The EUR/USD pair fell during the session on Tuesday, as we continue to get rumors and headlines coming from the Greek debt talks. With this, I believe that they are offering value every time this market sells, and as a result I like buying on supportive candles. However, we don’t have one yet, so we have to wait to see whether or not it forms. You can use short-term charts to start buying, as I believe we will eventually break out but I also recognize that there are a lot of rumors and headlines crossing the wires at the moment that could have a bit of an effect.

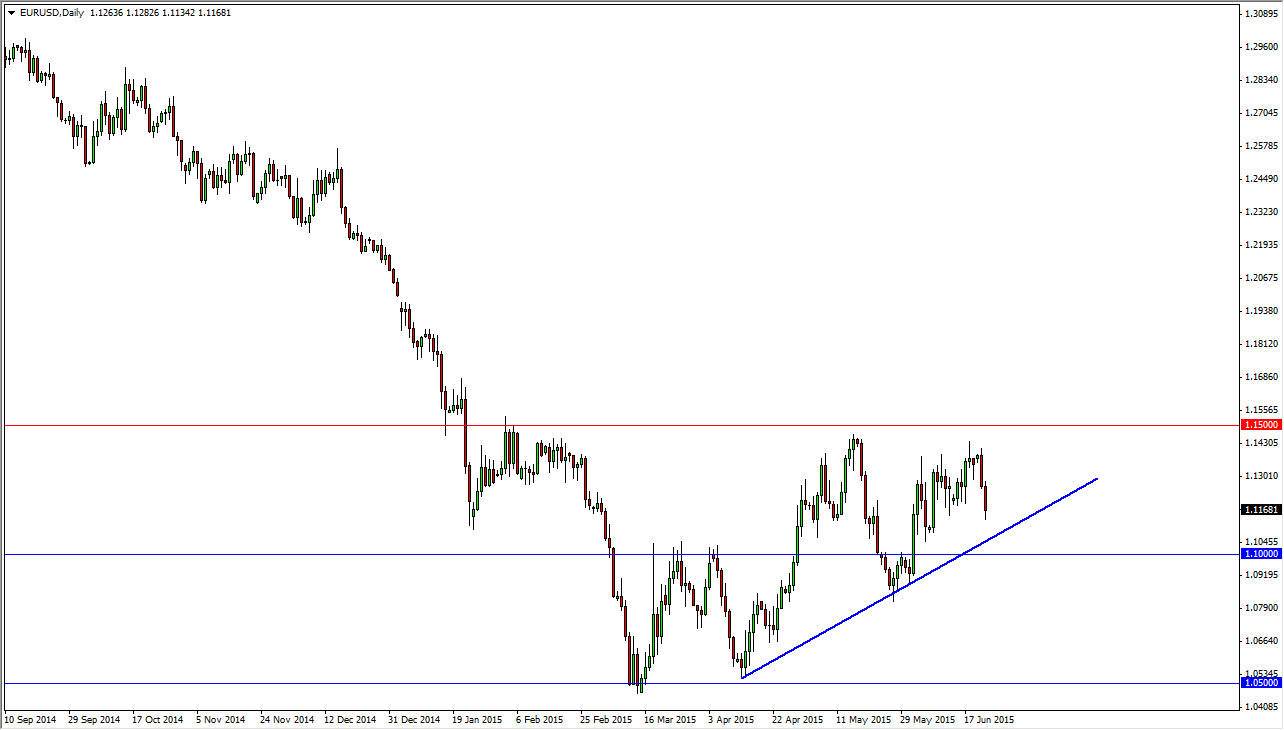

I also see an uptrend line as I have plotted on the chart, and as a result it’s probably only a matter time before the buyers get involved even if we do continue to fall lower. I believe that the 1.10 level is massively supportive anyway, so I can give you a lot of different technical reasons that the pair should continue to go higher. I believe also that there is a significant amount of support below the 1.10 level to the 1.09 handle, in other words, it’s very difficult for me to imagine selling this pair.

Longer-term uptrend

I still believe that if we can get above the 1.15 handle, it starts a much longer-term uptrend that we cannot only buy and hold, but add to our position size every time the market dips. I believe that a move above the 1.15 level sends this market looking for a multi-year uptrend, which is something that the market certainly is overdue to see. Yes, I understand that there are lot of fundamental reasons for the Euro to be soft at the moment, but at the end of the day the currency markets tend to run in three-year cycles, or so. With that, it’s about time to start turning back around and going higher as the European Union looks like it’s going to manage to not only strengthen its economy a little bit, but hold together.