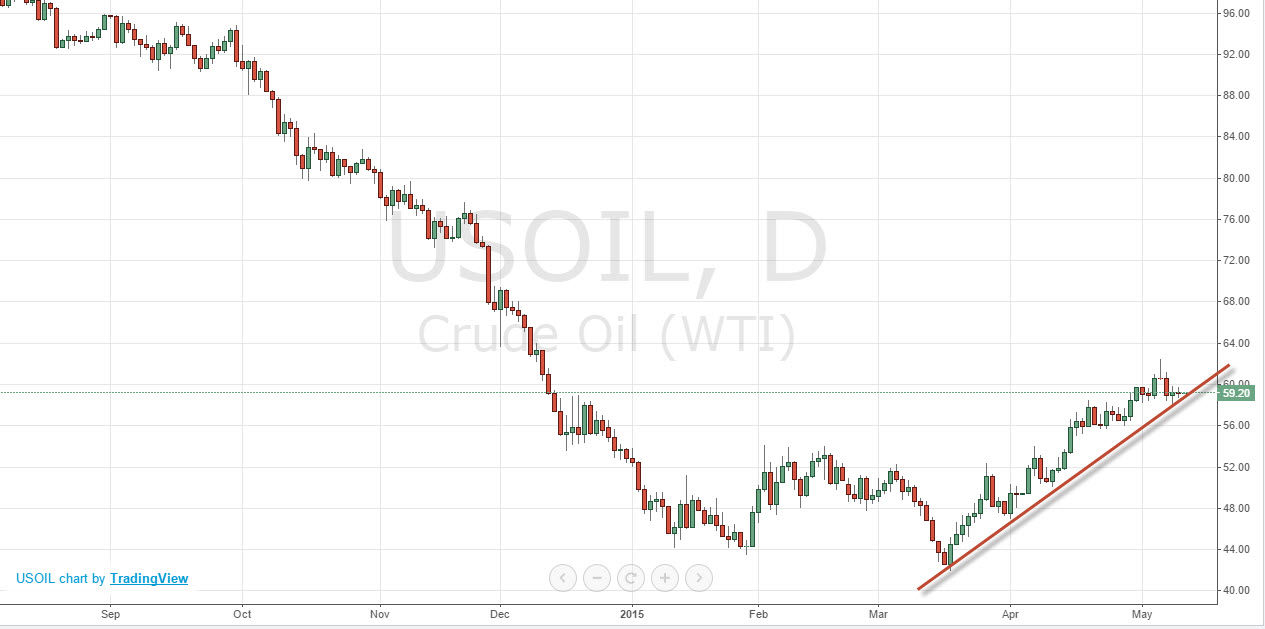

The WTI Crude Oil markets went sideways during the session on Monday as we continue to hover just below the $60 handle. This is a large, round, psychologically significant number, but we feel that it will eventually lose its luster. Right now, it seems that the market is willing to acknowledge the potential importance of this number, but I believe that given enough time it will simply be something in the rearview mirror.

We are sitting just above a significant cluster from December 2014, and as a result I think we should continue to see support. As you can see on the chart, I also have an uptrend line that could come into play. I think that the US dollar looks like it’s a little bit soft at the moment, and that perhaps the rally has been overdone. If that’s the case, oil could very well rally for that reason alone.

Looking for support

I believe that if we get a supportive candle, the buyers will come back into this market and push it much higher. Ultimately, I believe that the light sweet crude market will continue to go higher anyway, and it’s only a matter of time. We have had a significant breakout to the upside, and although we formed a wicked looking shooting star last week, I think there is enough below in the form of pressure to keep this market going higher.

I believe that there is massive support all the way down to the $55 handle, so at this point in time it’s really difficult to start selling here. It’s not until we break down below there that I would consider selling, and I just don’t see that happening right away. Once it does though, I would be more than willing to reevaluate the entire situation. In the meantime, I think that a move above $60 signals that we are going to end up hating much higher, probably $70 over the next couple of weeks.