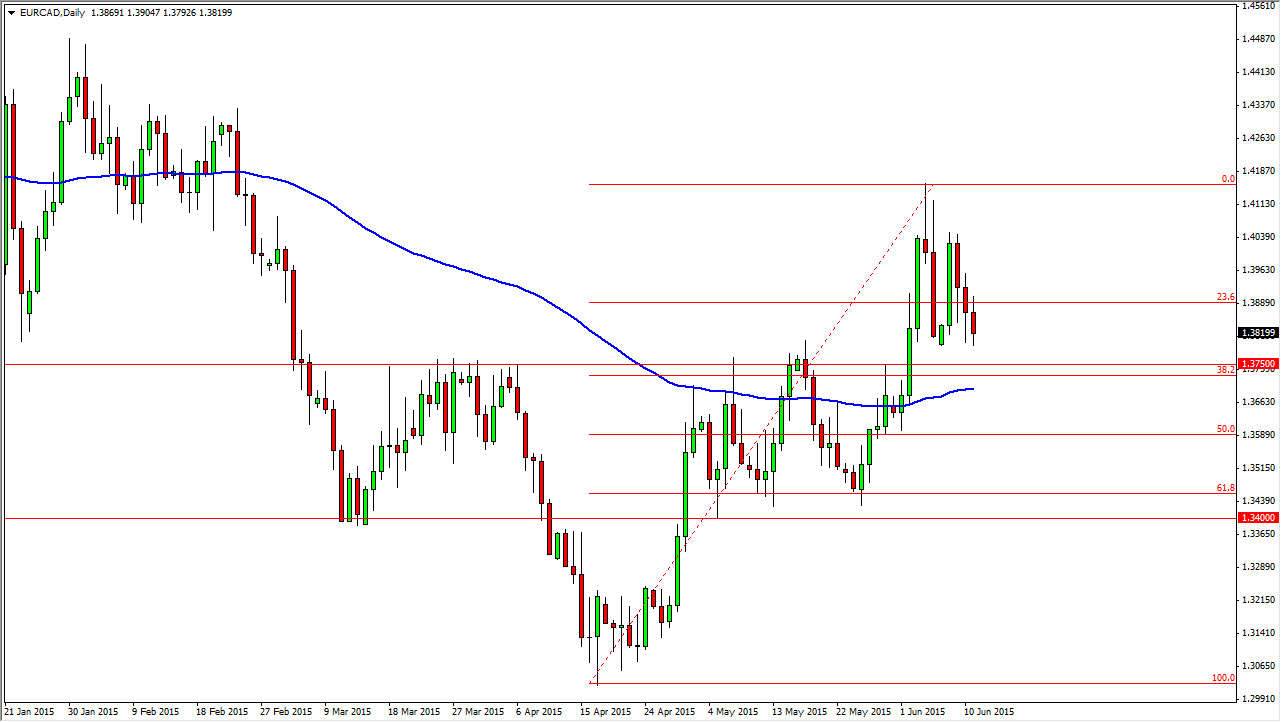

The EUR/CAD pair is one that is approaching a very significant support level in my opinion. The 1.3750 level below has been both supportive and resistive, so having said that, I don’t imagine that it will be easy to slice through as we fall. It is under that thought process that I think that buying this pair is going to be the way to go. On top of that, the 38.2% Fibonacci retracement level is just below there, as well as the 100 day exponential moving average. There are plenty of reasons the think that the buyers will step back into this market.

On top of all that, the Euro is starting to show real signs of strength against the US dollar, the yardstick of strength for currencies around the world. The Canadian dollar has been a little bit stronger than the US dollar lately, so that might be part of what is keeping this market fairly quiet. However, I believe that breaking above the 1.3750 level was significant, and means that the market is going higher.

Short-term rallies

I don’t necessarily think that we are going to break out to the upside with a massive amount of momentum, just that we will use short-term rallies from time to time. I think that the short-term charts will be best to look at for buying opportunities. Ultimately, the consolidation looks as if it is going to hold fairly soon, with the 1.38 level being the beginning of support, and the 1.41 level being resistance. In other words, we are going to continue to bounce around here but since we are near the bottom of this area I don’t see any reason why we should be buying.

Even if we broke down below the 1.3750 level, which of course would be bearish, I simply will not be bothered to short this market. On top of that, you can make a bit of an argument for an inverse head and shoulders that has previously been broken out of. In other words, I can find too many reasons to start buying to be bothered selling.