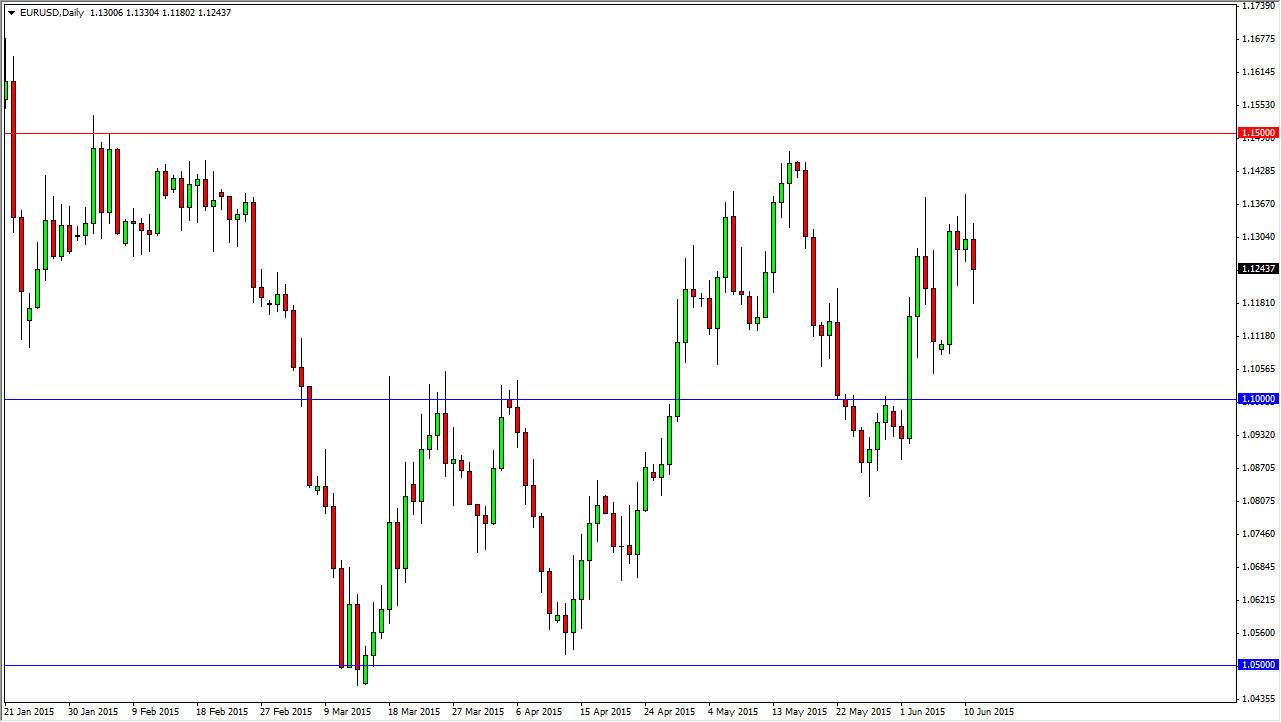

The EUR/USD pair initially fell during the course of the session on Thursday, as the 1.11 level offered enough support to turn things back around. Ultimately, we ended up forming a hammer like candle, and as a result we feel that the market will probably trying to rally from this area. However, we have a shooting star from Wednesday, and a hammer from Tuesday. What this essentially tells me is that the market is very volatile and trying to figure out which direction it wants to go eventually.

I still believe that the 1.14 level above is resistance, and now that the support below is higher than it was, it tells me that the market is trying to build up enough pressure to break out to the upside. I think that there is a significant amount of resistance above the 1.14 level all the way to the 1.15 level. In fact, I believe that if we break above the 1.15 level, we have changed the trend for good.

Inevitable

“Inevitable” isn’t a word I use very often when it comes to trading. However, I think that it’s only a matter of time before we break out above the aforementioned 1.15 level. You can certainly see on the chart that the lows are getting higher overall, and the last 7 sessions have featured a move from 1.11 as support, to change that support level to the 1.12 level. In other words, we are going higher over the longer term.

That being said, there are a lot of moving parts when it comes to this pair. Unfortunately, the last couple of years have featured the influx of high-frequency trading, and this particular pair is a favorite. Ultimately though, that doesn’t change the long-term movement of the markets, and as a result I believe that eventually the Euro buyers will get what they want. It’s going to be very volatile between now and then, so when I have been doing is simply buying short-term dips and aiming for small gains. I think that’s the way this market is going to be for a while.