The WTI Crude Oil markets fell again on Friday, as the US dollar in general saw buying pressure. Because of this, I believe that we are presently “taking a break” from the incredible amount of effort it took to break out to the upside in the oil markets. It isn’t that I think the rally is dead, just that we don’t have anything to propel it at the moment.

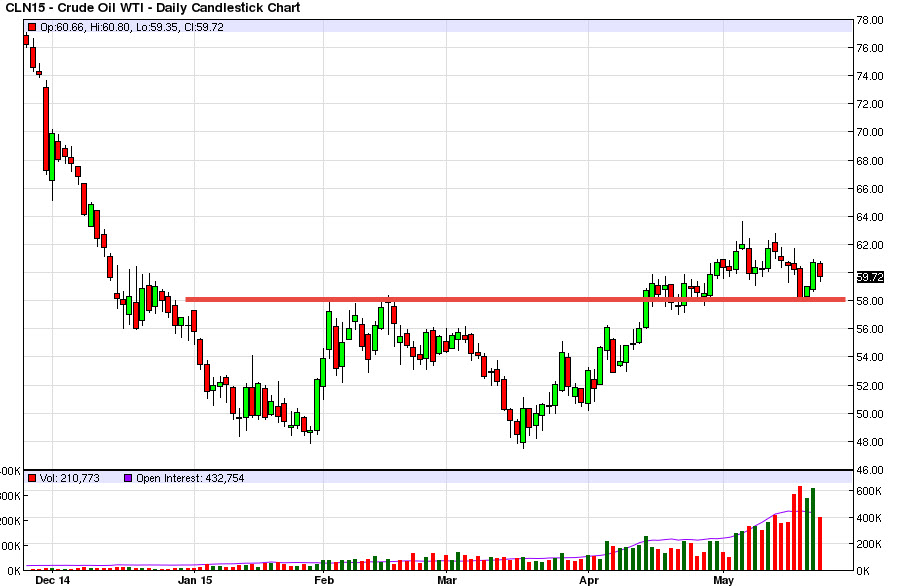

The WTI market broke above the $58 level in order to get us to this point. That was a significant break out in my estimation, and with this I think that we are still going to go looking for higher prices. However, the Dollar is working against this at the moment, and because of this I think we are looking at a market that will at best remain volatile.

Buying dips

I still think that “buying the dips” can work, but in this market we are seeing a lot of confusion. The Memorial Day holiday isn’t going to help this market as far as any real trend forming action is concerned, and I think that we may see a lot of nothing today. However, I still believe that the $58 level will be supportive, as it was so resistive previously.

The $60 level is of course psychologically important, but we have already sliced through it a few times, making it less important overall. I think that a pullback to $58 makes a bit of sense, and as a result I am looking for a supportive candle below in order to start buying again. The market should then perhaps look for the $68 level.

The market breaking below the $58 level would be bearish, and I would begin selling if we can break below the $56 level. A move like that could see us looking for the $50 level over time. In the meantime, I will look at the daily close in order to make my move. I anticipate very little in the way of tradable action today.