as high as 128 based upon the measurement. I have no interest in selling this market, and believe that there is a massive support level down at the 150 level that will keep this market in an uptrend regardless.

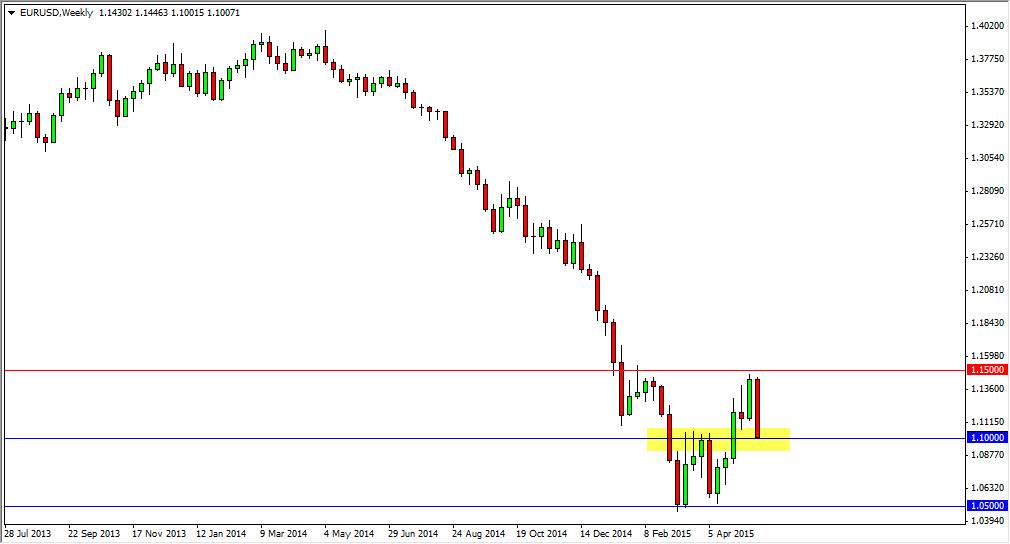

EUR/USD

The EUR/USD pair broke down during the course of the week, testing the 1.10 level. This is a bit of a conundrum for me, because I believe that we are about to make a significant decision. That being the case, we need to see whether or not we can close significantly above or below the 1.10 level. As soon as we get a significant move, I am willing to follow it, but right now I believe we have about a 50-50 shot as to which direction we are going to go. This pair will be a source of significant aggravation for many of you out there. I personally am staying away from it.