AUD/USD Signal Update

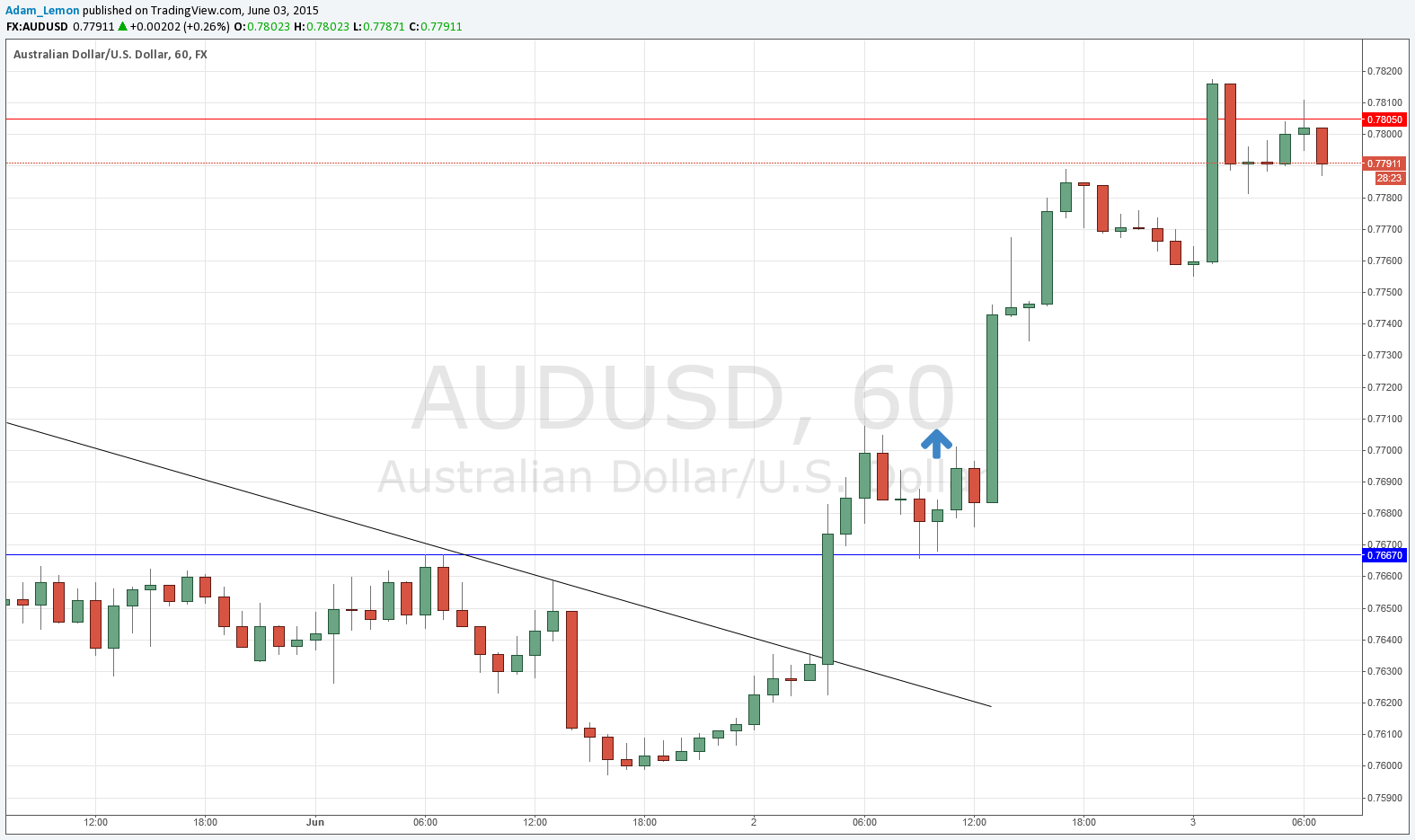

Yesterday’s signals provided a great profitable long trade off the break of an inside bar coming up off the support at 0.7667. As we have now reached resistance at 0.7805, it would be a good idea to take a lot of any remaining profit that might still be on the table.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7667.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following if the price is below 0.7750 at 9am London time.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run to at least 0.7667.

AUD/USD Analysis

I wrote yesterday that the support at 0.7667 would be the floor and the price should move up to 0.7740 at least and this outlook was completely correct. The price is now stalling at resistance which was also expected at 0.7805. The AUD moved up just as strongly yesterday as the GBP and the EUR. However all are now pausing at or very close to resistance so a move down today would be logical. As we have already hit the resistance at 0.7805, the easiest way to determine whether a short entry here would be worthwhile now would be how much momentum down we are seeing one hour after London opens.

There are no more high-impact events scheduled today for the AUD. Regarding the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm London time followed by Trade Balance numbers at 1:30pm. Then at 3pm there will be a release of ISM Non-Manufacturing PMI data.