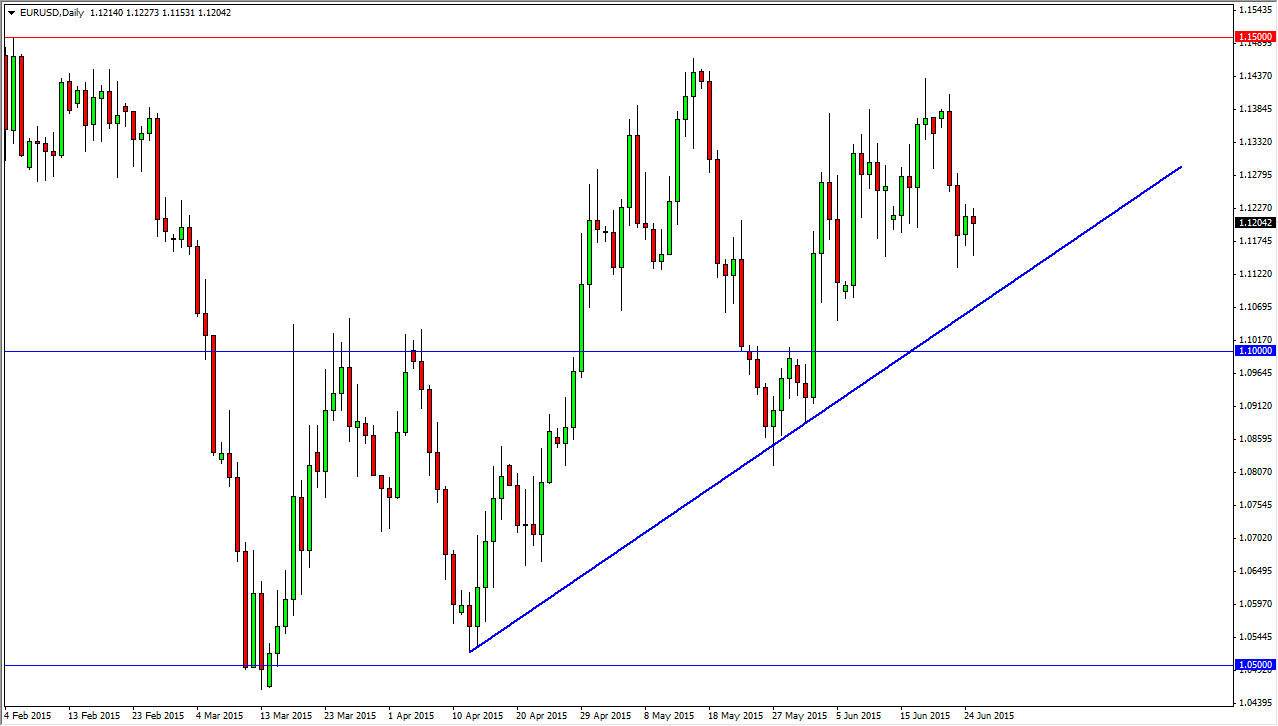

The EUR/USD pair fell initially during the session on Thursday, but yet again ended up finding support below. The 1.1150 level offers support yet again, and as a result it appears that the markets getting ready to bounce. On top of that, we have an uptrend line coming into play, and of course the 1.11 level has been rather supportive recently as well. So having said that, I believe that the consolidation area between the 1.11 and the 1.14 levels continues, as the market simply goes sideways with all of the nonsense in Greece and the debt issues continuing.

Looking at the market though, we have to keep in mind that it is probably more or less a short-term trader’s type of market. I believe that the market will continue to chop around for at least the next couple of weeks, but as soon as we get some type of solid commitment for debt restructuring or payment out of Greece, it is at that point in time things could change.

For my money, 1.15 is crucial

If we can ever get above the 1.15 level, I’m not only buying this currency pair, but I am holding onto my position. I would not only buy in the spot Forex market, but I would also by ETFs that are related to currency, as well as long-term options. I simply believe that would welcome in the overall trend change, and the Euro would be bought yet again. It would not only affect this marketplace, but it would also affect all EUR related pairs. After all, the US dollar is essentially the “measuring stick” of which all currencies are measured.

Ultimately, I believe that the market will continue to offer buying opportunities every time it pulls back, but I do anticipate eventually we get the upward momentum necessary to break out. It might even be several weeks from now, towards the end of summer but I think it’s almost inevitable at this point.