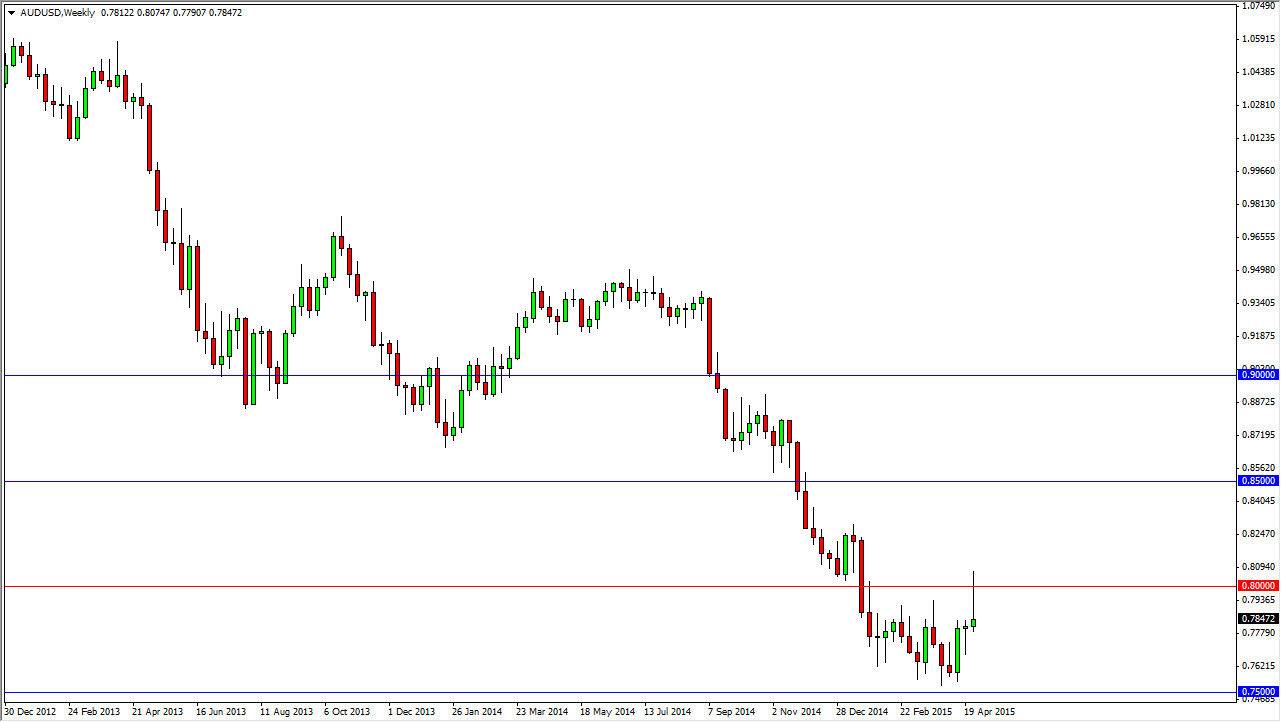

AUD/USD

The AUD/USD pair had a very bullish week originally, breaking above the 0.80 level. However, this area has been a problem for the market several times in the past both from the buyer and seller’s perspectives, so it’s no surprise that we pulled back. By forming the massive shooting star, I believe that we will continue to at least consolidate between the 0.80 level and the 0.75 level with a significant bearish bias. I believe that selling this pair on short-term rallies will probably be the best way to play it going forward.

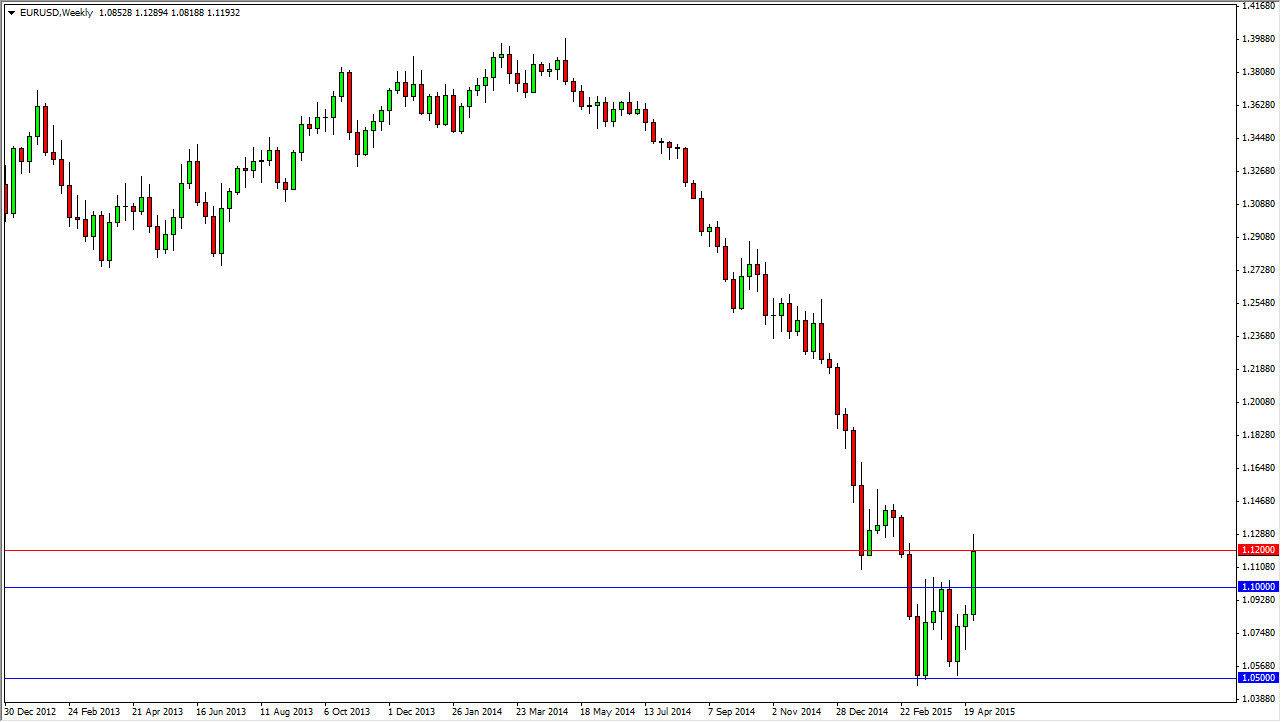

EUR/USD

Although the weekly candle for the EUR/USD pair is pretty impressive, what it doesn’t show is that Friday formed a shooting star. Because of this, I feel that this market is going to pull back at this point. I think that the 1.10 level is a significant support level, so that is where I anticipate this market going in the short-term. I’m not interested in buying until we get above the 1.15 level as it would show a breakthrough of clustering.

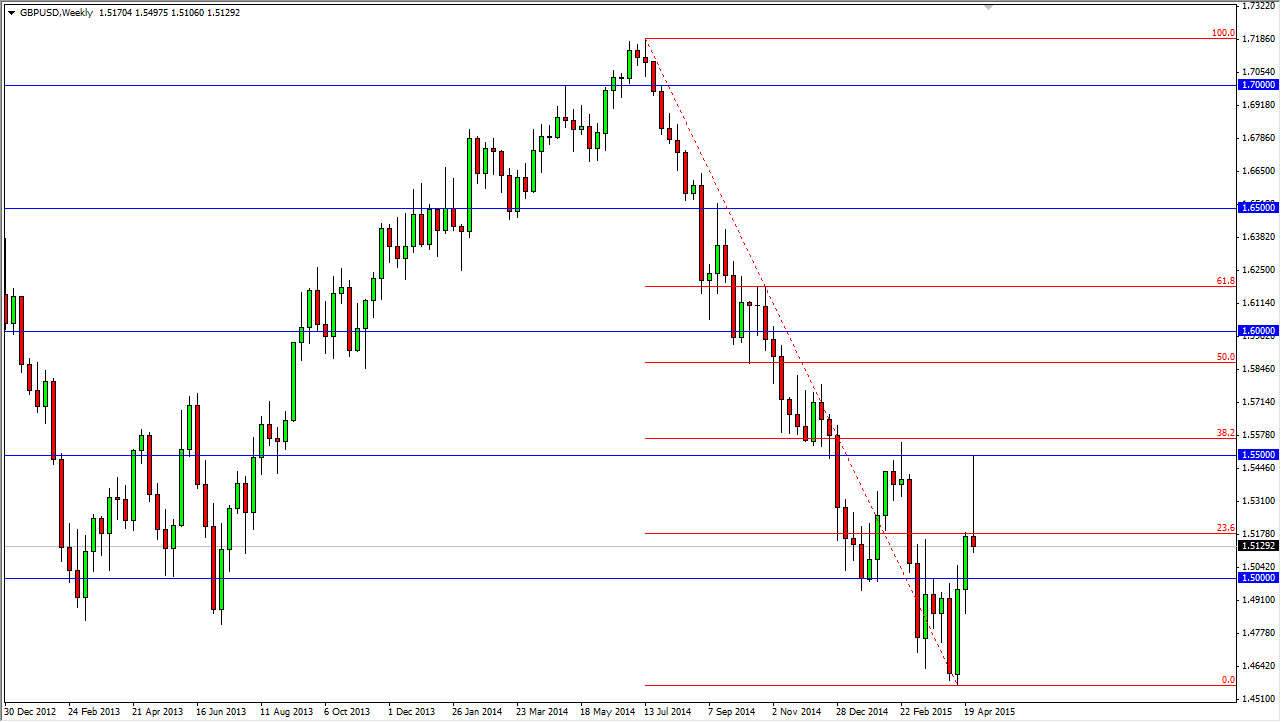

GBP/USD

The GBP/USD pair broke higher during the course of the week, but found so much resistance of the 1.55 level that it turned back around and sold off several hundred pips. Because of this and the fact that it forms a wicked shooting star I believe that the market is going to continue to fall. I think this week we will visit the 1.50 level again to see if it holds as support.

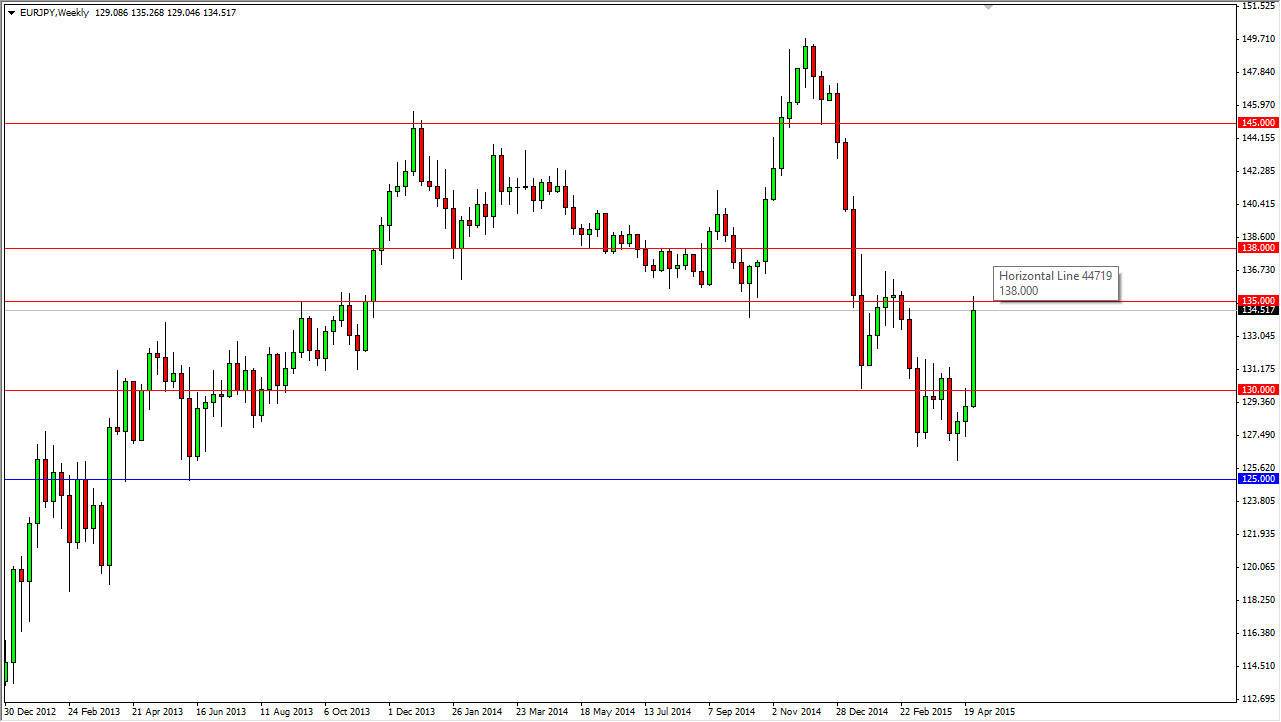

EUR/JPY

Just like the EUR/USD pair, this pair had a very strong showing. However, just as we saw in the EUR/USD pair, Friday formed a nasty shooting star at a large round number. Because of this, I believe that the EUR/JPY pair is going to pull back during the course of this week, probably heading back to the 132 handle where I see support. I believe that there is a significant resistance barrier above 135 all the way to the 138 level.