EUR/USD Signal Update

Last Thursday’s signals were not triggered as the price did not quite reach 1.1179 during that day’s London session.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 1.1190.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Move 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 1.1315.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Move 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1365.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Move 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 3

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1450.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Move 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

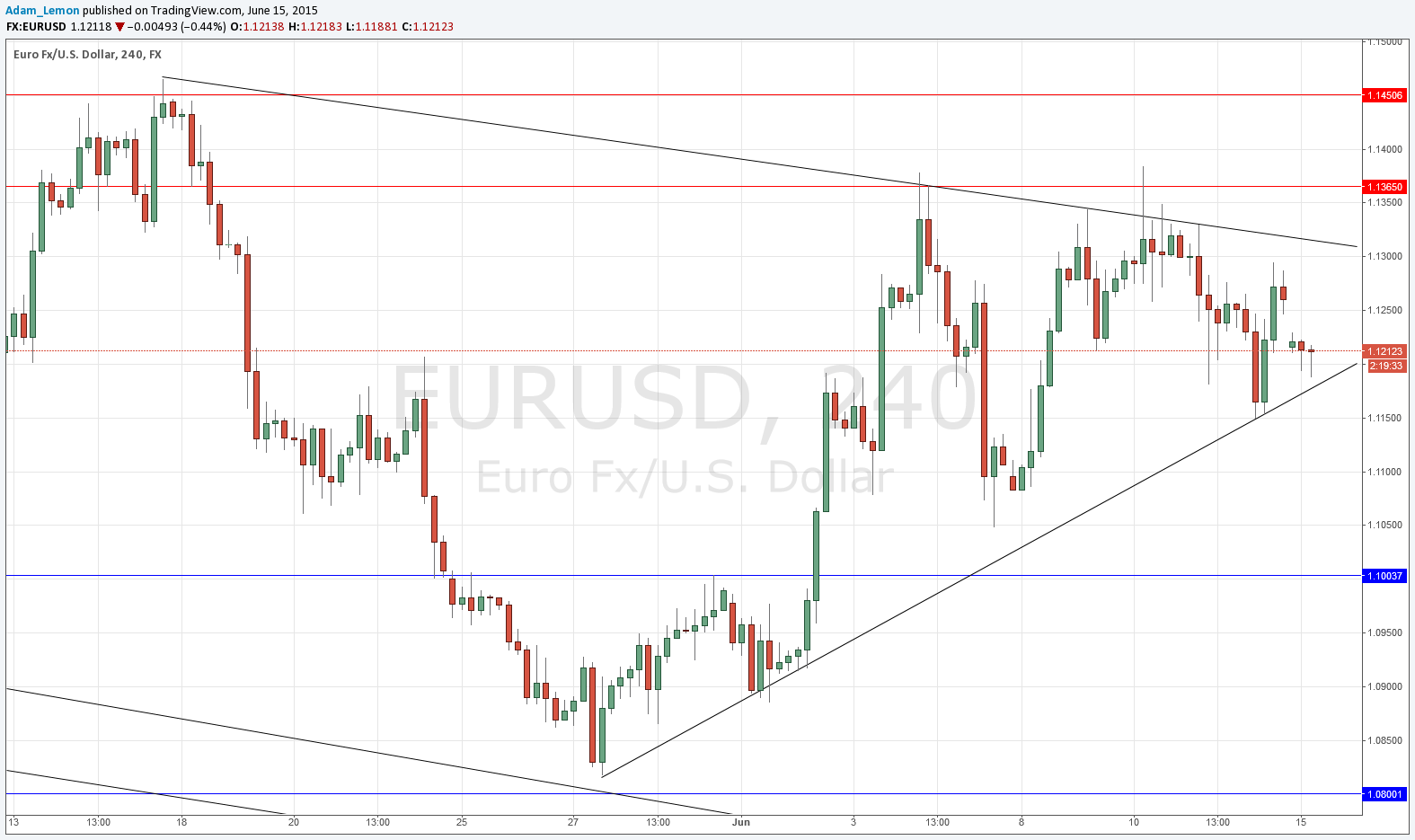

We broke below the major supportive trend line last week coming bearishly off the stronger trend line, which I had written looked more reliable than the bullish supportive one. It has had more touches and is also confluent with a resistant zone.

However we now seem to have pulled back into a consolidation and formed another supportive trend line which is producing a triangle, although it still seems to be the case that the bearish trend line will be stronger than this bullish supportive one.

A break below the supportive trend line could see a fall all the way down to 1.1000. However as we are approaching major USD news later this week, movement may be limited before Wednesday.

There may also be support between 1.1125 and 1.1150.

There are no high-impact events scheduled today for the USD. Regarding the EUR, the President of the ECB will be testifying before the European Parliament at 2pm London time.